Pakistan’s debt and liabilities soar to Rs33tr

Of this, external debt and liabilities stood at $99.1b by end of Dec 2018

Of this, external debt and liabilities stood at $99.1b by end of Dec 2018.

PHOTO: FILE

The Pakistan Tehreek-e-Insaf (PTI) government had promised to revive loss-making enterprises, but it is struggling to control these losses. By December, total losses of public sector enterprises (PSEs) surged to Rs1.6 trillion, a net addition of Rs192.6 billion or 13.8% in the past six months.

The only thing that the PTI government has so far done is the incorporation of Pakistan Sarmaya Company with the Securities and Exchange Commission of Pakistan (SECP). The company still remains on paper as the government has appointed three directors - all of them federal secretaries.

The federal finance secretary is the chief executive officer of the company that has a paid-up capital of Rs100,000.

External debt and liabilities of Pakistan mounted to $99.1 billion as of December 2018, according to the central bank. Taking new loans to repay the old ones is a new normal in the finance ministry. It also invited bids on Friday to hire financial advisers for floating Panda Bonds in Chinese debt markets.

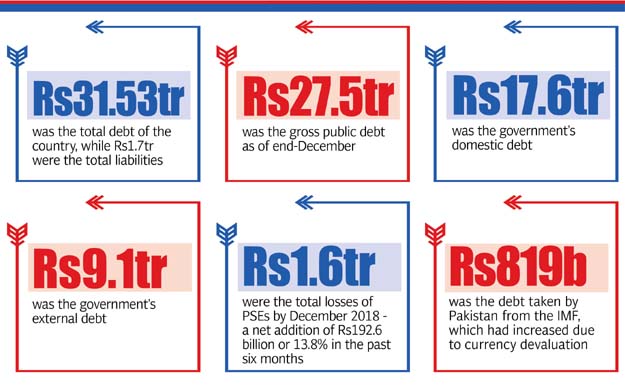

Statistics released by the central bank showed that by the end of first half of the current fiscal year, the country’s total debt and liabilities soared to Rs33.23 trillion. Within a span of six months, there was an increase of Rs3.34 trillion, or 11.2%, in the overall debt and liabilities.

Pakistan’s total debt and liabilities are now equal to 86.4% of its gross domestic product (GDP), which is a quite high ratio and is considered unsustainable for the country. Only to service the public debt, the finance ministry spends 36% of the total budget.

Of the Rs33.3 trillion, the gross public debt, which is the direct responsibility of the government, stood at Rs27.5 trillion as of the end of December. The gross public debt was now equal to 71.4% of GDP, far higher than the 60% statutory limit set in the Fiscal Responsibility and Debt Limitation Act of 2005.

There was an increase of Rs2.55 trillion in the gross public debt in six months, which was far higher than the overall budget deficit recorded during the period. One of the key reasons behind the higher debt was the increase in interest rate and depreciation of the rupee during July-December 2018.

The depreciation of one rupee adds Rs99.1 billion to the public debt. Similarly, a 1% increase in interest rate increases the cost of debt servicing by roughly Rs180 billion. This ultimately increases borrowing requirements for the finance ministry.

Since December 2017, the central bank has let the currency weaken by one-third and has jacked up interest rate by 4.50%. Total debt and liabilities also include the PSEs’ debt, non-governmental external debt and inter-company external debt from direct investors abroad.

Excluding the liabilities, the country’s total debt swelled to Rs31.53 trillion, up Rs3.1 trillion or nearly 11% in six months.

The government’s domestic debt surged to Rs17.6 trillion with addition of Rs1.1 trillion in first six months of the current fiscal year. Its external debt increased to a record Rs9.1 trillion by the end of December.

Total external debt and liabilities surged to Rs12.8 trillion on the back of currency depreciation and new borrowings. In dollar terms, Pakistan’s external debt and liabilities stood at $99.1 billion, higher by $3.8 billion in six months.

This was mainly because of Chinese and Saudi loans that Pakistan secured in first half of the current fiscal year for balance of payments support. One billion dollars each from Saudi Arabia and the United Arab Emirates, which were disbursed in January, are not part of these liabilities.

The central bank data showed that Pakistan’s foreign exchange liabilities increased to $7 billion by December, an addition of $1.9 billion or 36.4%. The central bank’s deposit-related liabilities increased to $2.7 billion from $700 million.

The PSEs’ total debt grew to Rs1.6 trillion at the end of December, an increase of Rs192.6 billion or 13.8% in just six months. Their domestic debt soared from Rs1.1 trillion to Rs1.21 trillion. Their external debt increased Rs54 billion to Rs372 billion.

PTI govt adds Rs2.42tr to debt in six months

The debt taken by Pakistan from the International Monetary Fund (IMF) increased in rupee terms by Rs79 billion to Rs819 billion due to currency devaluation.

Total liabilities, which are indirectly the responsibility of the finance ministry, increased to Rs1.7 trillion by the end of December. There was an increase of Rs262 billion or 18% in the liabilities.

Pakistan's debt capacity weakening, NA told

Domestic liabilities dropped from Rs819 billion to Rs734 billion. But external liabilities increased from Rs622 billion to Rs970 billion in the six-month period due to loans taken from China and Saudi Arabia.

Published in The Express Tribune, February 16th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ