PTI govt adds Rs2.42tr to debt in six months

On an average, Centre added Rs13.5 billion a day from July-Dec 218

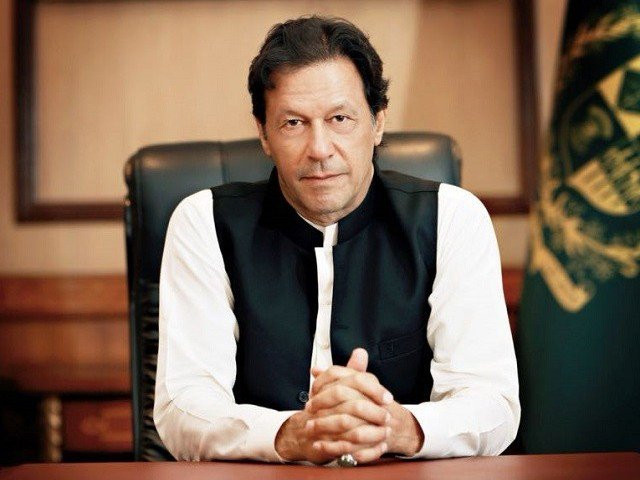

A file photo of Prime Minister Imran Khan. PHOTO: PID

From July through December 2018, the government on an average added Rs13.5 billion a day to its debt that included almost four-and-a-half-month of the Pakistan Tehreek-e-Insaf (PTI) government, according to the State Bank of Pakistan’s statistics.

Overall, the federal government’s debt increased to Rs26.64 trillion -- a net addition of Rs2.42 trillion from July through December. It was higher by 10% when compared with June 2018 statistics.

The accumulation of debt is the direct result of the gap between expenditures and revenues that is widening due to inelasticity in debt and defense servicing on the one hand and the FBR’s failure to enhance revenue collection on the other.

Moody’s assigns a negative outlook to Pakistani banks

The government’s estimates show that nearly 69% of the total budget will go to debt and defense servicing, which is higher than the net revenues of the federal government.

Due to this trend, the International Monetary Fund has proposed to target the primary budget balance, which means that the current expenditures, excluding debt servicing, should not be more than the revenues.

But this can only be achieved either by cutting defense budget or further slashing the development spending -- an option that the PTI government is not willing to take at this stage.

The IMF believes that achieving primary balance is the only way to stop the accumulation of debt and come out of the debt trap.

The FBR’s tax collection grew at a pace of less than 4% during the first half that was even lower than the nominal Gross Domestic Product growth rate.

The debt figures also underscore that refinancing and interest rate risks have rapidly grown in the past six months as the federal government’s short-term debt has grown to 58.6% of the total domestic debt.

In December alone, the government added nearly Rs200 billion in the debt. But the pace of accumulation of debt in December was slow due to a relatively stable exchange rate.

IMF asks Pakistan to take decisive actions

The overall increase in the central government debt seems not in line with the budget deficit requirements due to currency depreciation.

The increase in interest rates by the State Bank of Pakistan has also added at least Rs500 billion into the cost of debt servicing.

The external debt of the central government increased by 16.7% to Rs9.1 trillion in the first half of the current fiscal year. There was a net increase of Rs1.3 trillion in the external debt, largely due to currency devaluation.

In June 2018, the value of a dollar was equal to Rs121.54 which reached Rs138.792 by December 31, according to the central bank. But it was better than Rs140 parity with the dollar at the end of November.

The figures do not include loans of $7 billion acquired from China, Saudi Arabia, and the United Arab Emirates. Those loans are the responsibility of the central bank.

The ballooning public debt remains a concern due to the previous government’s inability to attract non-debt creating inflows and enhance tax revenues.

The PTI government has not yet changed the course of the fiscal policy and it is largely implementing the policies followed by the previous Pakistan Muslim League-Nawaz (PML-N) administration.

SBP’s latest debt bulletin showed that the most worrisome aspect was the continued growth in the short-term domestic debt that exposed the government to refinancing and interest rate risks.

The federal government’s total domestic debt increased to Rs17.54 trillion, an addition of Rs1.11 trillion or 6.8% in five half of the fiscal year.

The share of short-term public debt increased alarmingly to 58.6% or Rs10.3 trillion by the end of December.

In June last year, the short-term domestic debt stood at 54.1% or Rs8.9 trillion. The short-term debt grew Rs1.4 trillion or 15.7% in six months.

In the first half of the current fiscal year, the federal government’s debt got through market treasury bills (MTBs) from commercial banks marginally increased.

The government’s total borrowing through MTBs increased by Rs23 billion to Rs5.31 trillion. The MTBs issued to borrow from the central bank rose to Rs4.97 trillion, a net addition of Rs1.4 trillion or 38.3% from July through December.

The retirement of the central bank debt may become one of the sticky points between Pakistan and the International Monetary Fund future arrangement.

In contrast to the short-term debt, the country’s long-term debt decreased by 3.7% to Rs7.2 trillion. Its share was 46% in the total domestic debt at the end of June 2018, which fell to 41.4% by December.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ