PM Imran’s sister gives full money trail of her foreign property

Aleema claims sources of her income, assets had nothing to do with any ‘charities associated with her or her...

Aleema claims sources of her income, assets had nothing to do with any ‘charities associated with her or her siblings’. PHOTO: FILE

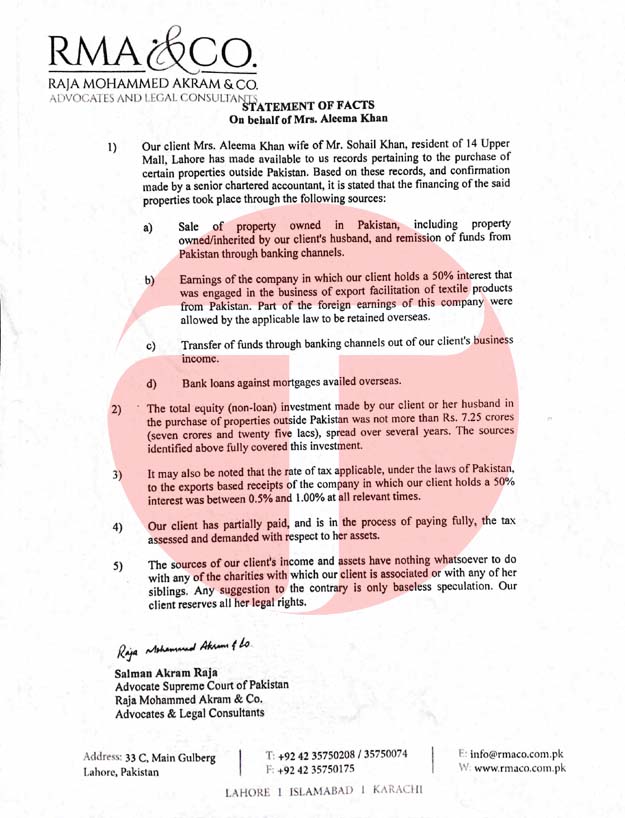

In a statement issued on Friday by her counsel Salman Akram Raja, Khanum said that she was in the process of fully paying the tax, assessed and demanded with respect to her assets abroad. The sources of her income and assets had nothing to do with any “charities with which she or any of her siblings is associated”, the statement said. “Suggestion to the contrary was only baseless speculation” and that she reserved all her legal rights.

Aleema Khanum fails to submit tax liabilities to FBR

The statement came as opposition parties, including the Pakistan Muslim League-Nawaz (PML-N) and the Pakistan Peoples Party (PPP) had alleged that the prime minister’s sister bought illegal property using the Pakistan Tehreek-e-Insaf (PTI) funds.

In her statement, Khanum revealed four sources for the purchase of foreign properties. She said that financing of foreign properties had come from the sale of property owned in Pakistan, including property owned or inherited by her husband and remission of funds from Pakistan through banking channels.

“Likewise, earnings of the company in which our client [Khanum] holds 50 per cent interest that was engaged in the business of export facilitation of textile products from Pakistan,” the statement said. “Part of the foreign earnings of this company was allowed by the applicable law to be retained overseas,” it added.

Fawad, Marriyum clash over Aleema Khanum's undeclared property

It is also contended that Khanum had transferred the funds through banking channels out of her clients’ business income. Likewise, she availed bank loans against mortgages overseas. “The total equity (non-loan) investment made by our client or her husband in the purchase of properties outside Pakistan was not more than Rs7.25 crores spread over several years. The sources identified above fully covered this investment,” her lawyer said in the statement.

Regarding the allegation of tax evasion, the statement read that the rate of tax applicable under the Pakistani laws to the exports-based receipts of the company in which “she holds a 50 per cent interest was between 0.5 per cent and 1.00 per cent at all relevant times”. The statement added: “Our client has partially paid and is in the process of paying fully the tax assessed and demanded with respect to her assets.”

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ