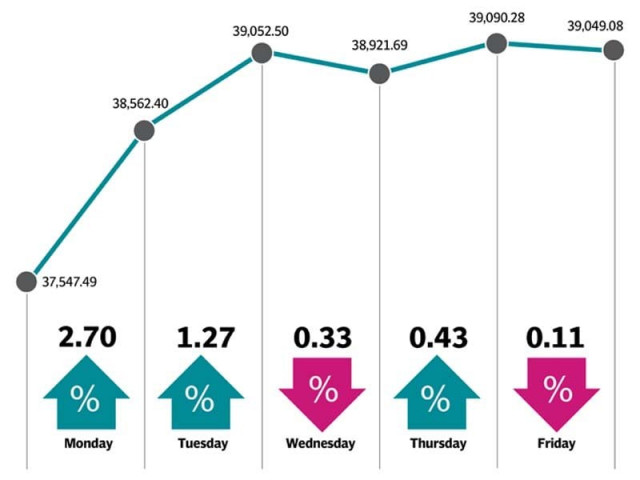

KSE-100 jumps 1,502 points in outgoing week

Increase comes on back of assistance from UAE and encouraging remarks from FATF

According to an AHL report, this was the second highest weekly gain in the last 12 months. The surge came on the back of a variety of developments on the political and economic front. From the visit of the UAE crown prince to increasing international oil prices, all fuelled positive sentiments at the stock market.

Monday kicked off on a positive note as the index rallied over 1,000 points as news of a financial package worth $6 billion from the UAE injected a new lease of life into the bourse. The UAE pledged to assist Pakistan by providing a $3 billion worth oil credit facility and $3 billion in financial support. Apart from that, a statement from Fitch Solutions that Pakistan’s central bank would keep interest rate unchanged at 10% in the next monetary policy statement, due this month, and an uptrend in global markets also encouraged investors to make fresh bets.

The bullish sentiments spilled over in to Tuesday’s session as the index extended its gains and crossed the 39,000 barrier. Unfortunately, the positive momentum could not be sustained and after two sessions in the green, the index retreated on Wednesday as investors resorted to selling.

Things took a positive turn on Thursday, as encouraging remarks from the Financial Action Task Force (FATF) over Pakistan’s efforts to control money laundering and terror financing boosted interest. The rising oil prices in the global market and attractive valuations also enticed market participants. However, Moody’s comments on Pakistan’s debt repayment situation led the market to dive back in red on the last trading day of the week. Market activity also picked up during the week with average daily traded value going up by 12.3% to $46 million, while volumes increased 17.8% to 139 million shares.

Contribution to the upside was led by oil and gas exploration (up 606 points) due to surge in international oil prices, commercial banks (348 points), fertilisers (252 points) amid news regarding settlement on GIDC matter, oil and gas marketing (103 points) and cements (69 points). While, sectors that contributed negatively to the index were tobacco (down 41 points), miscellaneous (29 points) and chemical (15 points). Scrip wise major gainers were PPL (up 259 points), OGDC (169 points), POL (146 points), FFC (121 points) and HBL (118 points).

Foreign investors accumulated stocks worth of $0.6 million this week compared to net selling of $0.5 million last week. Buying was concentrated in commercial banks ($1.7 million), and cements ($1.2 million). On the local front, mutual funds led the bullish sentiments, displaying major buying at the index worth $6.7 million followed by brokers ($6.4 million). Individuals and companies remained the major sellers, offloading shares worth $6.6 million and $6.3 million, respectively.

Among major highlights of the week were; trade deficit shrank by 5% in first half of FY19, SBP reserves decline 3.28%, to $7.05 billion, remittances increased 10% to $10.7 billion in first half of FY19, and furnace oil based power plants were made operational and the government appointed new managing directors for Sui Northern Gas Pipeline (SNGPL) and Sui Southern Gas (SSGC).

Published in The Express Tribune, January 13th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ