Market watch: Stocks fall 201 points as investors resort to profit-taking

Benchmark index decreases 0.53% to settle at 37,795.25

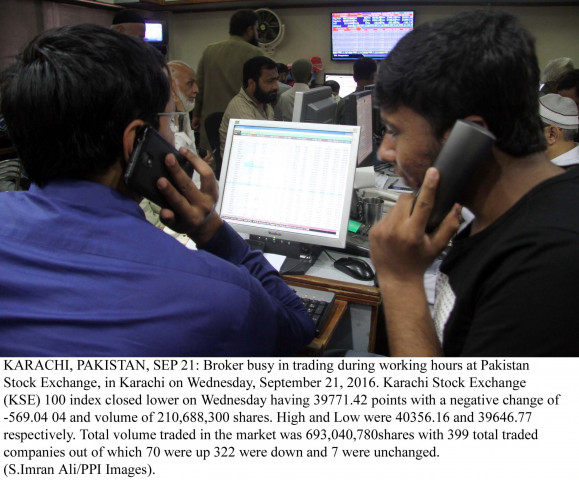

Benchmark index decreases 0.53% to settle at 37,795.25. PHOTO: PPI / FILE

Prime Minister Imran Khan's announcement to revisit the Exit Control List (ECL) seemed to have impacted trading activity at the bourse. A delay in long-awaited clarity on a potential bailout from the International Monetary Fund (IMF) kept investors at bay.

Earlier, trading began positively and a slight dip in initial hours pushed investors to cherry-pick stocks, which led to a rise of nearly 500 points in the KSE-100 index. However, a sharp plunge on the back of a selling spree towards the end of trading wiped out all the gains and dragged the index below 37,800-point mark by the close.

Market watch: Stocks surge over 900 points in first session of year

At the end of trading, the benchmark KSE 100-share Index recorded a decrease of 200.52 points or 0.53% to settle at 37,795.25.

Elixir Securities' analyst Murtaza Jafar said the market traded on both sides of the fence and closed down 201 points at 37,795 on institutional profit-taking following strong gains a day ago.

"MCB Bank (-3.15%), Lucky Cement (-3.45%) and Pakistan Oilfields Limited (-3.33%) collectively contributed 139 points to the day's decline," said Jafar.

"Descon Oxychem (-5%) and Sitara Peroxide (-5%) recorded heavy volumes and hit their respective lower circuits after Tuesday's reports of a reduction in domestic hydrogen peroxide prices to Rs85 per kg from Rs94-95."

The domestic price weakness was the reflection of a decline in global markets that had persisted over the past three months.

During the day, the Pakistan Bureau of Statistics also reported inflation reading for December 2018, which came in at 6.2% year-on-year, lower than Elixir Research's forecast of 6.7%.

"Going forward, we expect investors to wait till clarity emerges on the IMF programme and political dust settles between federal and Sindh governments over the placement of prominent names on the ECL despite Supreme Court's displeasure," the analyst added.

Stocks lose 100 points in volatile last session of 2018

Overall, trading volumes increased to 133.65 million shares compared with Tuesday's tally of 96.66 million. The value of shares traded during the day was Rs6.6 billion.

Shares of 336 companies were traded. At the end of the day, 93 stocks closed higher, 224 declined and 19 remained unchanged.

TRG Pakistan was the volume leader with 11.66 million shares, losing Rs0.01 to close at Rs23.40. It was followed by Lotte Chemical with 10.86 million shares, losing Rs0.68 to close at Rs17.01 and Pak Elektron with 8.29 million shares, losing Rs0.51 to close at Rs25.55.

Foreign institutional investors were net sellers of Rs32.3 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ