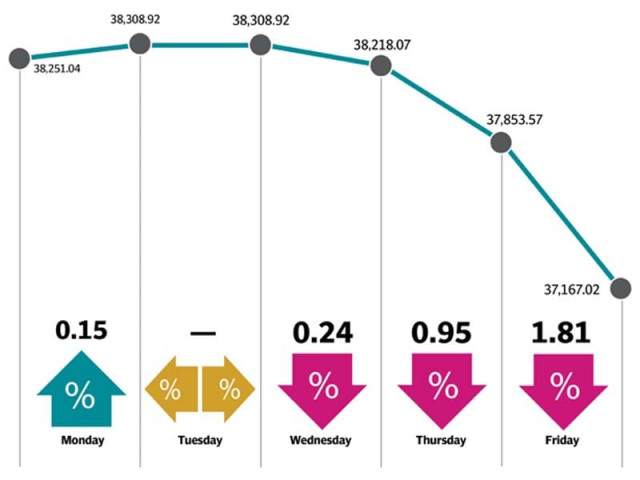

KSE-100 drops 1,084 points as political uncertainty takes toll

Lack of positive triggers and weak macro indicators also dent sentiments

KSE-100 drops 1,084 points as political uncertainty takes toll

Political instability following former prime minister Nawaz Sharif’s arrest in the Al-Azizia case and money laundering investigation against former president Asif Ali Zardari impacted the investment climate.

The UAE’s announcement of a $3-billion financial assistance for Pakistan to bridge the external funding gap failed to attract market participants who remained wary of the overall economic environment.

Furthermore, the upcoming review of the Financial Action Task Force (FATF) also cast a shadow over the trading activity and kept investors sidelined. The fast depleting foreign currency reserves of the central bank and weak macroeconomic indicators were among some other factors that aided the bearish sentiments.

However, investor participation grew during the week with average daily turnover increasing 5% to 110 million shares while average daily traded value rose 6% to $36 million.

Sector-wise negative contribution came from commercial banks (down 361 points), oil and gas exploration companies (230 points), cement (172 points), fertiliser (137 points) and power generation and distribution (59 points).

On the flipside, the sectors that contributed positively were tobacco (up 68 points), pharmaceuticals (33 points) and automobile parts and accessories (9 points).

News regarding discontinuation of power generation through furnace oil pushed the refineries down by 7% week-on-week.

In terms of individual stocks, United Bank Limited (down 117 points), Engro (down 101 points), Lucky Cement (down 87 points), Oil and Gas Development Company (down 82 points) and Pakistan Petroleum Limited (down 75 points) were the major laggards.

Foreign selling continued in the outgoing week as well which came in at $1.1 million compared to net selling of $12.2 million in the previous week. Selling was witnessed in fertiliser companies ($1.2 million) and commercial banks ($1.2 million). Domestic mutual funds also offloaded shares worth $6.2 million.

On the flip side, banks and companies stood out as major buyers, mopping shares worth $4.6 million and $3.6 million, respectively.

Among major highlights of the week were the International Monetary Fund (IMF) putting Pakistan in a tight spot, the regulator allowing maximum loss claims to Sui gas companies, the cabinet approving a plan to float yuan-denominated Panda bonds and Nepra slashing power tariff by Rs0.31 per unit.

Published in The Express Tribune, December 30th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ