Current account deficit surges to four-month high at $1.25b

Drop comes on back of lower workers’ remittances, sluggish exports

Representional image. PHOTO: REUTERS

The deficit, which widened mainly due to lower workers’ remittances and sluggish exports compared to October 2018, may accelerate depletion in the country’s critically low foreign exchange reserves.

This, simultaneously, has reminded the concerned authorities to gear up efforts to fix structural issues in the beleaguered economy as their failure would lead to an international payment crisis in Pakistan. The deficit stood at $1.21 billion in the previous month of October 2018, the State Bank of Pakistan (SBP) reported on Wednesday.

Experts have expressed hope that the significantly low oil prices globally and a likely revival in exports in the aftermath of numerous incentives would significantly curb the deficit in the remaining seven months (December 2018 to July 2019) of the current fiscal year compared to the historic high of $19 billion in the previous fiscal year 2018.

“The deficit is expected to be contained at around $11 billion in the complete fiscal year 2019,” Sherman Securities’ analyst Chander Kumar estimated while talking to The Express Tribune. The current account deficit widened to $1.25 billion due to a 20% drop in workers remittances to $1.60 billion in November compared to $2 billion last month.

Similarly, the exports again slowed down 8% to $1.89 billion in the month compared to $2.05 billion in the previous month. “Although, the much needed drop in imports has been achieved in the month (November saw imports drop 9.5% to $4.27 billion compared to $4.72 billion in October), but low remittances have offset the impact of the achievement,” Kumar added.

Deficit drops in five-month period

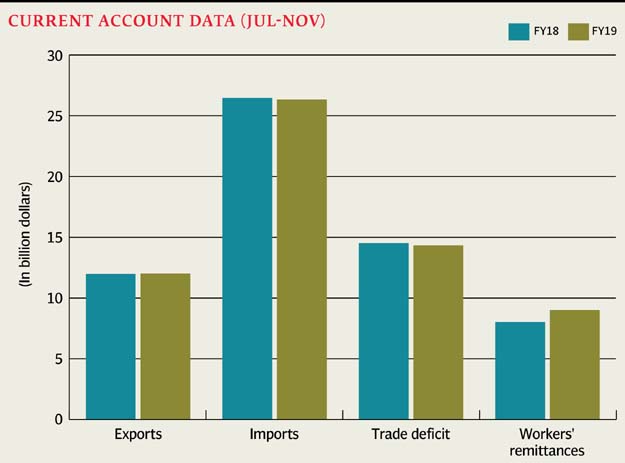

The current account deficit narrowed down 10.6% to $6.09 billion in the first five months (July-November 2018) of current fiscal year 2019 compared to $6.81 billion in the same period of last year, the SBP said.

The drop was seen mainly due to an increase of 12.6% in remittances to $9.02 billion in the five months compared to $8.02 billion in the same period of last year.

Besides, a 35.4% drop in trade of services to $1.43 billion compared to $2.21 billion also played a catalyst role in containing the deficit in the five months in question.

The imports have remained 3% higher at $22.7 billion and exports remained flat at $9.85 billion in the period under review.

The analyst estimated the deficit narrowing down to an average $700-800 million per month in the remaining seven months of FY19 compared to $1.21 billion in the previous five months.

“The Arab light oil (which Pakistan imports) prices would remain low at an average $65 per barrel in the remaining seven months compared to $80 in October,” he speculated. “This would help at length in cutting down imports and provide much needed support to contain the deficit at $11 billion in FY19.”

The analyst noted that the government depreciated the rupee by a massive 32% against the dollar in the last 12 months. Besides, it has announced to cut down energy tariffs for industries to boost sluggish exports. “The strategy to boost exports should work in the remaining months to FY19,” he said.

However, maintaining remittances on the higher side would remain a huge challenge for authorities in the time to come, as slowdown in world economies may impact the income of overseas Pakistanis in the remaining seven months, he said.

Published in The Express Tribune, December 20th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ