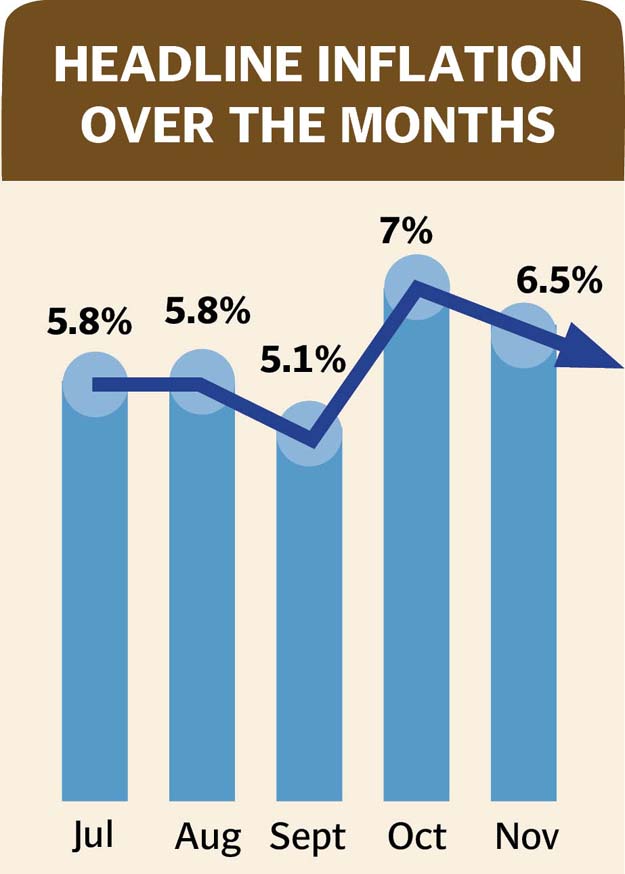

Consumer Price Index: Inflation slows down to 6.5% in Nov

Pace eases despite inflationary expectations, rise in oil prices

PHOTO: ZAHOORUL HAQ/EXPRESS

The headline inflation decelerated to 6.5% in November compared to 6.8% in the preceding month, reported the Pakistan Bureau of Statistics (PBS) on Tuesday. The pace slowed down despite inflationary expectations and increase in prices of petroleum products last month.

Market watch: Bull-run returns at PSX as index rises 442 points

However, the core inflation moderately increased from 8.2% to 8.3% in November. This increase in the core inflation, which is the target rate of the central bank, does not warrant a 1.5-percentage-point increase in the policy rate.

This suggests that the central bank probably increased the interest rate while keeping in mind the condition of the International Monetary Fund (IMF) for a bailout package.

After the recent decision, the central bank has cumulatively increased the interest rate by 4.25% since January this year, aimed at curtailing aggregate demand in the economy. Near-term challenges to Pakistan’s economy continue to persist with rising inflation, an elevated fiscal deficit and low foreign exchange reserves, according to the central bank.

In its statement, the central bank stated on Friday that the Monetary Policy Committee noted continued inflationary pressures and rising inflationary expectations, which needed to be checked.

The central bank also revised its inflation forecast upwards for the current fiscal year keeping it in the range of 6.5% to 7.5%, above the annual target of 6%.

Average inflation in first five months (Jul-Nov) of the current fiscal year rose slightly above 6% as compared to 3.6% in the corresponding period of previous fiscal year.

During bailout talks, the IMF noted that inflation in Pakistan could reach close to 14% and the country should adopt a policy of positive real interest rate to curb the inflationary pressures.

The continued increase in the interest rate has made it difficult to offer housing facilities under Prime Minister Imran Khan’s programme at affordable costs and has also pushed up the government’s cost of debt servicing.

Core inflation, excluding volatile food and energy prices, went up from 8.2% in October to 8.3% last month. It has been inching up for the last nine months, reaching the highest level in four years and three months.

Last time, in July 2014, the core inflation had jumped to 8.3%.

The headline inflation decelerated despite increase in prices of food and non-food items. Gas prices rose 85.3% on an annual basis, kerosene oil prices jumped 28.8%, motor fuel prices 28.7% and newspaper prices 27.6%.

After July, the government has also levied more regulatory duties in addition to letting the rupee depreciate further against the US currency. The impact of these measures will be more visible in coming months.

Transport service charges increased nearly 18% in November on an annual basis, followed by a 14.5% increase in prices of motor vehicles, 13.6% rise in water supply charges and 13.4% increase in clinical fee of doctors.

Oil sales plummet to decade low at 1.33m tons in Nov

On the other hand, construction wages and utensil prices increased 11% and stationary became expensive by one-tenth on an annual basis.

Overall, prices of the housing, water, electricity and gas group increased 9.1% in November over a year ago. The group has a 29.4% weight in the overall inflation basket - the second largest group after food.

Cost of educational services increased 10%. Transport group prices surged almost one-fifth due to consecutive increase in prices of high-speed diesel and motor fuels.

However, prices of perishable food items dropped over 21% in November on the back of better supplies. The cost of non-perishable food items increased over 5%.

Published in The Express Tribune, December 5th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ