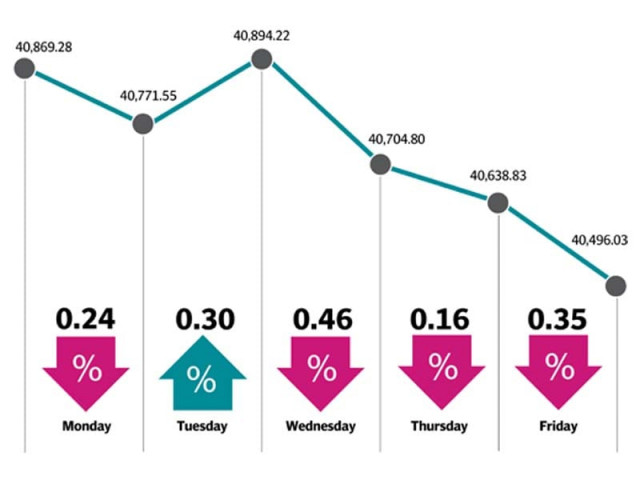

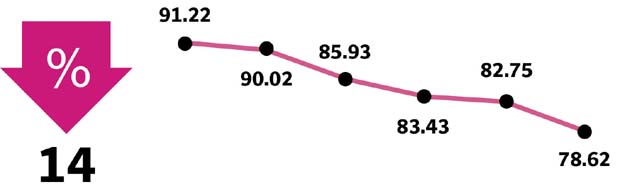

Dull week at stock exchange as index drops 373 points

Investors stay on the sidelines awaiting clarity on economic issues

The week kicked off on a negative note as a dearth of positive triggers kept investors on the sidelines. A widening budget deficit and plunging international crude oil prices dampened the overall mood.

Although the KSE-100 made some recovery on Tuesday, trading remained volatile. Market participants anxiously awaited the announcement of monetary policy by the central bank, which contributed to the lower activity.

In a major surprise, the State Bank of Pakistan (SBP) raised the key interest rate by 150 basis points to 10%. Although analysts had expected a hike, the general consensus was on an increase of 100 basis points.

Trading activity also remained subdued due to the government’s failure to negotiate a bailout package with the International Monetary Fund. Resultantly, the index ended the remaining three sessions in the red with investors resorting to profit-taking.

Moreover, the rupee hit an all-time low against the US dollar at Rs144 in intra-day trading on Friday and settled at Rs139.05 at close in the inter-bank market. The massive depreciation also dented the benchmark index, which settled below the 40,500-point mark.

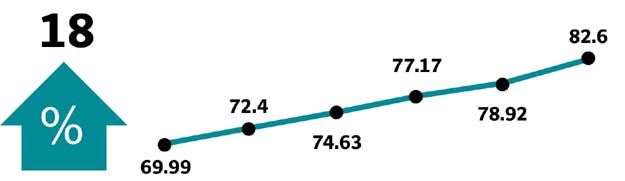

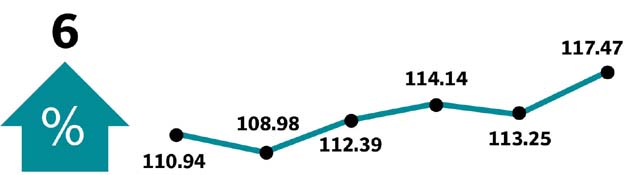

Volumes remained sluggish during the week as average daily traded volumes edged down 3% week-on-week to 152 million shares. On the flip side, average daily traded value jumped up substantially, with 29% week-on-week growth, standing at $72 million.

Furthermore, foreign investors were due to re-balance their portfolios following the removal of Lucky Cement and United Bank Limited (UBL) from the MSCI Global Standard Index Pakistan, which also sparked foreign selling.

The sectors benefiting from the interest rate hike, such as banks, traded in the green zone whereas other major sectors such as cement and fertiliser displayed a lacklustre performance as financing costs would go further up.

Sector-wise negative contribution came from cement producers (down 254 points), fertiliser manufacturers (106 points), oil and gas marketing companies (100 points) and engineering firms (58 points).

International crude oil prices declined 24% in November, severely hurting the exploration and production (E&P) and oil marketing companies’ stocks as they chipped away 735 points from the index, becoming the worst performing sectors for the month, stated a Topline Securities’ report.

On the other hand, positive contribution was led by commercial banks (up 231 points) and oil and gas exploration companies (159 points).

Stock-wise negative contribution came from Lucky Cement (down 107 points), Engro (83 points) and Sui Northern Gas Pipelines (42 points) while Pakistan Petroleum (67 points), MCB Bank (54 points) and Oil and Gas Development Company (52 points) contributed positively to the index.

Lucky Cement and UBL remained in the limelight during the week owing to rebalancing of the MSCI Emerging Markets’ stocks.

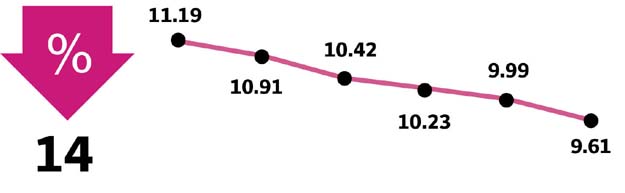

Foreign selling continued during the week, which came in at $51 million compared to net selling of $11.6 million last week. Selling was witnessed in commercial banks ($21.5 million) and cement companies ($21.1 million).

On the domestic front, major buying was reported by insurance companies ($25 million) and mutual funds ($12.3 million).

“Foreign selling for the month (Nov) stood at $100 million, which was the highest in 18 months (2018YTD net foreign selling is $509 million). This is also the 10th consecutive month of foreign selling,” said Topline Securities.

Among major highlights of the week were budget deficit continuing to widen, government mulling over floating up to Rs200 billion worth of Sukuk to reduce circular debt, Pakistan raising $1.5 billion in loans and grants in July-October 2018, orders for lifting furnace oil from refineries and Wapda completing load rejection test of all units at the Tarbela 4th Extension project.

Winners of the week

Feroze 1888 Mills

Feroze 1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

Systems Limited

Systems Limited is Pakistan’s leading IT company that specialises in providing next-generation BPO solutions, ERP solutions and BI services worldwide.

Losers of the week

Byco Petroleum

Byco Petroleum Pakistan Ltd operates a crude oil refinery for the manufacture and sale of petroleum products.

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

Published in The Express Tribune, December 2nd, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ