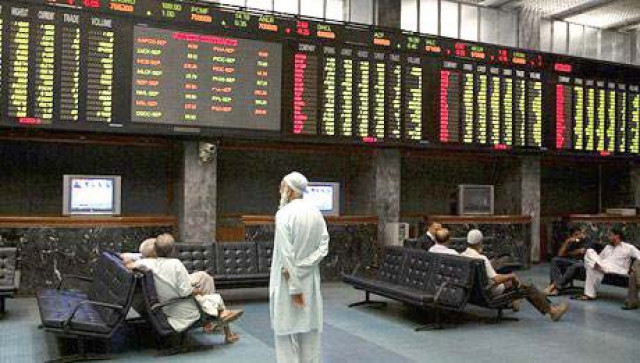

Stocks end up despite SBP governor resignation

Pakistani stocks ended higher on Thursday, maintaining Wednesday’s upward momentum despite news that the State Bank governor has tendered his resignation. Investors bought shares at attractive prices following the steep falls in recent days.

Dealers observed that investors were buying stocks that analysts believe will not be negatively affected by the budget announcement.

The Karachi Stock Exchange (KSE) benchmark 100-share index ended 1.29 percent, or 122.24 points, higher at 9,621.30.

Turnover was 140.1 million shares, up from 94.12 million shares traded on Wednesday.

“With two days left for the budget announcement, the market seems to have discounted the implementation of CGT and the full ramifications of the VAT,” said an analyst at Elixir Securities, Sara Shahid.

She added that the new leveraged products would introduce some much needed liquidity and mentioned that there were rumours of foreign institutional investment which had spurred local investors to buy selectively.

The margin financing product being approved by the law ministry and the SECP has helped build up sentiments in the market, said analyst at JS Global Capital, Sameer Danawala.

Dealers said local investors were unfazed by the resignation of State Bank of Pakistan Governor Salim Raza, who stepped down, citing personal reasons.

“Strong pullback continued today in expectation that imposition of CGT is already discounted in share prices, depicted from better volumes. Furthermore recovery in Asian markets also acted as a catalyst in this bullish momentum,” said Topline Securities’ analyst Furqan Punjani.

Dealers said that the recent fall had made the market very attractive and local institutions had also been active.

The KSE-100 recorded its highest closing this year of 10,677.47 points on April 15 but gradually fell to end at 9,294.18 points on June 1, its lowest this year.

Out of the 418 stocks which were traded during the day, 270 were up, 129 were down. The price of 19 stocks remained unchanged.

Trading was mixed and buying was witnessed across the board. Amongst the blue chip stocks, Pakistan State Oil and Engro remained in the limelight. Their stock prices rose by 3.3 per cent and 3.2 per cent respectively.

D.G. Khan Cement closed on its upper circuit for the second consecutive day at Rs22.56. Both it and Lucky Cement recovered on the back of hopes that Cement duties will not be increased.

PSO rose sharply amid whispers that the circular debt may receive some positives in the budget.

JSCL was once again among the top volume leaders as it closed at its upper circuit and remained so for most part of the trading session.

Lotte Pakistan, TRG (The Resources Group) and Azgard Nine were the volume leaders with 15.4, 13.3 and 6.6 million shares respectively.

Published in the Express Tribune, June 4th, 2010.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ