Market watch: Bears dominate as KSE-100 declines 98 points

Benchmark index decreases 0.24% to settle at 40,771.55

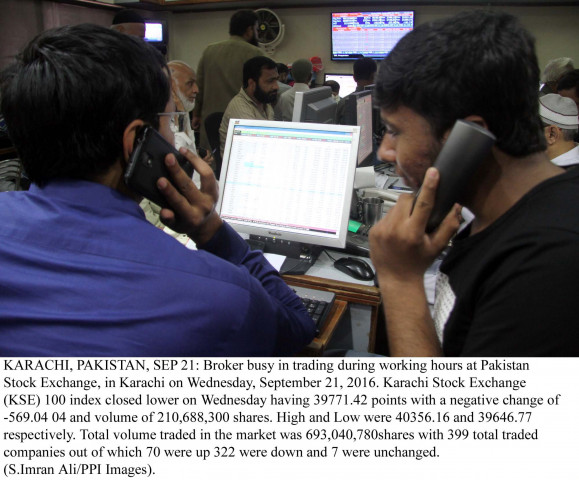

Benchmark index decreases 0.24% to settle at 40,771.55. PPI / FILE

The KSE-100 index opened on a positive note and powered past the 41,000 mark. However, lack of interest on the investors' part resulted in the index plunging into the red zone. The index oscillated between the red and green zone during the day, with investors awaiting the central bank's decision on interest rate, which is due on Nov 30.

News of widening budget deficit and declining international crude prices also dampened sentiments. Additionally, investors were wary of absence of government's serious efforts to curb twin deficits, which led to the increased selling pressure.

At the end of trading, the benchmark KSE 100-share Index recorded a decrease of 97.73 points or 0.24% to settle at 40,771.55.

Market watch: KSE-100 drops 545 points as talks with IMF fail

Elixir Securities' analyst Murtaza Jafar said the benchmark KSE-100 Index closed marginally negative at 40,772 level.

"Mixed sentiments were witnessed amid low volumes, however, major participation was seen in retail names," Jafar remarked.

On the corporate front, Engro Polymer and Chemical Limited (EPCL PA -1.94%) approved a CAPEX of $9 million to revamp its plant to pure oxygen based VCM technology.

"Going forward, we expect investors to align their positions with the upcoming monetary policy statement likely to be announced on 30 November 2018," he added.

According to Topline Securities, "It was a lacklustre trading session for the benchmark index, as uncertainty over the International Monetary Fund (IMF) bailout package and commencement of the rollover week kept investors at bay."

With a 100 basis points increase in MPS expected, commercial banks offered some respite to the index adding 48 points. While on the other hand, cement and OMC's weighed the index down chipping away 84 points, cumulatively, the report added.

Market watch: KSE-100 experiences lacklustre trading, sheds just 5 points

Overall, trading volumes increased to 135.3 million shares compared with Friday's tally of 123.6 million. The value of shares traded during the day was Rs6.9 billion.

Power Cement was the volume leader with 14.5 million shares, gaining Rs0.25 to close at Rs8.41. It was followed by Lotte Chemical with 10.3 million shares, losing Rs0.39 to close at Rs18.75 and Pak Elektron with 10.1 million shares, losing Rs1.62 to close at Rs30.87.

Foreign institutional investors were net sellers of Rs357.5 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ