Bears dominate as economic and political concerns hurt

KSE-100 index declines 791 points and settles at 40,869

KSE-100 index declines 791 points and settles at 40,869.

PHOTO: FILE

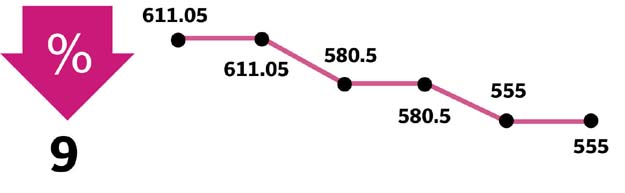

As the country was facing economic uncertainty, investors were hopeful of financial inflows following Prime Minister Imran Khan’s international trips. However, due to a lack of news on that front and absence of other positive triggers, the KSE-100 continued to take a beating. At the start of the week, the trading kicked off on a negative note as investors resorted to profit-taking amid deteriorating foreign exchange reserves and anti-Pakistan comments by the US president.

Tuesday fared no better and the index remained choppy in the wake of failure of talks between Pakistan and the International Monetary Fund (IMF) for a bailout package.

Weekly review: Stock market ends three-week rally, falls 615 points

Although Saudi Arabia announced the release of $1 billion worth of assistance under its financial package, the news failed to generate any euphoria as the overall mood remained tense.

Finance Minister Asad Umar said the government would not sign any agreement with the IMF under pressure and was not in a hurry for the package as alternative arrangements had been made to address immediate financing needs.

A latest Fitch report added to the poor sentiments. Fitch Solutions pointed out that Pakistan had been living beyond its means for several years as evident from its widening current account and trade deficits.

Additionally, selling pressure in exploration and production (E&P) stocks due to sliding international crude oil prices also dented the index, dragging it below the 41,000 mark.

The market activity remained dull during the week with average daily traded value declining 23% to $56 million while average daily volumes dropped 26% to 157 million shares.

In terms of sectors, negative contribution came from oil and gas exploration companies (down 329 points) amid weakening international crude oil prices, commercial banks (278 points) as concerns of higher interest rates during the period of IMF bailout waned to an extent, oil and gas marketing companies (72 points) and fertiliser producers (59 points).

Weekly review: KSE-100 index posts highest weekly gain in a year

According to Elixir Securities, the E&P sector contributed 42% to the decline in the KSE-100 index as it was down 4.8% week-on-week due to lower global crude prices on the back of supply glut fears.

On the other hand, positive contribution was led by the cement sector (up 53 points) and chemical sector (up 21 points). Scrip-wise, Habib Bank (up 219 points), Pakistan Oilfields (119 points), Oil and Gas Development Company (96 points), Pakistan Petroleum (82 points) and United Bank Limited (36 points) contributed positively to the index.

Foreign selling continued during the outgoing week as well which came in at $11.6 million compared to net selling of $24.1 million last week. Major selling was witnessed in cement shares ($3.8 million) and E&P stocks ($3.6 million).

On the domestic front, major buying was reported by insurance companies ($8 million) and banks/DFIs ($4.1 million).

Among major news were Pakistan and the UAE agreeing to transform ties into a long-term strategic economic partnership, UBL announcing the voluntary liquidation of its New York branch, the government and the IMF failing to reach an agreement and the fertiliser industry being reluctant to cut urea prices.

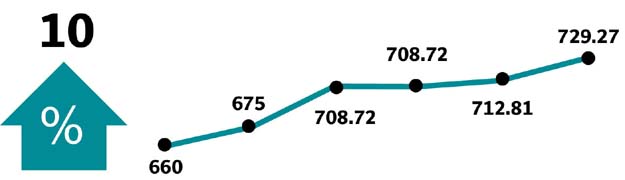

Winners of the week

ICI Pakistan

ICI Pakistan Limited manufactures a range of industrial and consumer goods. The company’s product line includes polyester staple fibres, POY chips, soda ash, paints, specialty chemicals, sodium bicarbonate, polyurethane and adhesives. ICI Pakistan also manufactures pharmaceuticals and animal health products, and trades in various chemicals for use in industries in Pakistan.

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

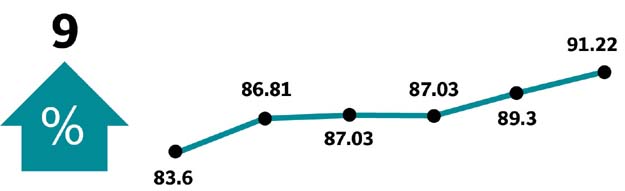

Losers of the week

Jubilee Life Insurance

Jubilee Life Insurance Company Ltd is a general insurance company which offers both individual life insurance and corporate business insurance. The company’s individual products include life, personal accident, critical illness, and investment insurance. Jubilee’s corporate products include group life, health, and pension schemes.

Pak Oilfields

Pakistan Oilfields Limited specialises in the exploration, drilling, production and transmission of petroleum. The company also markets Liquefied Petroleum Gas (LPG).

Published in The Express Tribune, November 25th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ