PM Imran warns of dissolving FBR over poor results

Underlines need for introducing reforms and improving performance

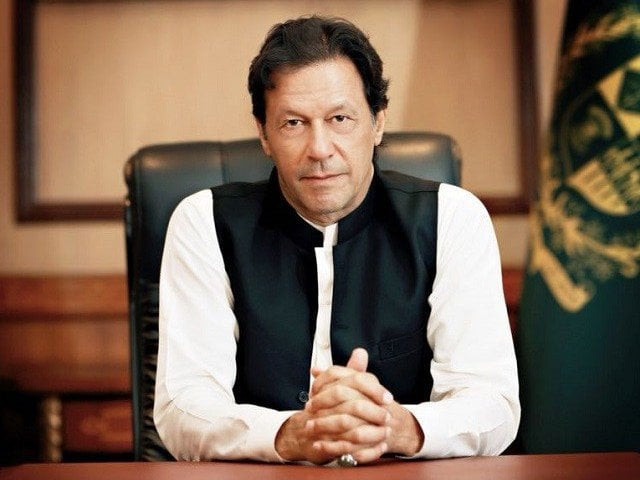

Prime Minister Imran Khan. PHOTO: GOVERNMENT OF PAKISTAN.

The premier gave the warning during a meeting held on Thursday, sources told The Express Tribune. FBR’s top management had been called for a briefing on the board’s performance in relation to revenue collection and catching tax dodgers.

Sources said after seeing poor results, the prime minister inquired whether the FBR could be reformed or a new institution should be established.

FBR spokesman Dr Mohammad Iqbal did not comment on details of the meeting, but he said the PM emphasised the need for introducing reforms and also asked for improving the performance and integrity.

The PM stated that reforming the FBR was critical for meeting the government’s goal of providing social justice and relief to the masses, said Iqbal.

Briefing to PM: Finance minister displeased with FBR’s performance

The premier’s comments indicate his displeasure with taxmen as he has declared that the government will double tax revenues from the Rs3.842 trillion collected in the previous fiscal year.

To press on with the plan, the prime minister had picked Jehanzeb Khan as the FBR chairman. Khan is an officer of the Pakistan Administrative Service. The FBR comprises over 20,000-strong workforce of the Inland Revenue Service and Customs Service.

Sources said the premier was also not interested in the presentation prepared by the FBR to show an apparently rosy picture of the tax affairs.

Finance Minister Asad Umar has already expressed his dissatisfaction with the FBR’s performance.

Revenue falls Rs56b short of target in Q1

In spite of the difficulties, Imran reposed his confidence in the FBR chief during the meeting. He also defended Jehanzeb’s appointment during an interaction with anchorpersons about two months ago.

The FBR could collect only Rs1.1 trillion in taxes in first four months of the current fiscal year and fell short of the revised target by Rs68 billion. The growth in revenue collection was less than 7%.

For the current fiscal year, the government has already revised downwards the annual target to Rs4.398 trillion and it seems that if things are not reversed, the FBR may face a shortfall of Rs150 billion to Rs175 billion at the end of the year.

The finance minister on Thursday said the Pakistan Tehreek-e-Insaf government’s success and failure hinged on the FBR’s performance.

The poor tax collection and its implications for the budget deficit turned out to be the biggest concern for the International Monetary Fund (IMF) during ongoing technical-level talks. Due to the shortfall in tax revenues, the budget deficit is expected to widen to around 1.4% of gross domestic product (GDP) in the first quarter.

Sources said there was talk in the Q Block and the FBR headquarters whether to continue with the existing FBR chairman or a new head should be brought from among FBR services.

However, blaming the FBR chief alone for the poor performance will not be justifiable as the FBR has always resisted reforms. For the past over one and a half year, the FBR members have not allowed implementation of administrative and policy reforms proposed by the Tax Reforms Commission.

The FBR is resisting even the simplest things like installation of a trace and tracking system in industries that are prone to high tax evasion like cigarette manufacturers. Despite the finance minister’s instructions, the FBR has not developed a simple one-page income tax return form for the salaried class.

The FBR has developed a new return form for the salaried class but it is still complicated for many.

The FBR has also been resisting the appointment of technically qualified people on the board of Pakistan Revenue Automation Private Limited - a subsidiary of the FBR that is responsible for using information technology for tax collection.

There are nearly 3.8 million National Tax Number (NTN) holders in Pakistan and only 1.4 million of them file income tax returns. The FBR has not been able to catch even these 2.8 million people who have the NTN but are not filing returns.

Efforts have not been made to improve audit functions and an almost negligible workforce has been assigned the audit task.

The FBR has issued an advice to the State Bank of Pakistan for releasing sales tax refunds amounting to Rs8.7 billion to facilitate exports.

The payment will benefit 739 claimants from five zero-rated export-oriented sectors - textile, carpet, leather, sports goods and surgical instruments. The refund will be made against 4,117 refund payment orders issued up to November 8, 2018.

The tax refunds will be transmitted electronically to respective bank accounts of the claimants by the State Bank by the close of banking hours on Monday, November 12, 2018.

The payments will be made to all those claimants who have provided their bank account details in the IBAN format.

Published in The Express Tribune, November 11th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ