PM Office gets ‘favoured officer’ appointed in FBR

Forces FBR chief to withdraw posting order for Aftab Alam, appoint Ashfaq Ahmad

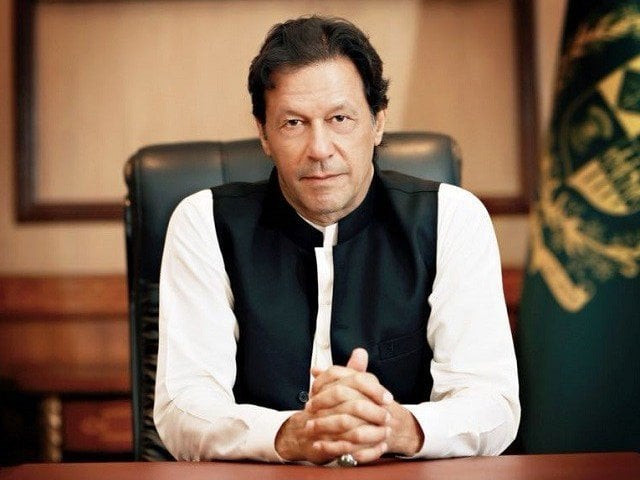

PM Imran Khan. PHOTO: GOVERNMENT OF PAKISTAN

The PM Office pressurised FBR chief Jehanzeb Khan to withdraw the posting order of Aftab Alam, a grade-20 officer, as chief international taxes within hours of its issuance, sources in the FBR told The Express Tribune.

The PM Office forced the FBR chairman to appoint Mohammad Ashfaq Ahmad as new chief of international taxes, they added.

PM vows to depoliticise bureaucracy, ensure merit-based appointments

The chief of international taxes handles bilateral and multilateral taxation treaties - a post that is very critical for fulfilling the PTI’s agenda of bringing back assets stashed abroad. However, both Alam and Ahmad are considered equally competent and upright officers, which raises questions over the motive of the PM Office’s intervention in administrative affairs of the tax machinery.

Prime Minister Imran Khan has vowed that his government would not interfere in the affairs of government departments. But his office is doing exactly opposite to that.

The development came a day after the premier promised to end political interference in the affairs of the civil bureaucracy during an address at a gathering of top bureaucrats at the PM Office.

The incident has undermined the authority of the FBR chairman, who had to withdraw posting order of Alam within hours. It was the first-ever transfer order issued by Jehanzeb Khan after becoming the FBR chairman.

Ahmad had in the past been involved in negotiations for the avoidance of double taxation treaty with Switzerland, which is probably the reason for his new posting.

The FBR chairman was not available for comments despite repeated attempts.

On September 14, he posted Alam as the chief of international taxes, showed an FBR notification. The next two days were official holidays. On Monday, September 17, another notification was issued by the FBR. Alam was posted out of the FBR headquarters and was appointed as director training and research, Lahore.

Through the same notification, Ahmad was appointed as the chief of international taxes. Earlier, Ahmad was serving as a commissioner at the Large Taxpayers Unit, Islamabad.

Sources said the FBR chairman tried to convince Prime Minister Secretary Azam Khan that it would be inappropriate for him to retract Alam’s posting notification within hours of its issuance.

They said the chairman offered the PM Office that he would accommodate Ahmad on a better position and would give him the task that the PM Office wanted. But according to sources, the PM Office did not budge from its stance.

Imran vows all appointments in ‘Naya Pakistan to be based on merit’

After appointing Ahmad as the chief of international taxes, the chairman was also asked to nominate Ahmad on the PM Asset Recovery Unit. The orders were followed again.

Ahmad, the then chief of FBR’s international tax department, had initialed the revised Convention for Avoidance of Double Taxation with respect to tax on income with Switzerland in 2014. The FBR subsequently decided to renegotiate the agreement and posted Ahmad outside after his return from Switzerland.

After coming to power in June 2013, the PML-N government had announced that it would bring back $200 billion said to have been stashed in Swiss banks. Pakistan Tehreek-e-Insaf has now taken this task upon itself. At that time, Asad Umar had said that the PML-N government was using delaying tactics and was not interested in bringing back the hidden assets.

Both Pakistan and Switzerland have signed the revised avoidance of double taxation treaty but it has not yet been ratified by Swiss parliament.

There are three types of information being received from foreign jurisdictions. These are spontaneous exchange, automatic exchange and information on request. In case of all bilateral treaties, the information is being received on request.

Unlike in the past, now Pakistan has better chances of recovery of foreign assets as it can receive all the three types of information from foreign jurisdictions under the Organisation for Economic Cooperation and Development multilateral treaty on taxation. Pakistan is a signatory of this treaty and all its member countries including Switzerland are bound to share information.

Published in The Express Tribune, October 7th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ