Govt mulls over strategy to facilitate overseas Pakistanis

Finance minister says they will extend more incentives to filers of tax returns

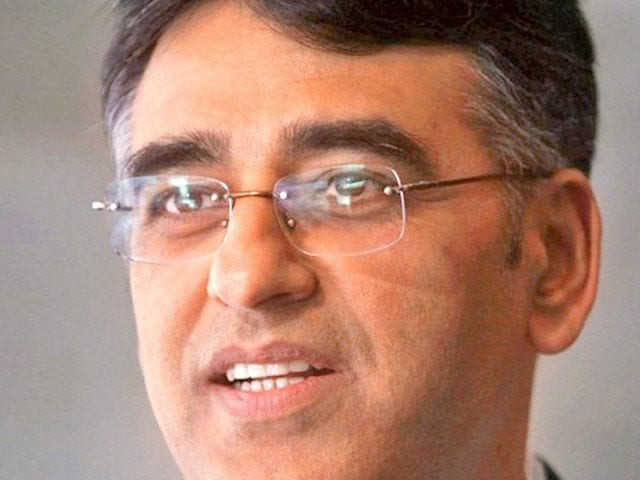

Finance Minister Asad Umar. PHOTO: EXPRESS/FILE

Reacting to the development, former finance minister Miftah Ismail criticised the government and accused it of succumbing to the pressure from auto companies and land developers. The government announced the lifting of the ban in the amended Finance Bill, but an official notification is yet to be issued.

Ismail had announced the ban in April this year, which came into effect on July 1. He boasted that his government had tackled the issue head-on by announcing the ban.

Officials of the Karachi Chamber of Commerce and Industry (KCCI) met recently with Finance Minister Asad Umar, where the minister said the government would extend more incentives to tax return filers and discourage non-filers.

He added that the government had been looking into the issue and was pondering to devise some kind of special measures to accommodate and facilitate non-resident and overseas Pakistanis. “It is very important that overseas and non-resident Pakistanis are facilitated as they send foreign exchange, which the country direly needs,” KCCI President Mufassar Ata Malik told The Express Tribune.

However, Malik said the government should not let resident non-filers of tax returns operate freely, adding filers should be given incentives, which would make it attractive to enter the tax net.

He said the meeting was fruitful and the minister also believes that non-filers must be restricted from buying property in order to pressurise them into becoming return filers.

The KCCI president said the move to prevent local non-filers from buying new cars and expensive property should remain in place, otherwise it would be difficult to bring them into the documented economy and subsequently widen the tax net.

“The government has to take some tough decision and restrict non-filers somewhere. If the decision is not taken, then the economy will continue to suffer.”

Malik lamented that delivery period for vehicles was still long and the restrictions on non-filers had only reduced it slightly.

“The aim of restricting non-filers from purchasing cars or properties is not to hurt any industry or sector but to encourage them to become filers, which is necessary,” he added. He explained that the case of overseas Pakistanis was different since they sent foreign exchange to Pakistan, which had been crucial for the country’s economy. Moreover, they do not qualify to pay taxes in Pakistan as they pay in the country of their current stay, where they earn.

Published in The Express Tribune, September 28th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ