Major policy shift: Govt allows tax dodgers purchase of cars and real estate

Reduces tax collection target, imposes regulatory duty on 312 tariff lines, increases sales tax on LNG supply

Reduces tax collection target, imposes regulatory duty on 312 tariff lines, increases sales tax on LNG supply.

PHOTO: REUTERS

Finance Minister Asad Umar on Tuesday unveiled the Finance Supplementary (Amendment) Bill 2018 in the National Assembly that carried the tax measures which had also been taken by his predecessor Ishaq Dar to enhance revenue collection. Umar also reversed the only major reform that the PML-N government had introduced to document the informal economy.

Most of the measures that Umar announced were not direct in nature except for the increase in income tax rates for individuals and salaried persons. The government imposed regulatory duty on 312 tariff lines and increased duty rates on another 295 lines.

It also increased sales tax on the supply of liquefied natural gas (LNG). The duty on mobile phones was also increased.

Similarly, the government increased the federal excise duty on imported cars, SUVs, vans of 1,800cc and more from 10% ad valorem to 20%

It allowed non-filers of income tax returns to purchase cars and immovable property. It also introduced a tax amnesty scheme for more than 800,000 people who in the past had been picked for audit due to their failure to file income tax returns.

It also increased the withholding tax on banking transactions being carried out by non-filers of tax returns, which was the brainchild of Dar.

The measures unveiled by the new government suggest that the PTI had not done its homework and continued the policies of previous Pakistan Muslim League-Nawaz (PML-N) government.

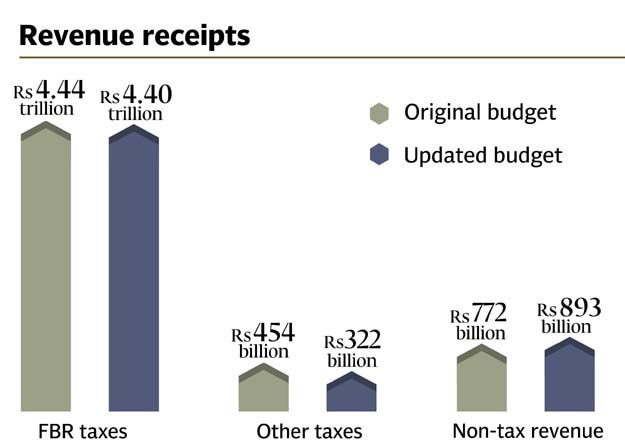

The revised revenue collection target for fiscal year 2018-19 is Rs4.398 trillion, said Minister of State for Revenue Hammad Azhar while addressing a press conference. The target is lower by Rs39 billion than that approved by the previous parliament.

But Umar said the PML-N government’s Rs4.435-trillion tax collection target was overestimated by Rs350 billion.

He announced that his government had decided to take gross revenue measures of Rs183 billion. However, Rs92 billion will be collected from tax evaders through administrative measures.

The Rs4.398-trillion target is only 14.4% higher than the collection of Rs3.841 trillion in the previous fiscal year. The PTI had promised to increase revenue collection to Rs8 trillion. Its target in the first year should have been at least 20% higher in order to achieve the Rs8-trillion objective in five years.

The International Monetary Fund (IMF) also does not recognise administrative measures and the government may face difficulty in defending the targeted collection of Rs92 billion under administrative measures during staff-level talks with the lender, beginning on September 27.

Azhar defended the decision to set a relatively lower tax collection target, saying even that target would require serious efforts due to stabilisation policies announced by the finance minister.

Benefits for tax dodgers

After allowing non-filers of tax returns to buy plots and cars, the undocumented economy will flourish. Cash will be withdrawn from the formal banking sector due to increase in the withholding tax on banking transactions.

The State Bank of Pakistan (SBP) has in the past warned about the adverse impact of the tax on the formal sector of the economy.

“It is very disappointing that the PTI government has lifted the ban on non-taxpayers to buy properties and vehicles ….today automakers have won and Pakistani taxpayers have lost,” tweeted former finance minister Dr Miftah Ismail.

Defending the move, the Federal Board of Revenue (FBR) said the PML-N government’s ban had dampened economic growth in these sectors. “The decision to lift the ban is a bonanza for real estate and automobile sector tycoons,” remarked Ashfaq Tola, former member of the Tax Reforms Commission (TRC).

Umar announced that a report prepared by the TRC would be the beginning document for introducing reforms in the FBR in coming weeks.

The PML-N government had barred non-filers of tax returns from purchasing immovable property of the value exceeding Rs5 million. The non-filers were also stopped from purchasing new locally manufactured cars or first registration of imported vehicles.

Income tax

In its last budget, the PML-N government had increased the minimum threshold of taxable income for individuals from Rs400,000 to Rs1.2 million and reduced the maximum tax of 30% for salaried persons and 35% for non-salaried individuals.

It also reduced tax slabs for salaried as well as non-salaried individuals to three to make the tax system simple.

The PTI government has now increased the tax slabs for salaried individuals to seven. Four new tax slabs ranging from 5% to 25% have been introduced for salaried individuals, increasing the tax burden on the highest paid persons by 66.6%.

It maintained the tax rates introduced by the previous government for people earning up to Rs2.4 million annually.

PTI govt unveil Rs5.3tr revised ‘status quo’ budget

For salaried people earning Rs2.5 million to Rs4 million annually, the tax rate has been increased from 10% to 15%. For those earning between Rs4 million and Rs8 million, the new rate is 20%, double the existing rate. For the highest income slab of more than Rs8 million, the new rate is 25% against earlier 15%.

Similarly, in the case of non-salaried individuals, eight tax slabs have been introduced - five more slabs ranging from 5% to 29%. This has increased the tax burden on businessmen by up to 93.3%. The withholding tax on non-filers conducting banking transactions valuing over Rs50,000 a day has been increased to 0.6%.

The government also proposed the withdrawal of tax-free perks of provincial governors and federal ministers. The perquisites including rent-free accommodation provided by the government to the provincial governors, free conveyance and entertainment allowance granted to provincial governors and rent-free accommodation, house rent allowance exceeding Rs550,000 per month and free conveyance and sumptuary allowance granted to the federal ministers have been withdrawn.

On the directive of apex court, the government has exempted from tax the donations for the Diamer-Bhasha and Mohmand Dam Fund.

Audit amnesty

The government also announced audit amnesty for such taxpayers who had automatically been picked for audit. It asked them to revise upwards by 25% their tax liability from the declared value for the closure of audit cases.

In cases where tax liability is zero, a taxpayer can avail of this option with tax payment equal to 2% of the declared turnover and in case no turnover is declared, upon voluntary payment of penalty for late filing of return under Section 182 of the ordinance. Tax amnesty will not be available to persons deriving income from salary, profit on debt, house property or where income is subject to a final or separate tax regime.

Persons and companies that have been selected for audit through computer balloting are also not eligible for the audit amnesty.

Prior to the passage of Finance Act 2018, a person was automatically selected for audit if the person failed to file return of income within due date or within the time period extended by the FBR.

Sales tax

The government also increased the sales tax on RLNG supply to all the sectors to the standard 17%. The reduced 12% sales tax will now be available only on supplies of RLNG/LNG to gas transmission and distribution companies. This will increase the cost of cement, fertiliser and CNG production.

On the recommendations of the Armed Forces Institute of Cardiology (AFIC), the government exempted 52 item categories of medical instruments and equipment from sales tax.

On the recommendation of the Pakistan Match Manufacturers Association, the government increased the sales tax on the import and supply of match box input from 17% plus Rs40 per kg to 17% plus Rs65 per kg. A ruling party senator does business in matchbox manufacturing.

Duties

LED/SMD lights are more energy efficient than energy savers and exemption is now provided for local supplies of LED/SMD lights meant for conservation of energy. The government has lowered the duties on about three-dozen raw material being used by export-oriented industries. This will dent the government’s revenues by Rs5 billion, said Azhar.

Cigarettes

The government has increased the federal excise duty on cigarettes in the range of 3.6% to 46.3%, but the influential tobacco lobby managed to persuade the government not to withdraw the third tier of taxation.

It increased the federal excise duty for the first tier of cigarettes by Rs530 per thousand sticks to Rs4,500, an increase of 13.4%. This will increase the price of a 20-cigarette pack by Rs12.5.

For the second tier, the federal excise duty has been increased to Rs1,840 per thousand sticks, an increase of Rs64 or 3.6%. This will increase the price of a 20-cigarette pack by only seven paisa.

For the third tier, the duty has been increased by 46.3% to Rs1,250 per thousand sticks. This will increase the cigarette pack price by Rs12.50.

The government has also increased the federal excise duty on unmanufactured tobacco produced by Green Leaf Threshing (GLT) units from Rs10 per kg to Rs300 per kg. The unmanufactured tobacco can only be sold by registered persons on active taxpayers list.

Published in The Express Tribune, September 19th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ