Pakistan needs to achieve rapid investment growth

PM should give a target to raise investment-to-GDP ratio to 20-25% from current 15%

The prime minister should give a clear target to the finance minister and the cabinet to raise the investment-to-GDP ratio to 20-25% during the government’s five-year tenure. This will improve job creation, productivity and exports.

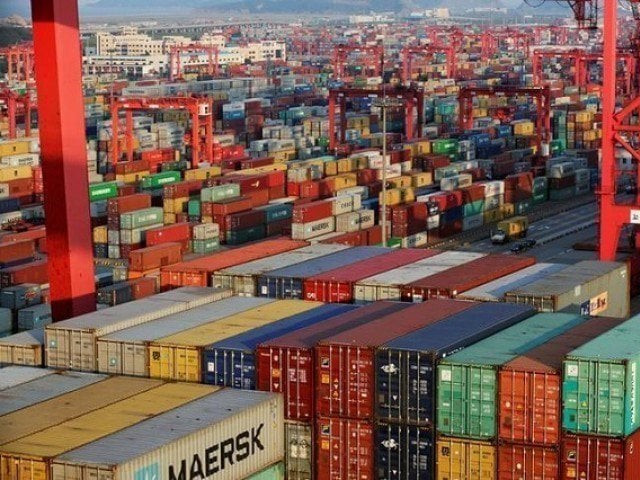

PHOTO:FILE

Now is the time to move on to the real agenda to bring economy out of crisis and to facilitate jobs and income growth for the people at large.

Pakistan’s investment-to-gross domestic product (GDP) ratio has been hovering around 15% while countries like China, India and South Korea have maintained the ratio above 30% to put their respective economies on a sustainable path.

The prime minister should give a clear target to the finance minister and the cabinet to raise the investment-to-GDP ratio to 20-25% during the government’s five-year tenure. This will improve job creation, productivity and exports.

A usual and useless recipe will be to focus on the World Bank’s Ease of Doing Business indicators to improve investment. Indeed, these indicators do not capture complete reality of investment climate in a country.

Over the past two decades, China and India performed relatively poorer than Pakistan in the doing business ranking, but they were top foreign direct investment destinations and highest domestic investment mobilisers.

Probably, some indicators matter more than others. For example, it does not matter if registering a company takes 5-10 more days, but it may matter substantially if a businessman is stuck in courts for dispute resolution for years.

Similarly, multiplicity of taxes and cumbersome procedures hurt businesses. Pakistan is advised to capture low-hanging fruits by improving starting a business or getting construction permit indicators through one-window or online operations. But very little progress has been achieved in terms of reforms in contract enforcement, tax payments and protecting intellectual property rights among others.

In order to achieve a rapid growth in investment, Pakistan Tehreek-e-Insaf (PTI) government needs to focus on the following areas:

Land-use policies

Due to massive speculation, property in Pakistan has become unaffordable for businesses due to sky-rocketing prices. Idle investments in real estate have led to shortage of buildings and commercial plazas for offices and factories.

Both China and India facilitate and lease land to investors on an individual basis. There is a need to encourage high-rise buildings in city centres to reduce office rents and promote investment in vertical housing.

Unbuilt property should be heavily taxed in order to encourage investment in more productive sectors of the economy.

Skilled labour

Foreign investors not only go to countries for skilled labour force, but they also look for knowledgeable workers and ideas. Pakistan needs to invest more in training and research.

Both school and tertiary education in Pakistan is useless for developing the skill-set. Technical and vocational education is marginalised and yields poor outcomes.

There is a need to identify key skills for garments, IT, engineering and food processing sectors and massive labour force should be trained through public-private partnership on the pattern of DigiSkills initiative of the Ministry of Information Technology.

Regulatory governance

Pakistan needs to strengthen its regulators by enhancing their autonomy and professionalism. The PTI government should especially focus on ensuring deployment of quality human resources at all levels in the regulators.

In this paper, one of my earlier articles titled “Regulators in Pakistan—watchdogs or lapdogs” lays out a framework for the improvement of regulatory governance.

Sindh CM vows to introduce investment, business reforms

The overall objective of this reform process should be to reduce regulatory burden on the private sector and to improve transparency in regulatory governance.

The State Bank of Pakistan should especially focus on enhancing credit for small and medium enterprises.

Building state capacity

The public sector has very little understanding of future economy. There is a need to train public servants to understand the dynamics of fourth industrial revolution and what sort of policy interventions will be required to boost investment in the new economy being shaped through the fourth industrial revolution.

Judicial system

Pakistan needs to establish separate commercial courts at the district level. Many redundant and inefficient laws need to be abolished or amended to improve dispute resolution.

Dubai International Financial Centre – the regional hub of finance – has developed partnership with the London International Arbitration Centre which has helped generate confidence among investors. Such measures are needed in Pakistan.

Tax payment

There is no tax policy in the country. There is a need to separate tax policy from tax administration as a key reform. On tax payments, both tax filing and refund mechanism should be made simpler and smooth.

Public-private partnerships

The government can leverage huge private investment by promoting public-private partnerships (PPPs) in railways, road and housing infrastructure. There is vast public land in many cities which should be used for developing affordable housing under PPPs.

Shell plans to invest $15-16m to meet growing demand

Such initiatives may open wide opportunities for domestic and foreign investment. However, efforts should be made to optimally distribute risks among public and private sectors.

The writer is a public policy adviser and research fellow having interest in public-sector governance, cities and entrepreneurship

Published in The Express Tribune, September 10th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ