With new strategy, NBP beats peers in profit growth

Management has followed a strategy of reducing cost of funding, improving loan margins

The bank’s management also revamped its two key products - advance salary and loan against gold - to improve the profitability.

PHOTO:NBP

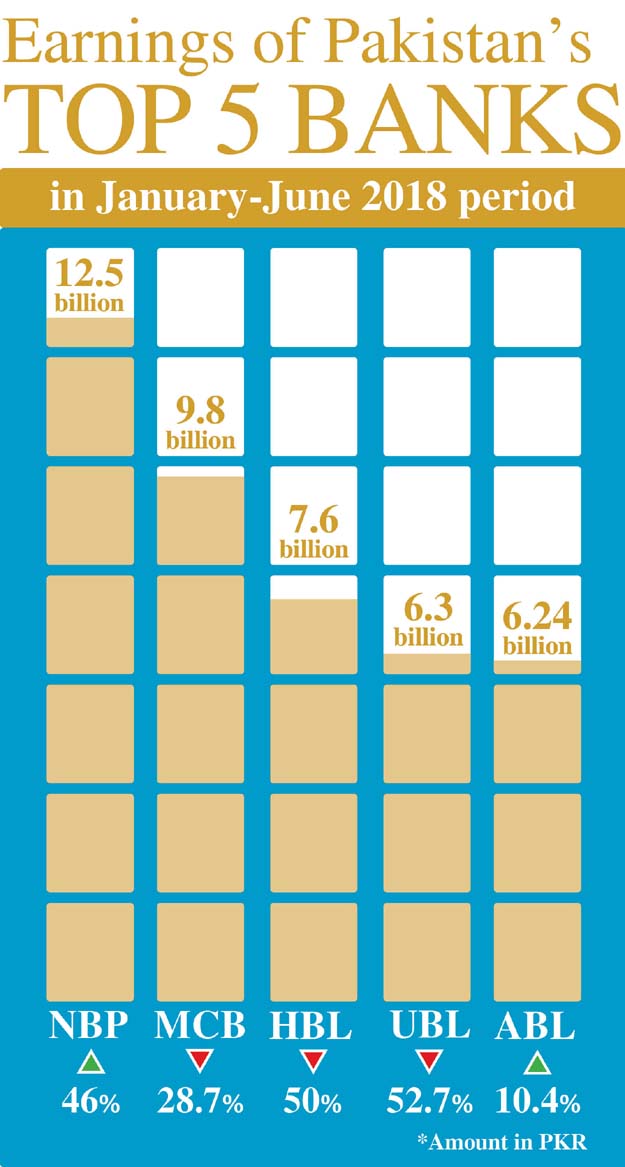

Three of the big five banks saw their after-tax profit go down massively in the first half of current calendar year. But state-owned NBP and Allied Bank Limited (ABL) registered 46% and 10.4% growth respectively.

Earnings of top-five banks are seen as an indicator of the health of Pakistan’s banking system. With most banks facing a significant decline in profit due to various reasons including different provisions and loss in trade business, NBP announced after-tax earnings of Rs12.5 billion for the January-June period.

Suspended NBP president challenges cabinet move

Owing to the improvement in its profitability, NBP’s share in total profits of the banking industry increased from 14.6% to 16.2%.

ABL’s profit jumped 10.4% to Rs6.24 billion in the first half. However, after-tax profit of Habib Bank Limited (HBL) showed a steep decline of around 50% to Rs7.6 billion, MCB Bank’s profit dipped 28.7% to Rs9.8 billion and United Bank Limited’s net earnings decreased 52.7% to Rs6.3 billion.

NBP saw the profit growth despite being a government entity that faced issues like corrupt practices, inefficiency and conspiracies. The bank also encountered challenges to removing non-performing loans from its balance sheet due to accountability fears.

Last week, the Pakistan Tehreek-e-Insaf (PTI) government suspended NBP president Saeed Ahmad who was facing charges of abetting money laundering in an accountability court. However, his exit may reverse the gains the bank has made in introducing the culture of accountability and meritocracy.

Ahmad had managed to sideline people having vested interests who had been working against the interest of the bank.

Govt suspends NBP President Saeed Ahmad

NBP’s net interest income rose 15.7% to Rs30.14 billion - the highest among its peers. MCB Bank was the only other bank among top five whose net interest income rose in double digits to Rs22.6 billion.

NBP’s management followed a strategy of reducing the cost of funding and improving margins on loans for bringing sustainability in its profitability, according to the bank’s senior management.

Its decision to shed expensive deposits also helped improve earnings by about Rs1 billion, they added.

The bank’s management also revamped its two key products - advance salary and loan against gold - to improve the profitability.

However, the bank still faces a high ratio of non-performing loans that stood at Rs122 billion at the end of June 2018, which was equal to 19.6% of total bad loans of the banking industry. The ratio was slightly lower than in December 2017.

Despite making provisions for almost the entire bad loans, NBP did not take these loans off the balance sheet due to fear of inquiry by the National Accountability Bureau (NAB). This has dented the bank’s plan to open a branch in China.

NBP is barred from charging interests on some government-related doubtful loans that has also affected its overall profitability.

The last president had brought major structural changes and increased the number of bank’s regional offices to 37 from 23 and delegated powers to regional management teams.

NBP’s head of forex branch arrested

However, despite his efforts, many fraud and embezzlement cases surfaced due to lack of control and system failure. A joint secretary level officer of the finance ministry was allegedly backing some of the corrupt elements in the bank.

Ahmad also could not complete investigation in relation to the bank’s new Islamabad building in which some of the bank’s top guns minted hundreds of millions of rupees.

Published in The Express Tribune, September 5th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ