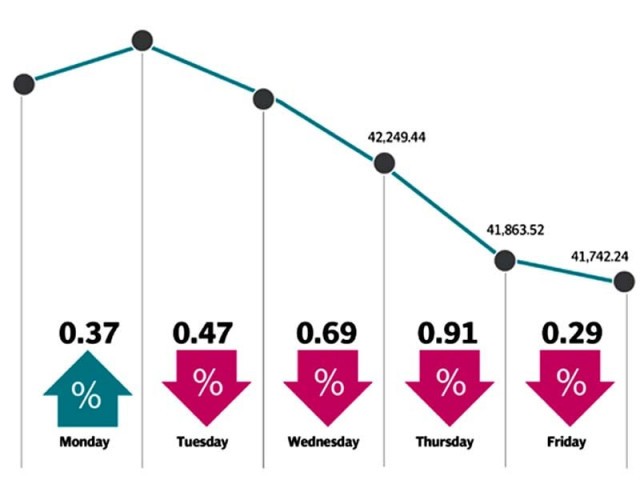

KSE-100 index loses 846 points in volatile ride

Benchmark index sheds 2% as investors wait for policy clarity

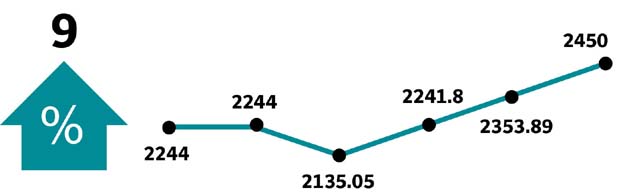

Market activity picked up amidst selling pressure as average daily traded value rose 9% week-on-week to $61 million while average daily volumes surged 19% week-on-week to 177 million.

PHOTO:FILE

Stocks remained under pressure with investors adopting a wait-and-see approach for clarity over the policies and steps required to deal with the country’s difficult financial situation.

A meeting of the Economic Coordination Committee (ECC) held during the week also dominated sentiments and kept market players at bay.

With the Oil and Gas Regulatory Authority (Ogra) recommending a major hike in gas prices, domestic industries remained exposed to the risk of higher input costs. However, the ECC meeting did not take decision on the tariff hike.

KSE-100 gains 175 points in range-bound trading

Earlier in the week, trading kicked off on a positive note at the Pakistan Stock Exchange, but optimism did not last long and the index fell in the following sessions.

The KSE-100 dipped on Tuesday on the back of profit-taking whereas continued selling by foreigners dragged the index down on Wednesday. The bearish trend did not come to an end by the close of week as investors stayed cautious.

Market activity picked up amidst selling pressure as average daily traded value rose 9% week-on-week to $61 million while average daily volumes surged 19% week-on-week to 177 million.

In terms of sectors, fertiliser (223 points), cement (224 points) and power (111 points) hit the index hard.

Fertiliser stocks were hammered after the ECC’s comment on collection of a Rs10-billion windfall from the industry.

Market watch: Bears continue to dominate as KSE-100 falls 386 points

The cement sector performed poorly following weak sales for August 2018. Commercial banks (82 points) and oil and gas exploration companies (51 points) also pulled the index lower.

On the other hand, positive contribution to the index came from tobacco (80 points) and food and personal care product (11 points) sectors.

Scrip-wise negative contribution was led by Lucky Cement (101 points), Fauji Fertilizer Company (91 points) and Engro (75 points). During the week, National Bank of Pakistan (NBP) announced higher-than-expected financial results and gained 2.3%, outperforming most other index names.

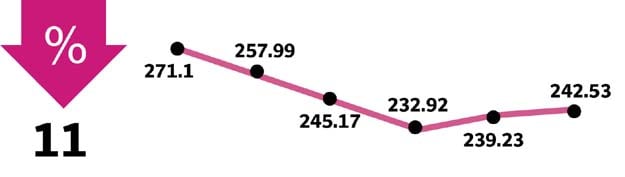

Foreigners sold $10 million worth of shares during the week vs net selling of $6.5 million in the previous week.

Selling was witnessed in stocks of exploration and production companies ($6.51 million) and commercial banks ($3.95 million). On the domestic front, insurance companies were net buyers of $8.4 million worth of shares.

In August 2018, foreigners sold $67.4 million worth of shares, the second highest in a month in 2018 to date.

Among major highlights of the week were Ogra recommending a reduction of Rs2 per litre in petrol price, foreign exchange reserves dipping $8 million, the World Bank being ready to support new government’s plans and circular debt soaring to an all-time high of Rs1.155 trillion.

Winners of the week

Philip Morris Pakistan

Philip Morris Pakistan Limited manufactures and sells tobacco and cigarettes.

Pak Tobacco

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Losers of the week

Pakistan International Container Terminal

Pakistan International Container Terminal operates a container shipping facility in Karachi.

Maple Leaf Cement Factory

Maple Leaf Cement Factory Limited produces and sells cement products in Pakistan.

Published in The Express Tribune, September 2nd, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ