Pakistan Oilfields’ profit falls slightly to Rs11.7b

It earns significantly lower income from associated firms

The board of directors recommended final cash dividend of Rs25 per share and 20% bonus shares (one share for every five shares). POL has already paid interim cash dividend of Rs17.5 per share during the year.

PHOTO:FILE

The company also paid a higher royalty against oil and gas exploration and earned a significantly lower income from associated firms which altogether eroded earnings despite robust net sales in FY18.

In the previous year, the exploration and production company had recorded a profit of Rs11.90 billion. Earnings per share dropped to Rs49.37 in FY18 compared to Rs50.23 in the previous year.

The board of directors recommended final cash dividend of Rs25 per share and 20% bonus shares (one share for every five shares). POL has already paid interim cash dividend of Rs17.5 per share during the year.

Government barred from imposing levy on oil production till next hearing

POL’s stock price dropped 0.78%, or Rs4.98, to close at Rs635.03 with 1.63 million shares changing hands at the Pakistan Stock Exchange (PSX) on Wednesday.

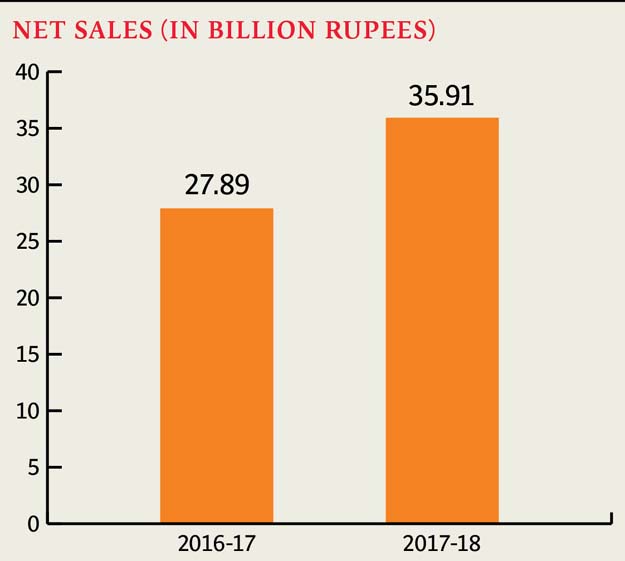

Net sales surged 20% to Rs35.91 billion in FY18 compared to Rs27.89 billion in the previous year. The surge in sales came as a result of 8% increase in oil production and 12% in gas output. Besides, rupee deprecation against the US dollar and 29% increase in oil prices also played a significant role in pushing sales higher, Arif Habib Limited’s analyst Tahir Abbas said in a note to clients.

Exploration cost doubled to Rs3 billion from Rs1.46 billion. “This comes on the back of a dry well cost booked during the period,” he said.

POL discovers hydrocarbon in Attock

Finance cost shot up 2.6 times to Rs1.91 billion compared to Rs747 million last year. Royalty payments increased 61% to Rs3.77 billion compared to Rs2.34 billion in the previous year.

Share of profits from associated companies shrank 2.8 times to Rs843 million compared to Rs2.38 billion last year. On the flip side, other income jumped three times to Rs2.59 billion.

Published in The Express Tribune, August 16th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ