KSE-100 ends marginally negative

Benchmark index decreases 48.53 points to settle at 42,760.13

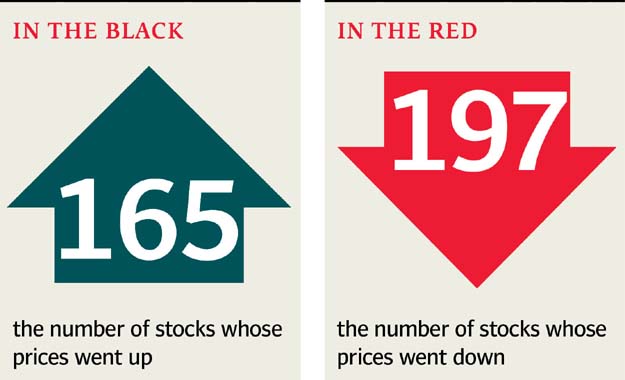

Shares of 376 companies were traded. At the end of the day, 165 stocks closed higher, 197 declined while 14 remained unchanged.

PHOTO:FILE

A positive start saw the benchmark test 43,000, falling shy by a mere seven points before profit-taking and selling pressure erased intra-day gains.

Negativity over earnings outlook and foreign selling continued to dampen sentiment, taking the benchmark into the red zone. At close, the KSE 100-share Index recorded a decrease of 48.53 points or 0.11% to settle at 42,760.13.

Elixir Securities’ analyst Murtaza Jafar said equities closed marginally negative with the index settling below the 43,000 level.

“Trading started on a positive note; however, due to lack of triggers in the broader market, a mixed trend was witnessed throughout the day.

Market watch: KSE-100 ends with trimmed gains after over 600-point increase

“The retail sector led the volume charts with LOTCHEM (+2.75%) churning over 33 million shares after it announced its second quarterly results at Rs0.65/share. MLCF (+5%) and FCCL (+5%) led gains in the cement sector to close at their respective upper limits.

“The index is likely to track political developments going forward as key government positions are expected to be decided in the upcoming days,” the analyst added.

Overall, trading volumes increased to 239.5 million shares compared with Monday’s tally of 153.8 million. The value of shares traded during the day was Rs9.94 billion.

Shares of 376 companies were traded. At the end of the day, 165 stocks closed higher, 197 declined while 14 remained unchanged.

Market watch: KSE-100 plunges over 1,200 points before minor recovery

Lotte Chemical was the volume leader with 33.4 million shares, gaining Rs0.38 to close at Rs14.22. It was followed by Pak Elektron with 16.3 million shares, gaining Rs0.84 to close at Rs41.46 and Fauji Cement with 16.1 million shares, gaining Re1 to close at Rs25.96.

Foreign institutional investors were net sellers of Rs469.5 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan.

Published in The Express Tribune, August 8th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ