With asset growth, tax payments by poll candidates rise sharply

It comes potentially in the wake of increased scrutiny, greater political competition

It comes potentially in the wake of increased scrutiny, greater political competition.

PHOTO: EXPRESS

While this sizable increase may come as no surprise to many given some recent reports on the growth of assets, the rich, systematic data released by the Election Commission of Pakistan (ECP) allows us to analyse the general trends and ask where this sharp increase came from.

Furthermore, we try to lay out the implications of these trends for the health of Pakistan’s elections.

Tax payments reported by the Federal Board of Revenue (FBR) and provided by the ECP reveal the tax payment history for a total of 15,911 candidates. There are more listed for the incoming election, but not all had their tax payment records reported.

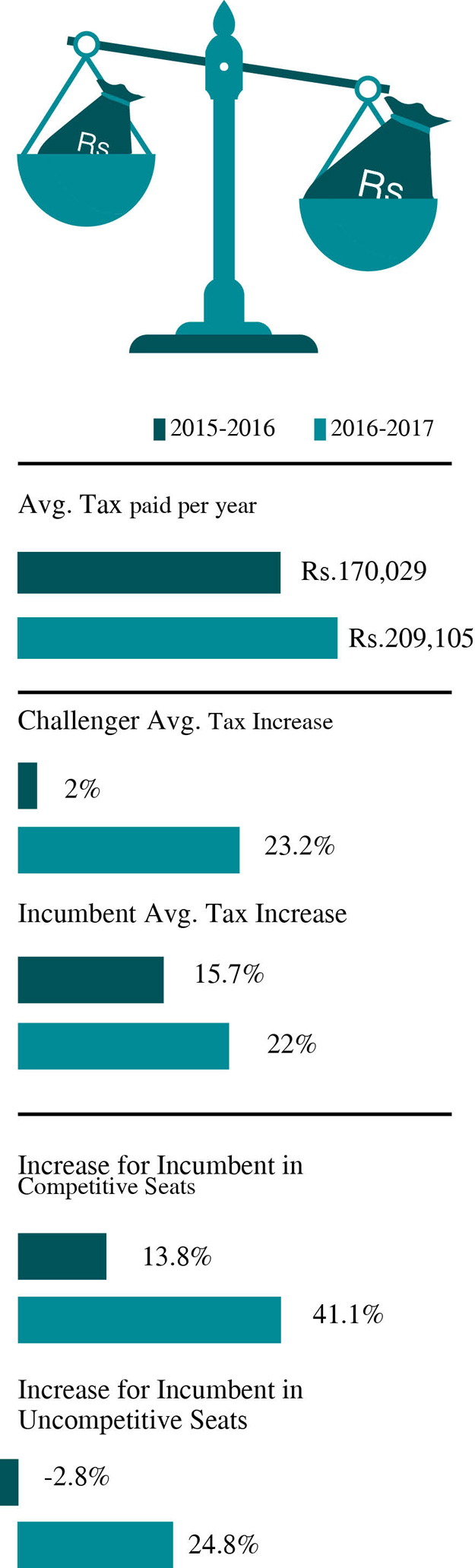

The average tax paid by these candidates in 2016 was roughly Rs170,000 while it rose to Rs209,000 in 2017.

While the growth in average taxes paid was only 4% from 2015 to 2016, the increase jumped to 23% in 2017. Furthermore, the percentage of candidates paying tax also increased.

This indicates that not only is tax coverage increasing, but candidates are, on average reporting, paying more tax over time.

It could be that the massive growth in assets reported between 2016 and 2017 is due to increased income earned from genuine business interests, political rent seeking or more nefarious means.

However, due to the very high increase in tax payments, we believe it has to be partly, if not mostly, due to increased accuracy of income and asset reporting as well as an increased willingness to pay taxes by politically active individuals.

There could be several explanations for this; increased scrutiny by the National Accountability Bureau (NAB) and the media, greater political competitiveness between the incumbent and opposition parties in the run-up to the election cycle leading to more oversight, or a general shift in reporting and tax paying norms.

One way to examine what kinds of individuals are paying more tax is to consider whether the increase is due to newcomers or due to incumbents in office.

We find that the increase in tax paid by incumbent candidates is not distinguishable from 2016 to 2017 from the increase among challengers. However, there is a greater increase among incumbents from 2015 to 2016 than among challengers.

The similar rates among both incumbents and challengers in the years immediately preceding the election indicates that increased reporting and payment might be attributable to closer media and institutional scrutiny in the latest election cycle.

FBR to miss tax collection target by Rs84 billion

Not only are incumbents feeling the pressure, but challengers are also anticipating increased scrutiny and are responding with transparency.

Furthermore, these similar rates across incumbents and challengers indicate that the growth in assets cannot be entirely attributed to ill-gotten political maneuvering as challengers are less able to avail themselves of those opportunities.

Scrutiny may be greatest in areas where political competition is most fierce and where the election is most closely monitored.

Indeed, it appears that incumbents who are in very competitive races (where they won with fewer than 10 percentage points more votes than the runner-up) are responsible for the vast majority of the increase among incumbents. Indeed, the growth in taxes paid by incumbents running again in competitive constituencies is nearly 50% from 2016 to 2017 alone.

Overall, these trends point to a positive influence of the media and court oversight of elected officials.

The fact that the FBR is recovering taxes at a much higher rate (despite incumbent parliamentarians as well as any individuals associated with a public post being unable to avail themselves of the recent tax amnesty scheme) indicates that there is increased pressure to honestly report.

As mentioned above, however, it could also be the case that competitive constituencies provide the greatest opportunity for possibly genuine increases in assets, some potentially ill-gotten.

However, whether increased pressure to report honestly or large increases in assets are driving this change in tax payments, we find it easy to be optimistic about what this indicates about the health of Pakistan’s elections.

If the sharp increase in tax payments is due to genuine increases in assets, then the fact that we can observe that with these data means the increases are being reported.

If the increases are being made public, then the media and the electorate can judge candidates with a large amount of information available. If we believe the sharp increase in tax payments is due to an increase in the honesty of reporting, then that is a trend that should be welcomed.

Tax amnesty about accountability: FBR official

Indeed, if increased competition leads to more honest reporting, then fostering a level playing field in each constituency could have knock-on effects regarding transparency and information available to the public that are not obvious at first.

In general, as election season progresses, increased collection and dissemination of data by the ECP is likely to allow further empirical examination of Pakistan’s political landscape, hopefully leading to insights that both affirm and challenge widely-held beliefs, as well as provide systematic evidence beyond anecdotes as to the nature of Pakistan’s democracy.

Next step is to bring back looted money: Imran

Luke Sonnet is a PhD candidate at the University of California, Los Angeles and is a pre-doctoral fellow at the Lahore University of Management Sciences

Ibrahim Khan is a BSc Economics and Mathematics graduate from the Lahore University of Management Sciences

Published in The Express Tribune, July 16th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ