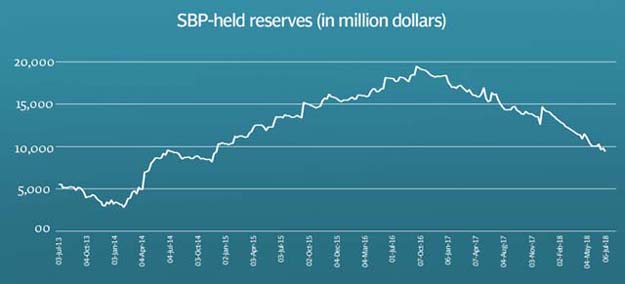

Foreign exchange: SBP's reserves fall below $9.5b as concerns rise

Decrease of 3.16% comes due to external debt and other official payments

Decrease of 3.16% comes due to external debt and other official payments. REUTERS/Chor Sokunthea

On July 6, foreign currency reserves held by the central bank were recorded at $9,479.5 million, down $309.3 million compared with $9,788.8 million in the previous week.

The decrease was due to external debt and other official payments, according to the SBP statement.

Overall, liquid foreign reserves held by the country, including net reserves held by banks other than the SBP, stood at $16,084.3 million. Net reserves held by banks amounted to $6,604.8 million.

Foreign exchange: SBP's reserves rise 1.31% to $9.79b

In April, the SBP's reserves increased $593 million due to official inflows. Pakistan also raised $2.5 billion in November 2017 by floating dollar-denominated bonds in the international market in a bid to shore up official reserves.

A few months ago, the foreign currency reserves surged due to official inflows including $622 million from the Asian Development Bank (ADB) and $106 million from the World Bank. The SBP also received $350 million under the Coalition Support Fund (CSF).

In January, the SBP made a $500-million loan repayment to the State Administration of Foreign Exchange (SAFE), China.

The low level of reserves has already put severe pressure on the Pakistani rupee that has witnessed three rounds of devaluation, cumulatively shedding over 13% to the US dollar in the last six months. With reserves now falling below the $9.5-billion mark and an import bill hovering around $6 billion a month, concerns have increased over an imminent balance of payments crisis.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ