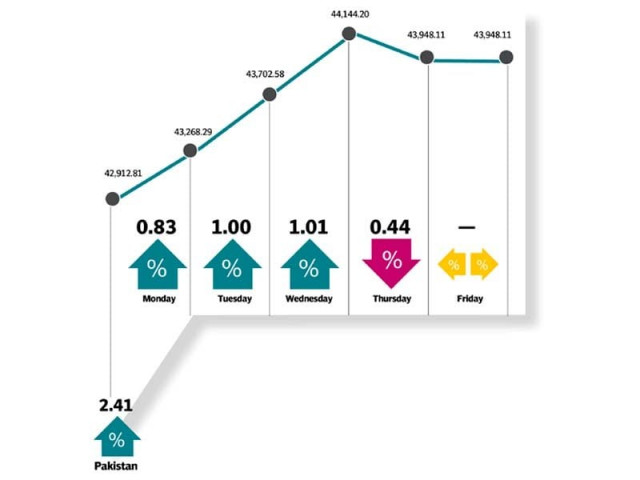

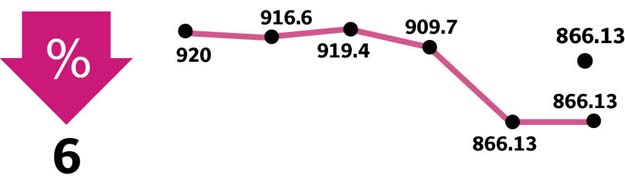

Bull-run continues as KSE-100 Index soars 1,035 points

Activity picks up with investors remaining optimistic about interim set-up

The KSE-100 kicked off trading on a positive note at the start of the week, maintaining the winning streak from the preceding session

PHOTO: EXPRESS

The bull-run persisted for the third successive week with investors remaining optimistic about the caretaker set-up. Confidence emerged in investment climate as concerns were allayed by the trust in caretaker Finance Minister Shamshad Akhtar’s abilities due to her successful stint as central bank governor previously.

The newly appointed minister took immediate notice of the deteriorating macroeconomic situation, held review meetings and was also expected to meet IMF officials during their visit to Pakistan. This developed a sense of optimism among the investors that sparked a buying spree.

The KSE-100 kicked off trading on a positive note at the start of the week, maintaining the winning streak from the preceding session. Institutional support pushed the index higher that crossed 43,000 points.

Investors were seen taking positions in attractive value plays with large banks and blue chips such as Sui Northern Gas Pipelines (SNGPL) and Lucky Cement being top choices.

The positive rally continued for the following two sessions with the index breaching the 44,000 barrier.

Unfortunately, the buoyant mood was cut short as bears returned to the market. Thursday, which was the last trading day of the week, saw the index retreat 196 points due to profit-taking. The World Bank’s projection of a slowdown in Pakistan’s economic growth in FY19 also dampened sentiments.

Stocks undergo correction as KSE-100 ends 1.21% lower

Looking at the historical trend, equities have always performed well with the average return provided by the KSE-100 Index during caretaker set-ups standing at 14%, according to AHL Research.

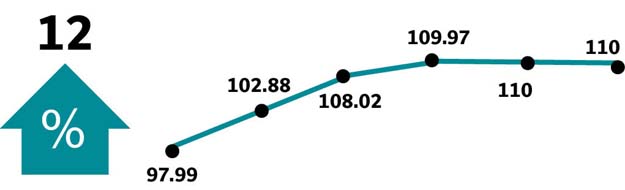

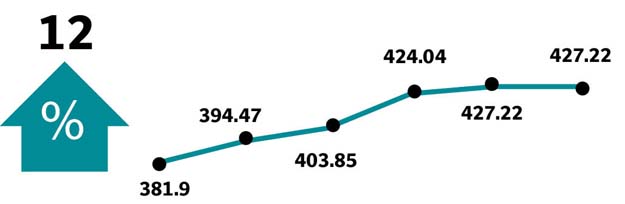

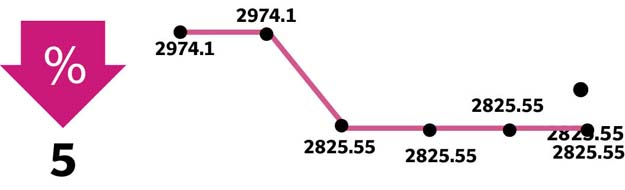

Participation improved significantly during the week as average daily traded volumes increased 54% to 184 million shares while average daily traded value was up 62% at $78 million.

Contribution to the index was lent by banks (+573 points), oil and gas marketing companies (+138 points), cement companies (+126 points), oil and gas exploration firms (+78 points) and fertiliser companies (+60 points).

On the other hand, the power generation and distribution sector dragged the index lower by 35 points.

Banking stocks rose on expectation of a continued interest rate hike on rising inflation and appointment of the new finance minister which was seen as a hawk while the rally in oil and gas marketing companies came on the back of a new tariff for gas distribution companies that would offer significantly higher returns than those previously recommended.

In terms of individual stocks, Habib Bank (up 194 points), United Bank (134 points), Lucky Cement (89 points), Bank AL Habib (83 points) and SNGPL (70 points) emerged as major winners. On the flip side, major laggards were Hubco (down 15 points) and ICI (15 points).

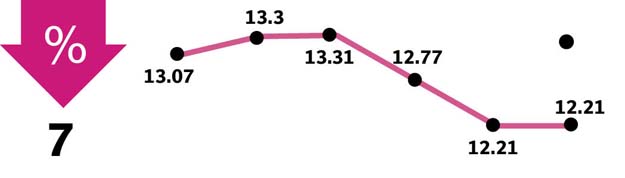

Foreign selling came in at $29.6 million compared to net selling of $17.5 million in the previous week, taking 2018 to date/FY18 to date net selling to $89 million/$244 million respectively, according to Elixir Securities.

Market watch: KSE-100 snaps five-day winning streak as selling pressure mounts

Selling was concentrated mainly in commercial banks ($8.4 million) and cement companies ($9 million).

On the domestic front, major buying was reported by insurance companies ($18 million), other companies ($7 million) and individuals ($4.9 million).

Market watch: KSE-100 continues to bleed, ends below 45,200

Among major news of the week were Pakistan and Russia going to sign a $10-billion offshore pipeline deal, the World Bank lowering Pakistan’s GDP growth projection to 5%, cement sales for May 2018 depicting 6% growth year-on-year, taking 11MFY18 growth to 14% and FATF meeting going to be held from June 24 to 26 in Paris.

Winners of the week

Colgate Palmolive (Pak)

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene and a variety of other products.

Sui Northern Gas

Sui Northern Gas Pipelines Limited purchases, purifies, transmits, distributes and supplies natural gas, in addition to marketing liquefied petroleum gas.

National Refinery

National Refinery Ltd manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Losers of the week

Pakistan International Bulk Terminal

PIBT has been setup as the country’s first terminal for handling coal, clinker and cement on build, operate and transfer (BOT) basis at Port Qasim Authority.

ICI Pakistan

ICI Pakistan Limited manufactures a range of industrial and consumer goods. The company’s product line includes polyester staple fibres, POY chips, soda ash, paints, specialty chemicals, sodium bicarbonate, polyurethane and adhesives. ICI Pakistan also manufactures pharmaceuticals and animal health products and trades in various chemicals for use in industries in Pakistan.

Philip Morris (Pakistan)

Philip Morris Pakistan Limited manufactures and sells tobacco and cigarettes.

Published in The Express Tribune, June 9th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ