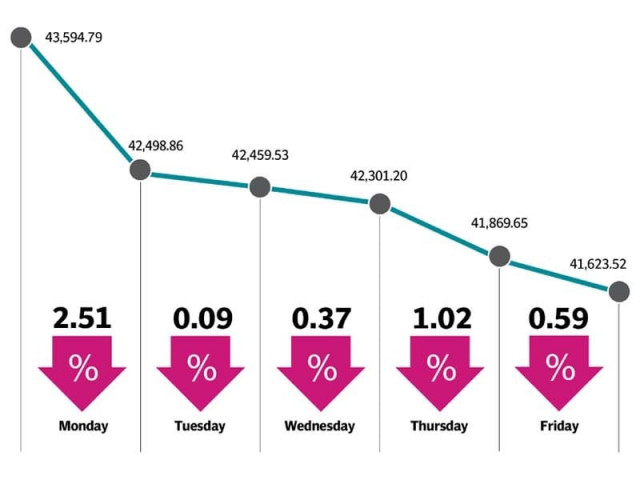

KSE-100 plummets 4.5%, marks highest weekly loss of 2018

Political uncertainty and deteriorating conditions on the economic front dented investor sentiment

The market was already under pressure owing to the current turmoil at the political and economic fronts; however, fallout over former prime minister Nawaz Sharif’s comments on Mumbai terror attacks sent the index into a free fall. Investors’ confidence was dented by the constant back-and-forth at the political front and developments regarding the caretaker. Additionally, news of mounting external debt and plunging foreign exchange reserves also kept players sidelined.

Market watch: Stocks take a hammering as KSE-100 plunges 1,096 points

The 4.5% decline marks the highest weekly loss of 2018, according to a Topline Securities report. Trading activity also suffered as lack of positive triggers meant investors remained on the sidelines. Market participation in terms of value touched a 46-month low on Thursday, the report added. The beginning of the month of Ramazan also contributed to the dull activity.

Traded value during the week went down by 22% to $44 million, while trading volume showed a decline of 31% to 115 million shares. The week also witnessed the 2018 Semi-Annual Review by MSCI, which remained a non-event for the Pakistan Stock Exchange with no changes being made to its weight in the emerging markets. However, three companies, namely National Refinery, Pak Elektron and IGI Holdings were removed from MSCI Small Cap Index.

Market watch: KSE-100 falls 246 points in sixth successive negative close

All heavyweight sectors remained in the red during the week where banks, cements, fertilisers and oil & gas exploration cumulatively took away 1,152 points.

The banking sector eroded 346 points from the index despite relaxation in the amended Finance Bill. Cements were down 304 points as coal crossed the $100 per ton mark, fertilisers took away 273 points on account of profit-taking, E&P companies 229 points and OMCs eroded 134 points off the index.

In terms of scrips, LUCK (-167 points), HBL (-118 points), ENGRO (-117 points), PPL (-94 points) and NESTLE (-87 points) remained the major laggards.

Govt refuses to revoke PSO-PNSC oil supply deal

Foreigners once again remained sellers in the outgoing week of $19.97 million against selling of $4.13 million in the previous week. Gauging activity of foreign market participants, massive net sell-off was witnessed in banks ($9.28 million) and oil and gas marketing companies ($2.65 million). Mutual funds also remained sellers as they sold equities worth $16.8 million during the week.

Whereas, on the local front, banks/DFIs and individuals absorbed the pressure, by buying equities worth $20.24 million and $2.76 million, respectively.

Among major highlights of the week were; auto sales increased 40% year-on-year in April 2018, government approved Rs20 billion loan guarantee for PIA’s overhaul, Rs24 billion was set aside for next export package, ECC approved higher UFG benchmark for gas utilities between FY13-17 at 7.6%, foreign direct investment clocked in at $2.2 billion and current account deficit widened 50% to $14.03 billion.

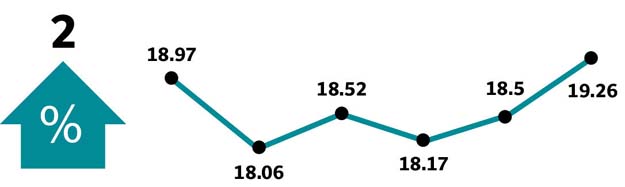

Winners of the week

Muree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Jahangir Siddiqui Company

Jahangir Siddiqui & Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

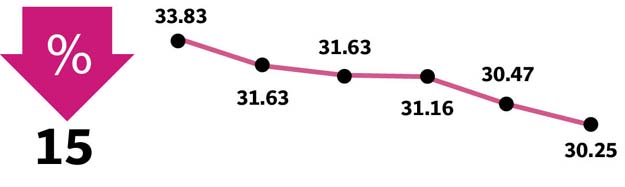

Losers of the week

Pak Elektron

Pak Electron Limited manufactures and sells a variety of electrical products and domestic appliances. The group’s power products include transformers, energy meters and switchgears. Their appliances consist of a range of deep freezers and air conditioners. The group also has an agreement with Sony Pakistan Ltd, for which Pak Electron will manufacture Sony brand televisions.

Attock Refinery

Attock Refinery Limited, a subsidiary of the Attock Oil Company, specialises in the refining of crude oil.

Published in The Express Tribune, May 20th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ