Pakistan posts 5.8% growth rate

Economy expands to $313b; per capita income increases to $1,640, income inequality also up

Economy expands to $313b; per capita income increases to $1,640, income inequality also up. PHOTO: INP

On Thursday, Adviser to the Prime Minister on Finance Dr Miftah Ismail launched the Economic Survey of Pakistan for the fiscal year 2017-18. He was accompanied by Minister for Planning Ahsan Iqbal.

The government’s five-year term comes to an end on May 31.

“Every statistic has improved and we have managed to increase gross domestic product growth rate and at the same time contained the budget deficit and inflation,” said Ismail. Pakistan’s economy expanded to $313 billion, the highest in history.

Miftah proudly claimed that the government made good on all promises made by former prime minister Nawaz Sharif.

Tax exemptions increase to whopping Rs541b

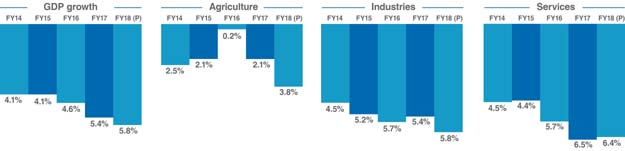

“Against last year’s 5.4% economic growth rate target, the economy provisionally grew at a pace of 5.8% in the outgoing fiscal year, which is the highest in 13 years,” said the finance adviser.

Planning Minister Ahsan Iqbal, who dubbed the Economic Survey “PML-N’s scorecard for its five-year economic performance”, said the party had managed to pull the country out of a chaos and resolve critical issues such as power outages and terrorism.

“Had there been no political turmoil…the government would have achieved the 6.1% economic growth rate target in its last year,” said Iqbal.

Iqbal said that Pakistan’s economic framework would have been more stable if the government had not focused on ending the energy crisis, which was necessary for industrial expansion and job creation.

However, the Economic Survey confirmed that Pakistan’s structural economic problems could not be fully addressed during the current government’s tenure. But overall situation significantly improved against the one prevailing five years ago.

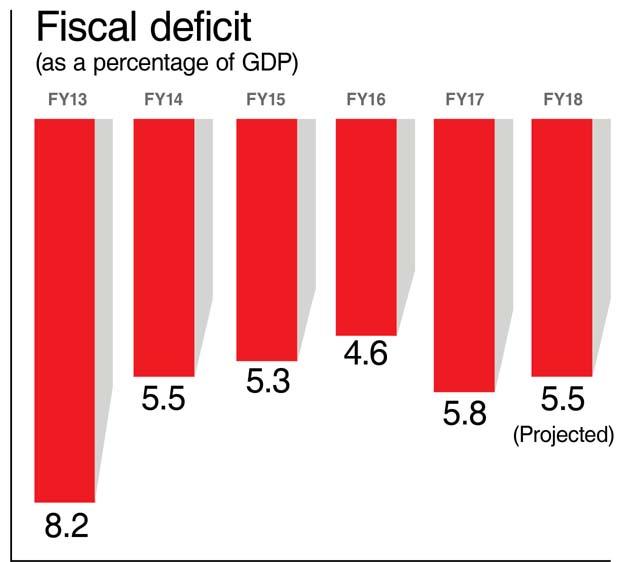

The budget deficit and the current account deficit remained far higher at the end of FY 2017-18 than what the PML-N had hoped to achieve. Against the promise of bringing down the budget deficit to 3.5% of Gross Domestic Product (GDP) by June this year, Ismail admitted that the budget deficit would be at least 5.5% of the GDP in the same period.

The current account deficit would remain at 5% of GDP at the end of this fiscal year against the promise of restricting it to 1.2% of GDP.

Ismail admitted problems on the external front and expressed the hope that the recent two devaluations of the rupee against the US dollar would help narrow down the widening current account deficit. He said that the government did not want to curtail imports but was trying to bridge this gap by increasing exports and remittances.

Also, for the first time, Miftah publically reacted to the adverse comments made by his predecessor. Two days ago, former finance minister Ishaq Dar had said that Pakistan should now forget about becoming a member of the G-20 — an elite club of the top 20 growing global economies — because of economic policies pursued in the past eight months.

“My approach on exchange rate policy, which is also shared by Governor State Bank of Pakistan (SBP), is different from that of Dar,” said Dr Ismail while responding to Dar’s criticism on rupee depreciation.

Bank of Punjab’s board approves financial results

Dr Ismail said that exporters, who had been complaining about the adverse impact of a strong rupee on exports for three years, were “not mad”.

The government, however, did not share unemployment data for FY 2017-18, because the latest jobless figure of 5.9% was three years old.

Investment and savings also remained below the targets. Tax and non-tax revenues, although better than the previous year, also remained below goalposts.

Exports also fell for the fourth consecutive year while debt kept piling up. Per capita income increased to $1,640.50, but income inequality widened.

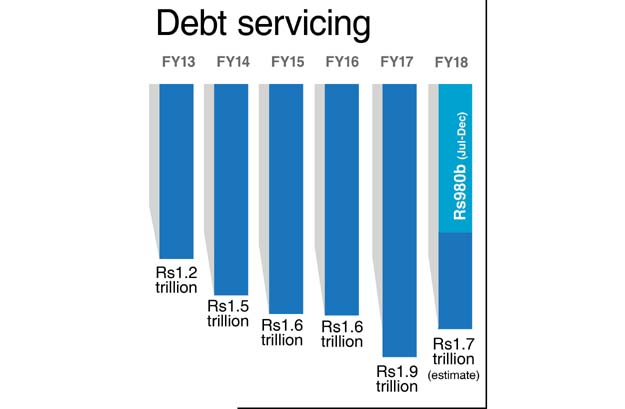

The public debt-to-GDP ratio was projected at 70.1%, which was even worse than the 64% level left by the PPP government.

Under its five year plan, the PML-N government wanted to bring it down to 60% of GDP.

But Ismail insisted that debt had to be incurred for new investment in the power sector.

Investment and savings

The investment-to-GDP ratio stood at 16.4% against the five-year target of 22.8%. This ratio was slightly better than last year’s revised rate of 16.1%. Savings slipped below last year’s level of 12% and stood at 11.4% of GDP, far below the five-year target of 21.3% of GDP.

Fixed investment remained at 14.8%. Public investment increased to 5% of GDP, which was better than the previous year. The target of private investment was also missed by a wide margin, which stood at 9.8% of GDP against the five-year target of 16.7%. Results for private investment are worse than last year when they had been estimated at 10%.

GDP growth

The PML-N government claimed to achieve an economic growth rate of 5.8% in its last year in power that is the highest over the past 13 years. But it is significantly lower than the 7% target the incumbent government wanted to achieve when it came to power in 2013.

However, the current growth rate is decent enough to give a political advantage to the ruling party in the upcoming general elections.

In 2012-13, which was the last year of the PPP tenure, the economic growth rate was 3.7%.

Just under than two-thirds of growth — 66.4% to be precise — came from the services sector, which performed slightly better than the expectations. The government achieved growth targets for services and agriculture sectors but missed the industrial sector growth target again.

Despite a better economic performance, the growth rate was still insufficient to absorb the youth bulge — Any pace of growth below 7% rate would increase unemployment.

Agriculture

After witnessing 2.1% growth in the previous fiscal year, the agriculture sector this time performed better because of exceptional growth in cotton ginning and better crop yields. The sector grew at a pace of 3.81% this year, against the government’s target of 3.5%.

Production of major crops saw 3.6% growth against the target of 2%. This time, minor crops also grew by 3.33% against a contraction last year. Cotton ginning surpassed the 6.5% target and showed 8.7% growth. Livestock also posted 3.8% growth, matching its annual target.

The forestry sector showed 7.2% growth but remained below the target of 10%. There was a surprising trend. The NAC revised down last year’s forestry growth figure of 14% to negative 2.3% growth rate.

The fishing sector grew by 1.63%, almost achieving the target.

Industries

The government missed all its targets set for the industrial sector despite giving it a preferential treatment in the supply of electricity. Heavy taxation and blockage of tax refunds affected the sector’s performance.

Against a target of 7.3%, output in the industrial sector stood at 5.8%. The output of large-scale manufacturing stood at 6.2%, which was below the official target while small-scale manufacturing grew to 6.1%, also below the target.

Electricity generation and distribution grew only 1.8% against a target of 12.5%, mining and quarrying sub-sector grew 3% against a target of 3.5%. The construction sector grew at a pace of 9.1%, missing the target of 12.1%.

Services

The services sector, which accounts for more than half of national economy, grew by 6.4%, slightly above the target. The wholesale and retail trade posted 7.5% growth against a target of 7.2%. The transport, storage and communication sub sector saw 3.6% growth against a target of 5.1%. Finance and insurance witnessed 6.1% growth against a target of 9.5%. The housing services saw a growth of 4% and the general government services 11.4% against the target of 7%.

Published in The Express Tribune, April 27th, 2018.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ