FDI reduces to $153 million ahead of elections

Amount in March lowest among all months of current fiscal year

Amount in March lowest among all months of current fiscal year. PHOTO: EXPRESS

The drop comes apparently due to a pickup in political noise ahead of the general elections to be held later this year.

The State Bank of Pakistan (SBP) reported on Tuesday that Foreign Direct Investment (FDI) has halved to $152.7 million in March compared with $318.3 million in the same month last year.

Defence, debt to eat up half of proposed Rs5.237 trillion budget for 2018-19

Cumulatively, in the first nine months (July 2017 to March 2018) of the current fiscal year, FDI improved 4.4% to $2.09 billion from $2 billion in the same period last year, the central bank added. The latest monthly investment is the lowest in any of the previous seven months or after August 2017’s FDI of $152.5 million, according to the central bank.

On the other hand, Pakistan’s economy continued to expand. Gross Domestic Product (GDP) grew at the decade high level of 5.8% in fiscal year 2018, in progress, compared to last year’s decade high of 5.3%.

Overseas Investors Chamber of Commerce and Industry (OICCI) Secretary General M Abdul Aleem cautiously expressed doubt that the drop in the single month’s investment number might be due to the prevailing uncertainty on political and macroeconomic fronts.

The secretary general did not give importance to the single month’s number and added one should analyse the overall trend of cumulative investment in the fiscal year to date. “The monthly number may fluctuate sharply up or down. It doesn’t matter. The nine-month data suggests foreign investors are on track of making fresh investment (in Pakistan),” he said.

Many European investors in the auto, infrastructure and LNG import terminal sectors are to make major investment decisions for Pakistan in the near future. And some of them are waiting for their regulatory approvals to initiate the investment process in Pakistan, he added.

“Pakistan carries huge potential to grow. The investment climate would be much better in the post-election period,” he said. “FDI may total at around $3 billion this fiscal year.” In the previous fiscal year 2017, the country received $2.73 billion in FDI.

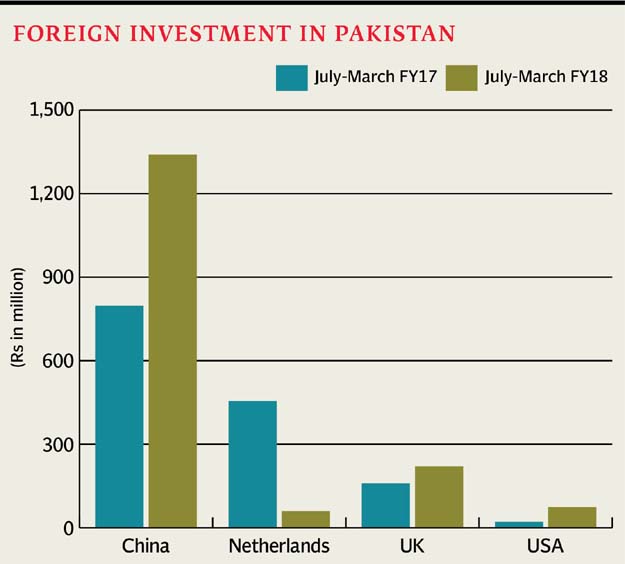

According to the central bank data, China remained the single largest foreign investor with net investment of $58.9 million in March, followed by the Netherlands $15.9 million, the United Kingdom $15.4 million, the United States $8.7 million and Norway’s $8.4 million.

FDI grows 132% to $340.8m as China dominates

Construction sector attracted the single largest amount of net (invest/divest) FDI of $54.5 million in March, financial business received $25.8 million, oil and gas exploration $16 million, electronic sector $8.4 million and cars manufacturing sector attracted $7.1 million.

Bourse investment

Foreign investors divested a net $300,000 at the Pakistan Stock Exchange (PSX) in March compared to $5.3 million in March 2017. Also, in nine months of the current fiscal year, foreign divestment slowed down to $93.3 million compared to $346.3 million in the nine-month period last year.

Net foreign investment - including foreign public, private and portfolio investments - totaled at $4.45 billion in the nine months that is 68.9% higher than $2.63 billion in the same period last year.

Published in The Express Tribune, April 18th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ