The legislation was introduced as presidential ordinances on April 8.

Terming the move illogical, Pakistan Peoples Party lawmaker Naveed Qamar questioned the need for passing the ordinances just 15 days before the announcement of the budget.

“What did they fear? If the government thinks it cannot have gotten it (the amnesty scheme) through the house and they fear criticism so much, they have no right to govern,” he said.

Consequences of the amnesty scheme would be faced by the caretaker and the next elected government, he insisted.

He said that such an amnesty was conceptually wrong and amounted to strangulating the next elected government.

“I cannot understand why every new amnesty scheme is praised and the previous one is criticised? Nothing has worked so far,” he maintained.

Pakistan Tehreek-e-Insaf’s Shah Mahmood Qureshi said: “Instead of honouring parliament, ordinances are being issued.”

The move, he said, benefitted nobody but looters, thieves and money launderers, adding that it was nothing but a slap in the face of taxpayers.

Questioning the motives for not consulting the Economic Coordination Committee (ECC) and the State Bank of Pakistan (SBP), he said: “I think (the amnesty scheme was) launched to help a special class (of people).”

“This action can lead Pakistan to be blacklisted by the Financial Action Task Force (FATF),” he warned.

Protecting corruption: Ex-information minister slams amnesty scheme

After facing similar outbursts from Jamat-e-Islami (JI) and Muttahida Qaumi Movement (MQM), Adviser to the Prime Minister on Finance Miftah Ismail said that the scheme had been misconstrued by PTI and PPP and they should appreciate the fact that the tax burden on a person earning Rs100,000 or so would be lowered.

He insisted that the scheme did not provide cover against legal proceedings.

Terming the tax break offered in the amnesty scheme fantastic, he said that no such relief had ever been offered in the country’s history.

He also said that the Federal Board of Revenue (FBR) was strictly keeping tabs on foreign remittances.

After July 1, he said, nobody would now be able to buy a plot if he or she was not a taxpayer.

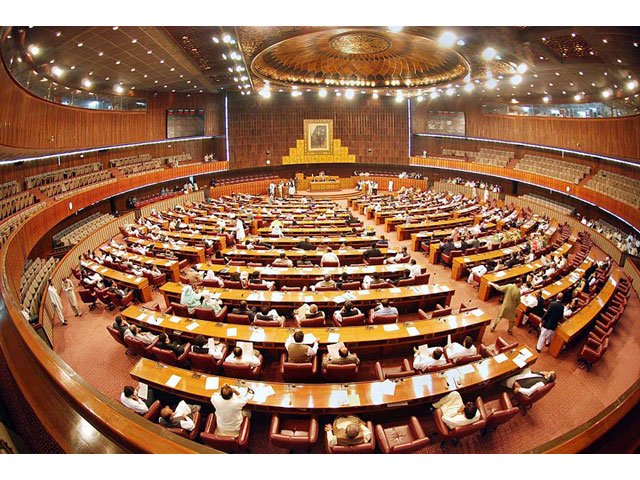

At this time, there were hardly 30 lawmakers in the house against the required quorum of 86. Opposition members were also not letting Ismail speak and presiding officer Zahid Hamid announced to adjourn the session to avert further embarrassment.

Q&A session

During the question-hour, Foreign Minister Khawaja Asif told the house that the United States (US) defence attaché, who was recently involved in a traffic accident that resulted in the death of a motorist in the federal capital, was still in the country and appropriate action would be taken against him in accordance with the law.

Asif said that the US embassy had assured of full cooperation in this matter.

The foreign minister also talked of five Pakistani prisoners still being detained at the Guantanamo Bay.

“Our mission in Washington has been coordinating with the US State Department to discuss legal options for repatriating these Pakistanis from Guantanamo Bay,” said Asif.

Two of the inmates were facing charges while the other three had not yet been charged.

Efforts, he said, were being made to bring the three of the detainees back to the country, he added.

The foreign minister stated that Pakistan was effectively highlighting the Kashmir dispute at all international forums, including the UN, Human Rights Commission and the OIC.

He said that Pakistan also wanted an honourable and dignified return of Afghan refugees to their homeland and there were currently 54 refugee camps in Balochistan and Khyber-Pakhtunkhwa which were being used by terrorists.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ