Salaried class to benefit as govt mulls lower income tax rates

If passed, measure will see 90% cut in tax burden on lowest income group; relief is worth Rs67b

A businessman rides an escalator at a banking district. PHOTO: REUTERS

If it passes the hurdle, the wage-boosting measure will see a 90% cut in tax burden of the lowest income group and around 43% for the highest income group, said officials in the finance ministry.

Cumulatively, the salaried class’s take-home pay will increase by Rs67 billion at their current income levels, which will be a major relief to them ahead of upcoming general elections, they added.

Government vows to bring ‘tax-free’ budget

The plan also includes increasing the tax exemption threshold from the current Rs400,000 to Rs500,000 annual income, they added.

So far, numerous meetings have taken place between the Federal Board of Revenue (FBR) and the Prime Minister’s Office to finalise the relief plan, they added. The plan, however, may see some obstacles, as there were also concerns about the impact of the massive relief on the government’s revenues and its already narrow income tax base, said the sources.

The PML-N government has announced to give fiscal year 2018-19 budget on April 27th - almost five weeks before its five-year constitutional term comes to an end. This will be the sixth budget that the present National Assembly will approve.

The Rs67-billion relief is still lower than what Prime Minister Shahid Khaqan Abbasi desired during the in-house meetings, said the sources. PM Abbasi’s plan talks about Rs100 billion relief to the salaried class, the sources said. The extremely narrow tax base remains a concern for all stakeholders. Less than half a percentage point of the total population or 1.261 million individuals and companies filed their income tax returns for tax year 2017, according to the new Active Taxpayers List.

The prime minister is of the view that low tax rates would encourage people to come in the net.

The number of income tax return filers from all main sectors of the economy has contracted in the past five years and the only exception is the salaried class. In the salaried class, the return filers increased from 242,153 in 2013 to 436,812 by February 15 of this year, a net addition of 232,368 or 96% in five years.

Under the law, it is legally binding on every citizen of the country to file income tax return by September 30 every year provided he has a taxable annual income of Rs400,000 or more.

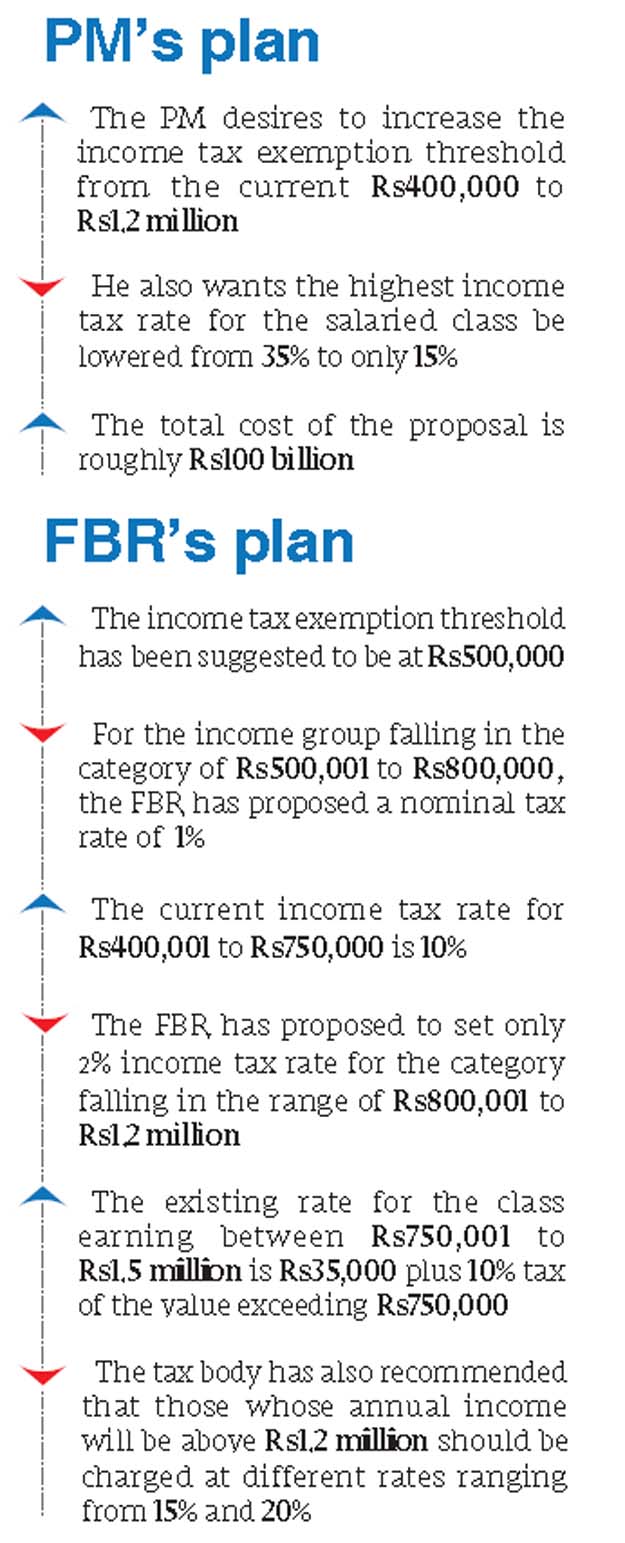

The sources said that the PM desired to increase the income tax exemption threshold from the current Rs400,000 to Rs1.2 million. Additionally, the PM also wanted that the highest income tax rate for the salaried class may be lowered from 35% to only 15%. The total cost of the PM’s proposal was roughly Rs100 billion.

Sources said that the FBR did not endorse this proposal and came up with an alternate workable plan. According to the FBR’s proposal, the income tax exemption threshold has been suggested to be at Rs500,000, the officials said.

For the income group falling in the category of Rs500,001 to Rs800,000, the FBR has proposed a nominal tax rate of 1% of the income exceeding Rs500,000, said the sources. If this proposal is accepted, the tax burden of this income class will come down by 90%. The current income tax rate for Rs400,001 to Rs750,000 is 10%.

The FBR has proposed to set only 2% income tax rate for the category falling in the range of Rs800,001 to Rs1.2 million. The existing rate for the class earning between Rs750,001 to Rs1.5 million is Rs35,000 plus 10% tax of the value exceeding Rs750,000.

Development budget to take hit from cuts

The FBR has also recommended the PM that those whose annual income is above Rs1.2 million should be charged at different rates ranging from 15% and 20%. This will give tax relief of minimum 43% to the highest income slab.

Currently, there are four income tax slabs for those earning between Rs1.5 million to six million and plus. The highest slab comprises people earning Rs6 million plus and it attracts income tax rate of 35% plus Rs1.32 million. The second highest slab comprises of those earning from Rs4 million to Rs6 million and is charged at 30% rate plus Rs722,500 fixed income tax.

The sources said that the Adviser to Prime Minister on Finance Dr Miftah Ismail was reluctant to let the government take a hit of Rs67 billion and asked the FBR to increase tax rates for other sectors to compensate this loss.

Published in The Express Tribune, March 27th, 2018.

Published in The Express Tribune, March 27th, 2018.Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ