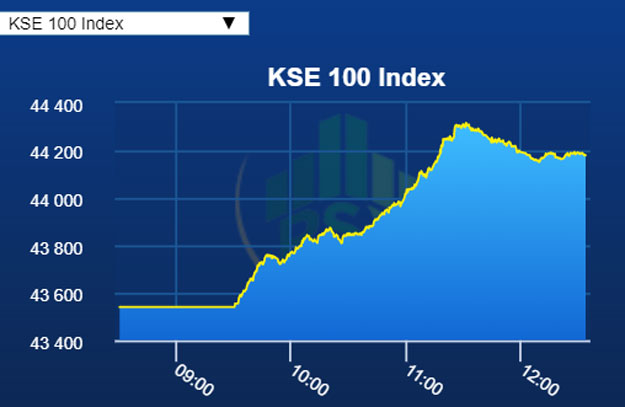

Rupee loses almost 5%, KSE-100 gains almost 1.8% in intra-day trading

Currency traded sharply lower in the inter-bank market, boosting specific sectors in the stock market

Currency traded sharply lower in the inter-bank market, boosting specific sectors in the stock market. PHOTO: REUTERS

Quite fittingly, the textile and oil sectors gained due to a direct advantage, while shares of banks got a boost due to expectations of an early interest rate hike that would come on the back of higher inflation readings.

By 12:15pm, the KSE-100 Index was hovering around the 44,160 level for an intra-day increase of 620 points or 1.42% with index-heavy banks, oil and textile stocks leading the rally. Volume on the all-share index were up to 125 million shares already, less than halfway through the session. The increased activity was in sharp contrast to a dull session on Monday when volume for the entire session amounted to 116 million shares.

Pakistan's stock market: from Asia's best to Asia's worst

Market talk suggested the dollar went up to Rs116, but the number would only be final at close of trading on Tuesday. The rupee depreciation comes on the back of immense pressure on Pakistan’s foreign exchange reserves that have plunged to around $12 billion as a widening current account deficit takes its toll on the economy.

Source: PSX website

Source: PSX websiteInternational creditors as well as independent economists have long said that the Pakistani rupee is overvalued against the dollar and needs to fall to around Rs115.

On Tuesday, however, it seemed like economic fundamentals were incharge.

“The dollar went as high as Rs116 (in the inter-bank market),” Saad Khan, head of research at IGI Securities, told The Express Tribune. “We will have to see where it ends today.

“However, the market seems to have gotten the push due to this. Textile, banks and oil sector benefit the most from this.”

Unilever announces fresh $120 million investment in Pakistan

Given that a fall in the rupee’s value would stoke inflation, analysts and experts now expect an early interest rate hike by the central bank.

“There is going to be a minimum 25 basis points increase in the interest rate in the upcoming monetary policy.”

To recall, the State Bank of Pakistan, in a widely unexpected move, increase the key interest rate by 25 basis points in its last monetary policy announced at the end of January.

With the next announcement expected to be made soon, analysts are factoring in at least another 25-basis-point increase, which would take the key interest rate to 6.25%.

“Inflation readings are expected to be higher and would slowly creep up to over 5% by the end of the fiscal year. There could now be a more permanent impact in the pace of inflation.”

A weaker rupee makes exports cheaper, benefitting the country’s export-oriented textile sector. However, it also makes imports expensive, denting margins of import-centric industries like autos. The trend was visible in Tuesday’s share prices of these companies.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ