Weekly review: KSE-100 moves north as bulls dominate

Cement sector leads surge; index ends positive four times out of five

Cement sector leads surge; index ends positive four times out of five

PHOTO: REUTERS

The market opened the week on a negative note owing to reports about Pakistan’s addition on the Financial Action Task Force (FATF) Grey List. However, sentiments improved over the week due to positive news flow emanating from the cement sector as well as encouraging developments on the political front.

Market watch: Cement sector shines as KSE-100 rises 271 points

Cherry-picking of selected index names on Tuesday revitalised the stock market, which created a bullish momentum on Wednesday, allowing the index to gain over 200 points. The banking sector, however, remained under pressure as heavyweight HBL and UBL stocks plummeted due to Supreme Court’s ruling of increased minimum pensions.

On Thursday, cement, auto and refinery stocks exhibited buying interest, which pushed the index forward. On Friday, news that Pakistan’s energy sector’s circular debt has mounted to Rs922 billion with payables to PSO scaling to Rs89.4 billion kept the oil marketing giant’s stock in red.

Cements remained in the limelight throughout the week as cement players in the ‘north’ increased prices by Rs10 per bag and are further expected to increase prices by Rs10-20/bag.

Global markets rattled further as US President Trump proposed to levy 25% and 10% duties on steel and aluminum imports, respectively. While increased protectionist measures from the world’s largest economy do not bode well for global markets, additional duties, if imposed, will not have any impact on the margins of Pakistan-based steel manufacturers, stated a report by Elixir Securities.

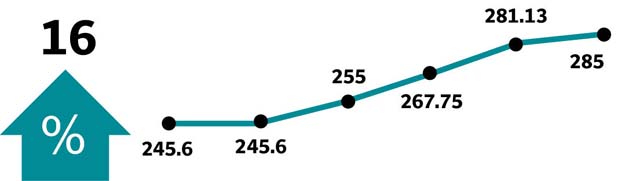

In terms of sectors, the cement and fertiliser sectors led the overall surge, tanking the index by 468 points cumulatively. Commercial banks, despite being the highest gainers in the previous week, led the declines along with oil and gas exploration companies cumulatively, erasing 137 points from the market.

On the economic front, foreign exchange reserves held by the State Bank of Pakistan (SBP) continued to remain under pressure, decreasing 2.82% on a weekly basis to stand at $12.3 billion as of 23rd February, 2018.

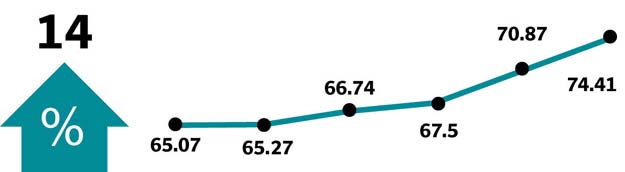

Overall activity remained almost flat with average daily volumes recording a meagre decline of 1% to settle at 181 million shares whereas average value traded increased by 1% to $74 million.

Scrip-wise, Lucky Cement was the single largest contributor to the index, adding 116 points, with Maple Leaf Cement (52 points) and Engro (48 points) following behind.

That said, foreigners offloaded stocks worth of $11.4 million compared to a net sell of $2.8 million last week. Major foreign selling was witnessed in power generation and distribution ($16.4 million) due to deal of Hub Power Company’s 20.4 million shares at Rs96.5/share on the last day of trading. While on the local front, major buying was reported by companies ($11.7 million) and insurance companies ($6.0 million).

Cement prices go up by Rs10 per bag in northern region

Other major news during the week included: consumer inflation recorded 3-month low at 3.8% in Feb’18, energy sector’s circular debt touched record Rs922 billion, Dewan Group partnered with South Korean automaker to re-launch Shehzore, reserves slipped to $18.41 billion, outlook on Pakistan banks remained stable according to Moody’s, and PAEL and Kohinoor got debarred from World Bank-funded project.

Winners of the week

Punjab Oil Mills

Punjab Oil Mills Ltd manufactures and sells vegetable ghee, cooking oil, and laundry soap.

Maple Leaf Cement

Maple Leaf Cement Factory Limited produces and sells cement products in Pakistan.

Losers of the week

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Pak Elektron

Pak Electron Limited manufactures and sells a variety of electrical products and domestic appliances. The group’s power products include transformers, energy meters and switchgears. Their appliances consist of a range of deep freezers and air conditioners. The group also has an agreement with Sony Pakistan (Pvt) Ltd, for which Pak Electron will manufacture Sony brand televisions.

Published in The Express Tribune, March 4th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ