The Federal Board of Revenue (FBR) on Tuesday presented sector-wise income tax return data of the last five years to the Senate Standing Committee on Finance. The data was nothing less than an admission of failure on the part of tax officials.

This comes despite the announcement of four tax amnesty schemes and declaration by Prime Minister Shahid Khaqan Abbasi that broadening of the tax base is his foremost priority. The data covers 36 sectors including the salaried class from tax year 2013 to 2017. Excluding the categories of ‘salaried’ and ‘others’, there were more return filers in 2013 than in 2017.

PM announces one-time amnesty scheme on offshore assets

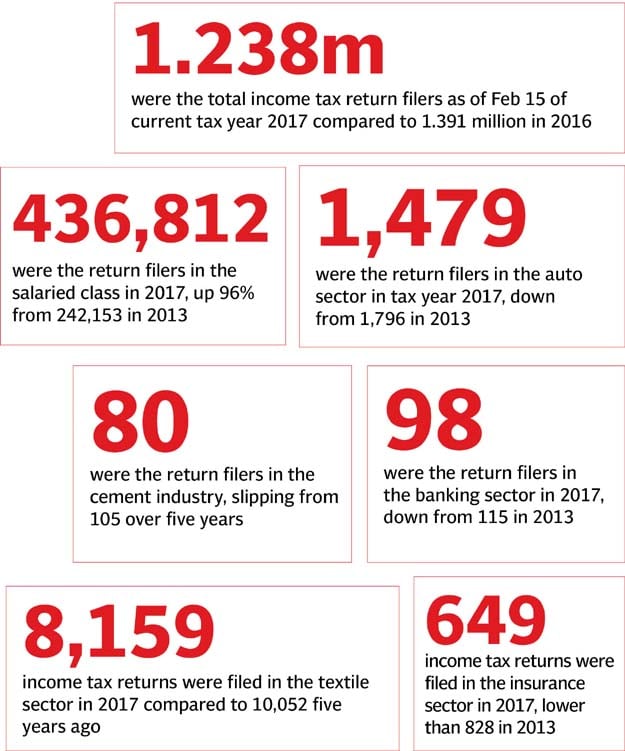

Total income tax return filers stood at 1.238 million as of February 15 of the current tax year 2017 compared to 1.391 million in 2016. This shows that about 152,789 people have slipped from the FBR’s already narrow tax base. These numbers are inclusive of the salaried class.

Under the law, it is legally binding on every citizen of the country to file income tax return by September 30 every year provided he has a taxable annual income of Rs400,000 or more. However, due to its inefficiency, the FBR extends the last date till the time the total number of return filers comes close to the last year’s level.

Hoping against hope, the FBR’s chief of income tax policy on Tuesday emphasised that the return filers would jump up from 1.238 million to 1.6 million when the FBR would publish the Active Taxpayers List next week. In the salaried class, the return filers increased from 242,153 in 2013 to 436,812 in 2017, a net addition of 232,368 or 96% in five years. In the others category, the return filers were 633,250 in 2013 that went up to 754,254 this year.

According to the FBR’s data, in 2013 the income tax return filers in the asset management sector were 15, which came down to 13 this year. In the auto sector, there were 1,796 return filers in 2013, which dropped to 1,479 this year.

In the banking sector, there were 115 return filers in 2013, which fell to only 98 this year. The beverages industry had 145 return filers five years ago and now the figure is 115.

Similarly, in the building construction sector, the return filers were 1,140 five years ago, who slipped to mere 885 this year. The reduction in the number of tax returns from the mainstream economic sectors does not commensurate with the economic expansion over the past five years. In the capital investment sector, the return filers were 11, which have now come down to 9. In the cement industry, they slipped from 105 to just 80 in five years.

In the chemical business, the number dropped from 1,302 to just 1,104 while in the booming business of electronics, the return filers shrank from 1,285 to 1,038.

In the fertiliser industry, the return filers slipped from 84 to only 51. In the growing food business, the number dipped from 5,187 in 2013 to 3,910 in tax year 2017. The filers owning foundations shrank from 458 to 360.

Return filers in the fund management business came down from 215 to 185 in five years. In the hotel business, they shrank from 605 to 485.

In the insurance sector, the filers slipped from 828 to 649 whereas in the investments category, they slid from 112 to 103. In the iron and steel sector, the number contracted from 1,448 to 1,180.

Withholding taxes dominate revenue collection

“When hotel and insurance businesses are growing, then how come the return filers are going down,” asked Senator Ilyas Bilour of the Awami National Party.

In the leasing sector, the filers decreased from 1,649 to 1,324, leather sector - from 1,188 to 983, oil and gas - from 1,239 to 988, paper - from 1,699 to 1,326, pharmaceuticals - from 1,286 to 1,081, plastics - from 1,593 to 1,228, power sector - from 356 to 310, sugar - from 186 to 104 and telecom - from 809 to 616.

In the textile sector, the number of return filers dropped from 10,052 to 8,159 in five years whereas in the category of trusts they fell from 1,008 to only 797.

Published in The Express Tribune, February 21st, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732184775-0/BeFunky-collage-(80)1732184775-0-165x106.webp)

COMMENTS (11)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ