Bitcoin plummets 7% to a fresh 2-1/2-month low

Banks in Britain, the US ban use of credit cards to buy cryptocurrencies

PHOTO: REUTERS

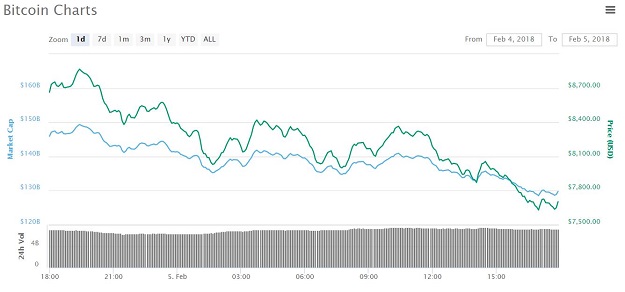

The price of Bitcoin on the Luxembourg-based Bitstamp exchange has now fallen by more than half from a peak of almost $20,000 hit in December. Last week, it suffered its worst weekly performance since 2013.

Banks in Britain and the United States have banned the use of credit cards to buy Bitcoin and other cryptocurrencies, fearing a plunge in their value will leave customers unable to repay their debts.

Bitcoin slides as Facebook ad ban, India clampdown unnerve investors

Lloyds Banking Group Plc, Britain's biggest lender, said on Sunday it would ban its credit card customers from buying cryptocurrencies, following the lead of US banking giants JP Morgan Chase & Co and Citigroup.

Source: coinmarketcap.com

Source: coinmarketcap.comThe move is aimed at protecting customers from running up huge debts from buying virtual currencies on credit, if their values were to plummet, a Lloyds spokeswoman said.

Last week, Mastercard Inc, the world's second biggest payments network, said customers buying cryptocurrencies with credit cards fuelled a one-percentage-point increase in overseas transaction volumes in the fourth quarter.

At that time, Bitcoin was staging a spectacular rise in value, reaching a peak of $19,187 on December 16 on the Luxembourg-based Bitstamp exchange.

But the biggest and best-known cryptocurrency has since fallen dramatically and on Monday was down 6% to $7,700 at 11:00 GMT on Bitstamp, extending losses from Friday amid worries of a global regulatory clampdown.

India's measures against cryptocurrencies

India is planning steps to ensure cryptocurrencies are illegal within its payments system, while at the same time appointing a regulator to oversee unregulated exchanges that trade in "crypto assets", a finance ministry official said.

US official warns Bitcoin could become the new Swiss bank account

A panel constituted by the government to look into issues relating to cryptocurrencies is expected to submit its report in the current fiscal year ending March 31, SC Garg, Economic Affairs Secretary, told CNBC TV18 news channel.

"The government will take steps to make it illegal as a payment system," he said at a post-budget event telecast by the news channel, adding the trading of "crypto assets" at the unregulated exchanges would be regulated.

The government does not consider cryptocurrencies legal tender and will take all measures to eliminate use of crypto assets in financing illegitimate activities or as part of payment system, Finance Minister Arun Jaitley told parliament while presenting his annual budget last week.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ