Weekly review: KSE-100’s bullish run ends due to profit-taking

Index closes 250 points lower amid foreign capital outflows

Weekly review: KSE-100’s bullish run ends due to profit-taking

Heavyweight sectors, including banking and cement, succumbed to negative sentiments generated by fear of adverse court rulings in the former’s case regarding retrospective pension payments.

A sooner than expected hike in the discount rate by the central bank aimed at curtailing aggregate demand growth also spiked concerns over the external sector and foreign reserves position.

Reduced cement prices in northern parts of the country, despite considerable utilisation levels, dampened sentiments due to fears over unsustainability of cement sector profits.

Market watch: KSE-100 maintains positive momentum with slight rise

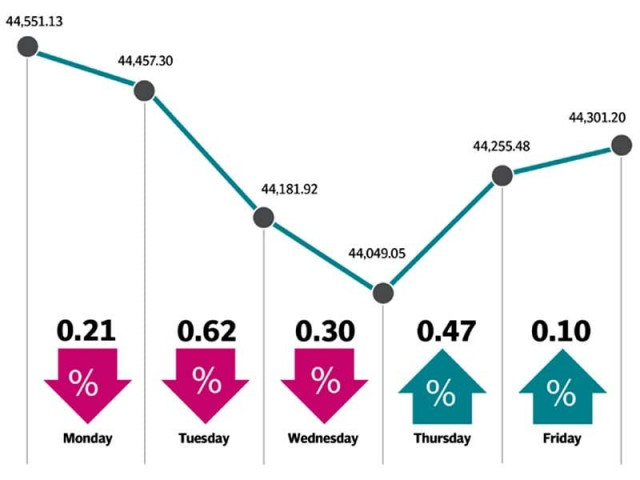

Profit-booking coupled with low institutional activity during the first three days of the week kept the index in the red, causing the stock market to cumulatively lose 502.1 points.

The KSE-100 was able to find its resistance level near the 44,000 mark on Thursday as it snapped a five-day losing streak to climb over 200 points. An uptick in global oil prices allowed the bourse to carry the winning momentum on Friday with increased interest in oil and gas exploration and production companies.

During the week, average daily turnover decreased 7.3% to 255 million shares, whereas traded value fell 22% to $89.8 million.

The index saw positive contributions mainly from fertilisers (45.2 points) and pharmaceuticals (43.4 points), with the government’s approval of increase in drug prices generating interest in the latter. On the other hand, negative contributions came from banks (181 points) and cements (160.6 points).

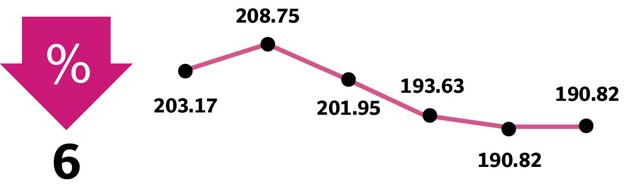

On an individual basis, negative contributions were led by United Bank (132.2 points), Lucky Cement (69.1 points), Habib Bank (67.3 points) and MCB (62.5 points).

Market watch: KSE-100 snaps five-day losing streak

Foreigners sold stocks worth $12.62 million, negating the $12.44 million buying last week. On the domestic front, individual investors ($6.29m) and other organisations ($6.26) bought stocks worth $12.62 million, while banks remained on the selling side ($12.1m)

Other major highlights of the week were; SBP raised interest rate to balance growth, petrol price increased by Rs2.98 while diesel price rose by Rs5.92 from February 1, Hascol reached a settlement with Mena Energy, HBL became the only bank to open branches in Gwadar and China, Dawood Hercules accepted offer for Hubco Power Company’s stake sale.

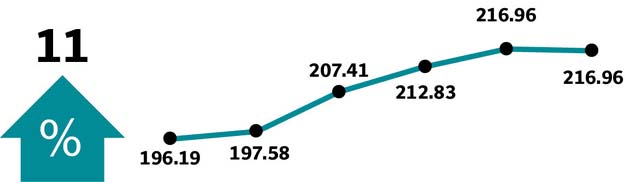

Winners of the week

GlaxoSmithKline Pakistan

GlaxoSmithKline Pakistan Limited manufactures and markets pharmaceuticals and animal health products.

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively.

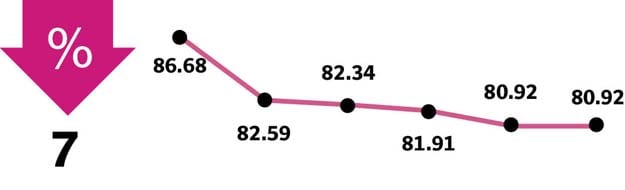

Losers of the week

Maple Leaf

Maple Leaf Cement Factory Limited produces and sells cement products in Pakistan.

United Bank

United Bank Ltd provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

Published in The Express Tribune, February 4th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ