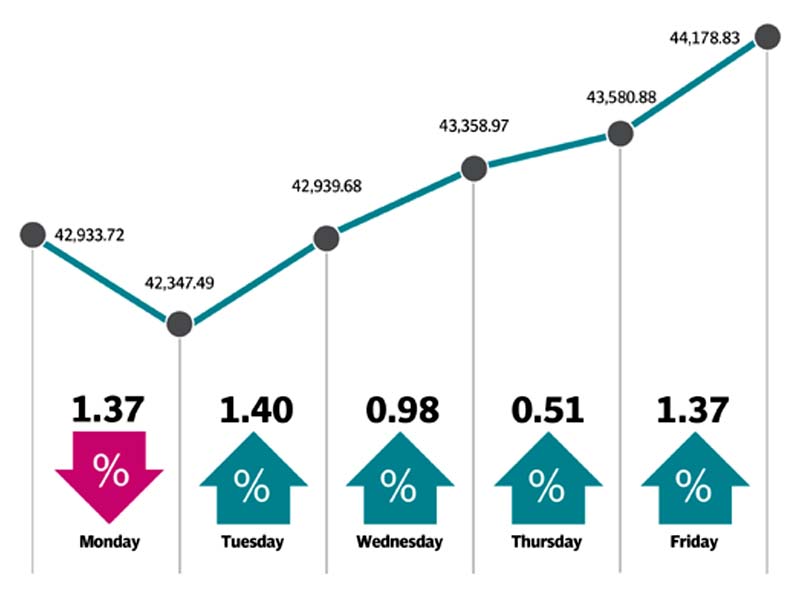

Aggressive buying, with foreign investors turning out to be net buyers of $33 million, pushed the benchmark index up 1,244 points or 2.9% to close at 44,178.83.

The KSE-100 remained choppy at the start of the week as investors were jittery on account of protest planned by the joint opposition parties to pressure the ruling government. However, a rather underwhelming show revived investor sentiment, resulting in a strong rally later. Prime Minister Shahid Khaqan Abbasi’s announcement that premature dissolution of any provincial assembly would not affect the Senate election helped allay concerns as well. Participants were further encouraged by expectations of a hike in interest rate and WTI crude oil trading around $64/bbl.

Weekly review: KSE-100 Index manages finish over 40,000

“Pertinently, this year has turned out surprisingly well with investors tossing the KSE-100 index higher to achieve 11 positive sessions out of the 15 trading days in January 2018, which has cumulatively added 3,707 points or 9.2% to the index,” stated AHL Research in a note to clients.

Compared to the previous week, participation saw a dip as average volumes decreased 33% to 184 million shares, while value declined 28% to $80 million. In terms of sectors, the index was driven by banks, cements, fertilisers and autos, which contributed 864 points, cumulatively.

Banks returned 2.6% week-on-week led by increase in expectation of higher inflation owing to rupee depreciation and resultant increase in interest rates. However, the real thrust came from foreign buying, which was largely concentrated in banks, followed by cements.

Cements gained 6.4% week-on-week on the back of Supreme Court’s allowance of multi-storey buildings (up to six-storeys) in Karachi and continued regulatory delays on cement expansions in Punjab.

Autos returned 5.7% week-on-week on regulatory controls on automobile imports under gifts scheme, which can significantly add to demand for locally assembled players.

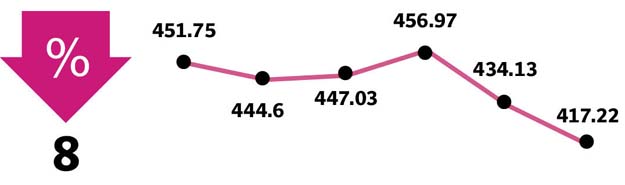

Negative contribution during the week came from refineries, which took away 27 points from the index.

Stock-wise, HBL (up 6%), ENGRO (7%), LUCK (7%), HUBC (5%) and DGKC (9%) added 531 points to the index. On the other hand, NRL (down 8%), ATRL (5%), JDWS (8%), PAKT (6%) and PKGS (6%) withheld 47 points.

Foreign buying continued this week, following rupee’s devaluation. FIPI’s month-to-date cumulative buying has clocked in at $82.5 million, surpassing foreign flows last seen back in April 2014. Foreigners bought $33 million worth of shares during the week versus buying of $26 million during the last week. On the local front, mutual funds were net sellers of $12.8 million whereas individuals were net sellers of $10.1 million.

Weekly review: KSE-100 Index endures another tough ride

Among major highlight’s of the week were; PM Abbasi announced an amnesty scheme for foreign assets, hefty participation of Rs1 trillion in T-Bills auction with no bids for 6-month and 12-months papers, FDI declined by 2.8% year-on-year to $1.38 billion and foreign reserves slipped below $14 billion.

Winners of the week

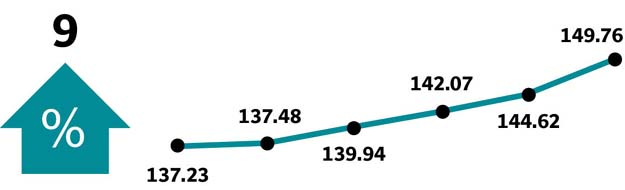

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

DG Khan Cement

DG Khan Cement Company Limited manufactures and sells portland cement.

Losers of the week

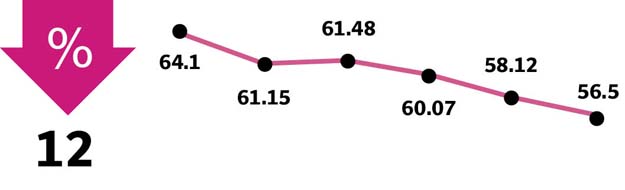

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres Ltd also owns an in-house power generation plant.

National Refinery

National Refinery Ltd manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Published in The Express Tribune, January 21st, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ