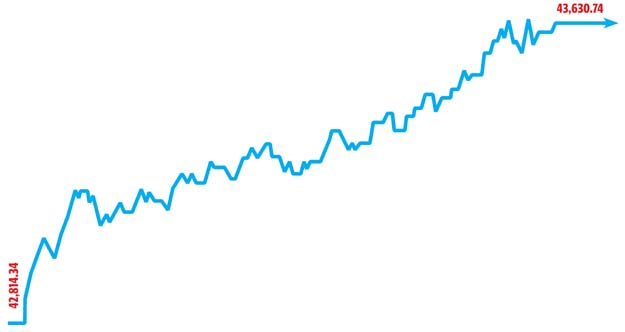

Market watch: KSE-100 registers 816-point increase as buying spree continues

Benchmark index rises 1.91% to close at 43,630.74

Benchmark index rises 1.91% to close at 43,630.74. PHOTO: AFP

Volumes rose significantly on the all-share index and index-heavy, along with retail-favourite stocks, increased on bullish sentiment.

After Tuesday’s session in which profit-taking dominated the charts, investors were keen to pump in more money as stocks across the board witnessed higher volumes and buying orders. The KSE-100 maintained a steady rise throughout the day.

At close on Wednesday, the KSE-100 Index ended with an increase of 816.40 points or 1.91% to finish at 43,630.74.

JS Global analyst Maaz Mulla said bulls resumed control by taking the index up 816 points to close at 43,631 level.

“Overall volumes increased by 45%, while value increased by 60%, compared to the previous trading session,” Mulla remarked.

Major contribution to the index came from HBL (+2.46%), ENGRO (+3.04%), UBL (+2.27%), MCB (+2.23%) and LUCK (+2.33%) cumulatively contributing 248 points to the index. Commercial banking sector led the optimism where heavyweights HBL (+2.46%), UBL (+2.27%) NBP (+0.98%) and MCB (+2.23%) closed in green zone.

Bullish sentiment was witnessed in the fertiliser sector, where FFBL (+2.93%) and FFC (+1.92%) contributed 33 points and closed positively on the back of the news of proposal in reduction in GIDC that would materially benefit FFC and FFBL.

“Investor interest was seen in the engineering sector where ISL (+5%), ASL (+5.06%) DSL (+9.17%) and ASTL (+3.30%) closed in the green zone.”

Oil prices closed at a fresh three-year high, where POL (+0.34%) PPL (+1.21%) and OGDC (+0.79%) from the aforementioned sector closed positive.

“Moving forward, we expect market to continue its positive trend, however, prevailing political situation may shake investors’ confidence for the short-term. We advise investors to book profits on the higher side,” the analyst added.

Market watch: KSE-100’s 13-session positive streak ends

According to Topline Securities, after some profit-taking on Tuesday, market regained its positive momentum.

Participation improved significantly where volumes rose 45% day-on-day to 328 million shares, while value traded increased 60% to Rs15.6bn. This has been the highest activity since August 2017 owing to strong interest in blue chip stocks.

Top 10 Index point contributors were HBL (+2.5%), ENGRO (+3%), UBL (+2.3%), MCB (+2.4%), LUCK (+2.3%), SNGP (+4.2%), MTL (+5%), PPL (+1.2%), FFC (+1.6%) & BAFL (+4%); adding 377 points, while top 10 Index point decliners were NML (-0.2%), MUREB (-1%), NATF (-0.5%), ABOT (-0.9%), SCBPL (-0.6%), IBFL (-2%), ATLH (-0.5%), OLPL (-0.5%), FML (-1.3%) & GADT (-1.8%); withholding 9 points.

“On the sector front; commercial banks added 227 points, fertiliser 105 points, cement 95 points, OMCs 56 points, E&Ps 53 points, engineering 45 points, power 35 points, while not a single sector had negative contribution,” the report added.

Overall, trading volume increased to 327 million shares, compared with Tuesday’s tally of 225 million.

Shares of 400 companies were traded. At the end of the day, 316 stocks closed higher, 65 declined while 19 remained unchanged. The value of shares traded during the day was Rs15.6 billion.

Aisha Steel Mills was the volume leader with 16.9 million shares, gaining Rs1 to close at Rs20.77. It was followed by TRG Pakistan with 16.7 million shares, gaining Rs1.53 to close at Rs32.31 and Dewan Cement with 15.6 million shares, gaining Rs1.10 to close at Rs23.10.

Foreign institutional investors were net buyers of Rs38.7 million during the trading session, according to data compiled by the National Clearing Company of Pakistan.

Published in The Express Tribune, January 11th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ