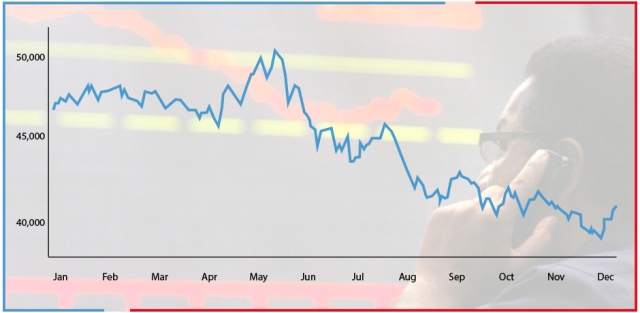

PSX ends as world’s worst market in 2017

In 2016, the KSE-100 was Asia’s best-performing index

File photo

PHOTO: EXPRESS TRIBUNE

The Pakistan Stock Exchange’s (PSX) KSE-100 – a benchmark for market performance – was Asia’s top-performing index in 2016, much to the delight of thousands of investors who thought the golden run would continue. After close to 45% return in dollar terms for the average investor in the previous year, fresh money poured in.

No progress on any bailout package for stock market

But 2017 would prove to be a nightmare. Equity-based funds posted negative returns in the range of 10% to 20%, while brokerage houses had to be content with low volumes that put a dent on their earnings.

Overall, the KSE-100 Index posted an absolute negative return of 15.34% during the year. In dollar terms, it was a negative return of 20%. The year was the worst one for the PSX since the financial crisis enveloped global equity markets in 2008.

It also meant that the PSX’s performance was the worst in the world, in sharp contrast to global equity markets that outshone most asset classes.

On December 29, the last trading day of the year, the PSX benchmark KSE 100 Index ended at 40,471.48 points. This is a drop of 23.45% from its all-time high of 52,874.46 points it touched on May 24 this year.

The index even touched 37,919.42 points, a 20.68% fall since January and 28.28% from its all-time high in mid-December. However, a relief rally, sparked by buying in select oversold stocks, was enough to propel the index past 40,000.

In terms of numbers, the market capitalisation dropped to $73.5 billion, wiping off $21 billion from the stock market from the all-time high. The value of all shares ended at $77.55 billion as on December 29, 2017, a slight recovery.

“This was the worst year for Pakistan equities since 2008 when the market crashed 58% due to the price floor,” Topline Securities’ analyst Fahad Qasim said in a note on the market year-ender.

Reasons for the downfall

Many analysts and market followers said political instability, which hit its peak following the disqualification of Nawaz Sharif as prime minister, was the root cause behind the bearish run.

Tension between civilian-military leadership along with uncertain economic policies, triggered by the ungraceful exit of finance minister Ishaq Dar, was another.

There are several other reasons as well.

Anti-budget measures announced by the PML-N in May also discouraged investors. Given its phenomenal return up till that point, the government thought it would be an easy revenue earner. The move backfired as events unfolded.

However, one other reason – which gets lost in the shadow of louder and longer-lasting events – was the failure of the PSX to attract foreign inflows post MSCI reclassification.

MSCI announced that it would upgrade Pakistan from its frontier markets status to the emerging market status in 2016. From the day of the announcement till the day PSX was actually upgraded, mutual funds and brokerage houses went on a buying spree. Anticipating huge inflows, the market seemed like it was overbought.

Estimates of inflows were largely met, but the outflow was so huge that the market was caught off-guard. The shock was enough for investors to pull out, especially given that there were negative triggers all around.

Additionally, worrying economic indicators, widening current account deficit and talk of much-needed depreciation in the rupee were more than enough for investors to take the bench. Day-to-day court appearances of officials responsible for economic policymaking and worrying numbers coming out of official quarters gave jolts every month.

They say the market was due for a correction after seven years of growth, and 2017 was destined to be that year.

Foreigners’ input

Foreigners, who once had a one-fourth stake in the PSX, bought shares worth $4.4 billion, but sold $4.9 billion worth of equities, resulting in net outflow of $488 million. This remained higher than in 2016, when it was $339 million, and took the three-year cumulative outflow to $1.1 billion.

Average daily traded volumes at the PSX were down by 16% to 236 million shares, while average daily traded value was marginally up 3% to $115 million in 2017.

Most of the selling by foreigners was seen in cement ($168 million), banks ($98 million) and power ($51 million), Topline Securities said.

This major chunk of selling was absorbed by mutual funds who bought $217 million worth of shares, it added.

The year ahead

With 2017 proving to be disastrous, despite the Chinese consortium finalising its deal to buy a 40% stake in the PSX, many believe 2018 will be better.

We have heard that before.

Pakistan’s stock market: from Asia’s best to Asia’s worst

When all is said and done, projections don’t really work, especially when you are studying Pakistan. Its political climate is unpredictable, to say the least, and investors have had better avenues to put money in. If 2018 sees a smooth transition from one government to the next and economic policies remain consistent, the PSX would make a comeback.

But saying that the rupee will not depreciate and then let it fall within a few weeks isn’t consistent. Raising tax rates on investors who put money in the economy isn’t helpful, either.

The writer is a staff correspondent

Published in The Express Tribune, January 1st, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ