Economic performance in 4-year report card, failing grade for PML-N

Budget deficit, circular debt increase as state-owned enterprises continue to suffer

Budget deficit, circular debt increase as state-owned enterprises continue to suffer. PHOTO: FILE CREATIVE WORK: SAADAT ALI

The gap between what was said and what was done has pushed the country into a deep debt trap, increased income inequality, and an increasing number of question marks hovering over the economic outlook.

Foreign investors are concerned by macroeconomic indicators, and the possibility of Pakistan needing another bailout is much more real than ever before.

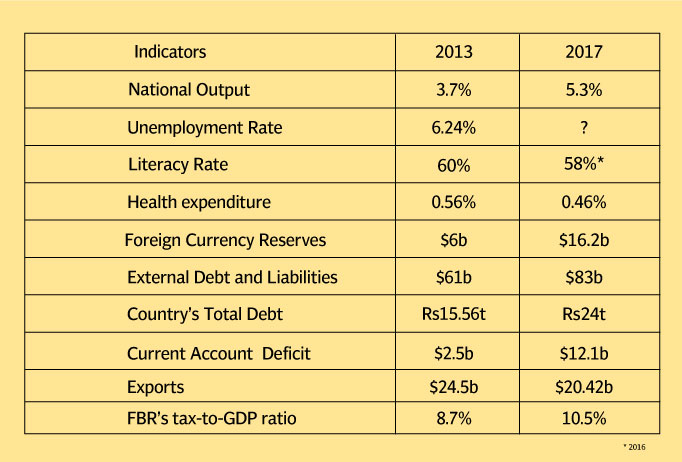

Barring progress on the pace of inflation and increasing national output, which grew from 3.7 per cent to 5.3 per cent in four years, the government’s performance remained questionable on all economic fronts. Even the annual economic growth of 5.3 per cent in the fiscal year 2016-17 was the result of growth in the services sector, which is not labour intensive.

In its election manifesto, the government had promised to increase the economic growth rate to 6 per cent by the end of the fourth year, and 7 per cent by June 2018.

PPP, PML-N agree to work together to avert technocrat govt

According to a report from the International Food Policy Research Institute, Pakistan remains near the bottom of the Global Hunger Index, standing at 106 among 119 developing countries ranked.

In June 2013, the official unemployment rate in the country was 6.24 per cent, but due to growing joblessness, the government has not announced unemployment figures for the last two fiscal years, showed a State Bank of Pakistan report.

The literacy rate, which was 60 per cent in 2013, actually slipped to 58 per cent in June 2016. Figures for the current year have not been released yet. Health expenditure, which stood at a meagre 0.56 per cent of total national output in 2013, has been decreased even further to 0.46 per cent in June 2017, according to the SBP’s annual report on the state of the economy.

In its latest report, which covered the four-year economic performance of the PML-N, the Policy Research Institute of Market Economy (PRIME) noted that the incumbent government has failed to fully implement its election manifesto on the economic front and has achieved just six of its 89 announced goals.

According to the report, progress has been reversed on the elimination of VIP culture by reducing expenses on the Prime Minister’s office and the Presidency, appointing independent professional boards of state-owned entities, eliminating circular debt, and notifying the tariffs determined by the National Electric Power Regulatory Authority.

Even in areas where it had initially shown some progress, performance deteriorated during the January-June 2017 period, says the report from the Islamabad-based, independent think tank.

Growing debt burden

Former finance minister Ishaq Dar claimed that Pakistan’s economy had turned around and the country did not need another International Monetary Fund (IMF) bailout. However, the situation has already worsened. From July through October of this fiscal year, the federal government has obtained $2.3 billion in foreign loans, including $1.02 billion in commercial loans.

PML-N’s economic scorecard: a story of under-performance

A team of Finance Ministry and SBP officials is already in the United States to raise between $2 billion and $3 billion from the debt markets by floating sovereign bonds aimed at creating some space till the time a new programme is negotiated with the IMF, sources said.

The country’s official foreign currency reserves, which peaked to $19 billion, slid on the back of foreign borrowings to $13.54 billion as of November 17, barely enough to finance two-and-a-half months of imports.

The federal government consumed a significant amount of foreign currency reserves to manage the rupee-dollar exchange rate parity while turning down proposals to let the currency devalue to its ‘real value’ of around Rs118 to a dollar. The current parity is Rs105.4 per dollar.

The biggest criticism against the incumbent government, however, is the massive increase in external debt and liabilities, which have increased to $83 billion as of June 2017. In June 2013, a few weeks after the PML-N government came into power, external debt and liabilities stood at $61 billion.

The government is also accused of twice amending the Fiscal Responsibility and Debt Limitation Act of 2005 in an effort to understate the growing debt burden. Against the total debt of Rs15.56 trillion in June 2013, the country’s total debt has now increased to Rs24 trillion, which is equal to 75.3 per cent of the GDP and far above the ‘safe’ threshold.

Since the government has not been able to enhance exports and attract significant foreign direct investment, the external sector has remained under pressure. In June 2013, the current account deficit – the gap between external receivables and payments – was $2.5 billion or 1.1 per cent of the GDP. The government closed the fiscal year 2016-17 at a record deficit of $12.1 billion, equal to 4 per cent of the GDP.

PML-N’s performance in two years – a blend of effort and luck

That record is likely to be short lived, as the government has already booked a $5-billion current account deficit during the July-October period.

Exports, which stood at $24.5 billion in June 2013, have decreased to $20.42 billion as of June 2017, according to the SBP annual report.

Poor fiscal performance

In June 2013, the country had booked Rs1.834 trillion as its budget deficit, equal to 8.2 per cent of GDP. This figure was inclusive of the Rs480-billion circular debt payment the PML-N government cleared after coming into power, but booked in the last year of the PPP tenure.

However, at the end of the fiscal year 2016-17, the budget deficit widened to a record Rs1.864 trillion, excluding Rs800 billion as circular debt. In terms of GDP, the 2016-17 budget deficit was equal to 5.8 per cent of GDP, which was far higher than the 4.1per cent limit approved by parliament. After including the impact of unsettled circular debt, the budget deficit as a percentage of GDP would increase to the same level in the last fiscal year that the county witnessed in 2013.

The extremely poor position of the fiscal and external fronts belies the official claims of turning around the economy. Instead, the worsening situation forced the chief of army staff to give a wakeup call to the government. The army chief warned the authorities about the “sky-high debt” and “abysmally low tax base”.

In June 2013, the FBR’s tax-to-GDP ratio was 8.7 per cent, which increased to 10.5 per cent in 2016-17, but remained far below the government’s target of 15 per cent. In absolute terms, the FBR’s tax collection increased from Rs1.946 trillion to Rs3.361 trillion due to the imposition of roughly Rs1.4 trillion in new taxes.

The government also failed to meet its promise of rationalising sales tax by ensuring standard rates for all items.

Nawaz tells party MPs to improve performance

In fact, a recent World Bank report suggests that Pakistan is losing Rs3.2 trillion in revenue every year due to weak tax compliance and enforcement.

Core macroeconomic indicators remain disappointing

The government failed to show notable progress on the two most critical macroeconomic areas – investment and national savings. The investment-to-GDP ratio inched up from 15 per cent in June 2013 to 15.8 per cent four years later. It was well below the government’s targets, and Dar would conveniently fail to bring it up.

The PML-N always boasts of promoting private investment in the country — a claim far from reality. In June 2013, private sector investment was 9.8 per cent of GDP. At the end of June 2017, it stood at 9.9 per cent, according to the SBP report.

The same is the case with national savings. In June 2013, Gross National Savings as a percentage of GDP was 13.9 per cent, which actually decreased to 13.1 per cent in June 2017.

PSEs’ performance

Another poorly managed area was the functioning of Public Sector Enterprises. The PML-N government claimed that it would privatise all loss-making enterprises and reduce their losses. The numbers tell a different story.

PML-N to grill ministers over performance

In June 2013, the PSEs’ debt and liabilities were Rs495 billion. By June 2017, they had rocketed up to Rs1.107 trillion, according to the SBP annual report. There was a net 123 per cent increase in PSEs’ losses in just four years. This was primarily because the government did not settle the circular debt and parked huge sums outside the budget.

In the energy sector, the government was unable to reform Nepra. Likewise, reforms could not be introduced in power distribution and generation companies. These entities kept causing heavy losses, which the government tried to cover by charging various surcharges from consumers.

The PML-N also failed to meet its election promise of permanently eliminating circular debt, which has piled up to Rs400 billion. By including the stock of debt that is parked in a holding company, the total circular debt would jump to Rs800 billion.

The government somehow managed to build the confidence of the private sector, but it was still not up to the mark. The two components where it performed well were infrastructure building and creating job opportunities.

There was no development on the goals of converting at least 50 per cent of remittances from overseas Pakistanis into investments and reforming tariffs to eliminate anti-export bias. The PML-N could not establish an equity fund to facilitate investment from the private and public sectors. It also could not fulfil its promise to tax all income, including agriculture income, and failed to reduce the number of federal and provincial taxes, according to PRIME.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ