Govt asked to streamline duty drawback process

Exporters fear backlog will emerge as already billions are stuck with the govt

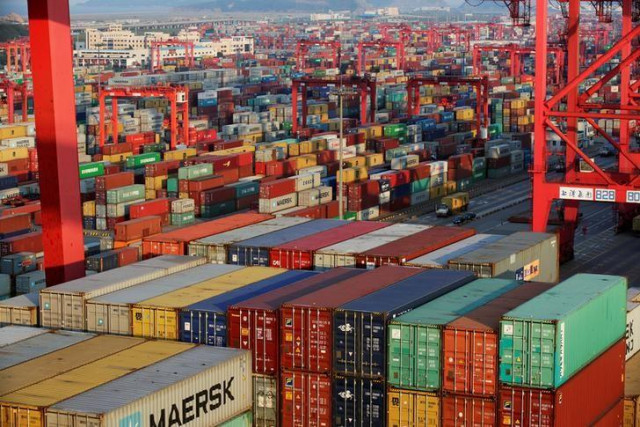

Container boxes are seen at a port. PHOTO: REUTERS

“The incentive amount should be credited directly to the accounts of exporters at the time of realisation of export proceeds. The State Bank of Pakistan (SBP) may subsequently claim the money from the government,” said a joint statement issued by the exporters of finished textile goods.

Import duty on eatables, luxury items raised by up to 350pc

The condition of “after receipt” should be abolished and prompt payment should be made. In case of failure, a backlog would emerge again at a time when previous payments of billions of rupees had also not been made to the exporters, they said.

Referring to the Duty Drawback of Taxes Order 2017-18 issued recently by the Ministry of Commerce and Textile, the exporters said the Ministry of Finance had not yet released tax refunds to the central bank.

They pointed out that all export documents were submitted online and available with the government like E-Form, which was generated through WeBOC and submitted to the SBP, goods declaration was generated online in WeBOC and foreign exchange payments were realised through authorised dealers and reported to the SBP.

To improve cash flow for the exporters, they suggested early disbursement of duty drawback claims against increase of 10% or more in exports for July-December 2017, which was subject to the submission of a bank guarantee that the exporter would return the excess amount.

However, they said there were numerous small and medium enterprises that did business on self-finance basis and did not acquire bank financing. “How could they submit the bank guarantee for early disbursement?”

MCCI slates govt over regulatory duty on imports

Billions of rupees against the previous Drawback of Local Taxes and Levies (DLTL) and Duty Drawback of Taxes (DDT) schemes have been pending with the government for years, causing liquidity problems for the exporters.

The textile exporters asked the government to release the payments immediately, which would streamline cash flow, help increase exports, generate employment opportunities and bring down the runaway trade deficit.

Published in The Express Tribune, October 29th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ