Earnings per share (EPS) stood at Rs2.53 in Jul-Sep 2017 compared with Rs2.94 in the corresponding period of last year.

The KSE-100 index closed at 42,087, up 529 points or 1.27% on Friday. Fauji Fertilizer share price closed at Rs82.32, up 1.27%.

Along with the result, the company declared a cash dividend of Rs1.5 per share, taking nine-month pay-out to Rs4 compared to Rs5.15 last year. Sales grew 55% year-on-year in third quarter of 2017 due to significant growth in Di-ammonium Phosphate (DAP) off-take, which as per provisional September 2017 figures stood near 250,000 tons, up 15 times compared to last year. However, urea sales declined 14%.

Margins contracted by four percentage points year-on-year to 21% due to lower urea prices and higher proportion of DAP sales.

Administration and distribution expenses rose 42% year-on-year to Rs2.6 billion likely due to aggressive incentives and higher DAP sales (imported).

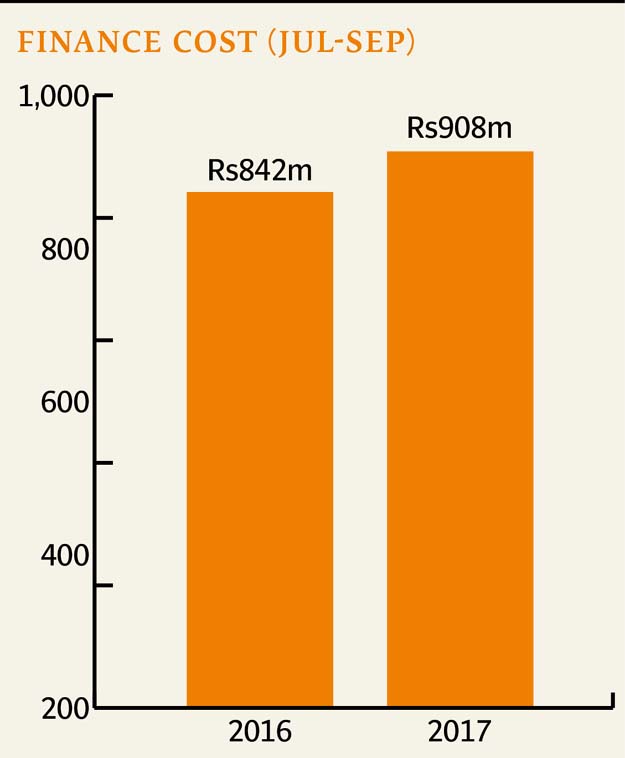

Finance cost went up by 8% year-on-year to Rs908 million whereas other income declined 44% year-on-year to Rs1.4 billion.

During nine months of 2017, revenue of the company posted an increase of 25% while gross margins declined by seven percentage points to 21% due to a decline in urea prices. Key risks for the company include decline in international urea prices, slower-than-expected urea sales, and weaker-than-expected local urea prices.

Published in The Express Tribune, October 21st, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1730959638-0/trump-(19)1730959638-0-405x300.webp)

1719925273-0/BeFunky-collage-(46)1719925273-0-165x106.webp)

1730957050-0/Copy-of-Untitled-(17)1730957050-0-270x192.webp)

1730379446-0/WhatsApp-Image-2024-10-31-at-17-56-13-(1)1730379446-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ