Current account deficit widens 102% in Q1

Analyst, however, does not expect sharp decline in forex reserves

Analyst, however, does not expect sharp decline in forex reserves. PHOTO: FILE

In September 2017 alone, the current account gap swelled $956 million compared to $550 million in August 2017.

Topline Securities commented that the numbers were broadly in line with its estimates and investor concerns were allayed after seeing August and September numbers as the deficit had widened $2.1 billion in July 2017.

“We may not see a sharp drawdown in foreign exchange reserves and Pakistan may not enter another IMF programme in FY18,” the report said.

Investors are concerned about the growing deficit after the country recorded a much higher-than-expected deficit of $12.1 billion (4% of gross domestic product - GDP) in the previous fiscal year.

With the difference between exports and imports being the biggest determinant of the current account balance, a deficit or surplus reflects whether a country is a net borrower or net lender with respect to the rest of the world.

To control the gap, analysts were anticipating that the government could allow the rupee to weaken against the dollar or impose duties on imports.

This week, the government enhanced regulatory duties by up to 350% on 356 essential and luxury goods. However, the rupee has largely stood firm.

As a percentage of GDP, the deficit rose to 4.2% in the first three months of FY18 as opposed to 2.2% in the same period of previous year.

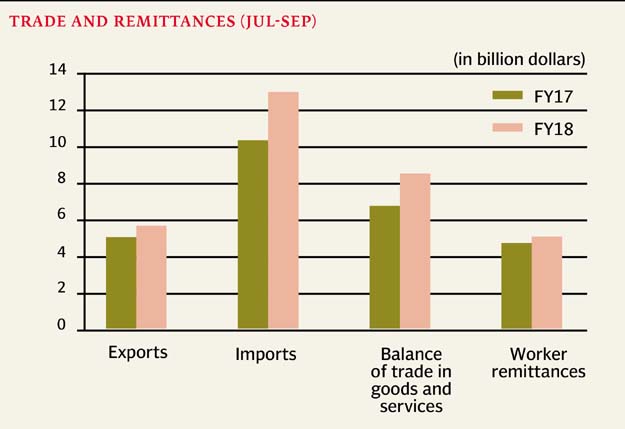

In Jul-Sep FY18, Pakistan exported goods worth $5.67 billion compared with exports valuing at $5.05 billion in the same period of last year, reflecting a year-on-year increase of 12.2%.

However, imports jumped much faster to $12.89 billion against $10.32 billion last year, up 25%. The balance of trade in both goods and services in the three months was negative at $8.44 billion compared with $6.42 billion in the same period of previous year.

Worker remittances amounted to $4.79 billion in Jul-Sep FY18, up 1.05% from the corresponding period of previous year, when they totalled $4.74 billion.

Remittances saw a steep decline of 34% standing at $1.3 billion in September 2017 due to a high base effect (higher remittances in August 2017 owing to Eidul Azha and lower number of working days in September 2017).

Remittances make up almost half of the import bill of Pakistan and cover the deficit in the trade of goods account.

Pakistan is also facing low levels of foreign direct investment (FDI) in recent years. In fiscal year ended June 30, 2017, the FDI increased just 5% to $2.41 billion compared to $2.30 billion in the previous year.

According to the Board of Investment, the country received a record high FDI of $5.4 billion in FY08 but since then it has been struggling to touch even half of that milestone.

Published in The Express Tribune, October 21st, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ