Govt efforts to reduce imports unlikely to yield significant results

Enhanced regulatory duties not enough, additional measures including rupee depreciation necessary

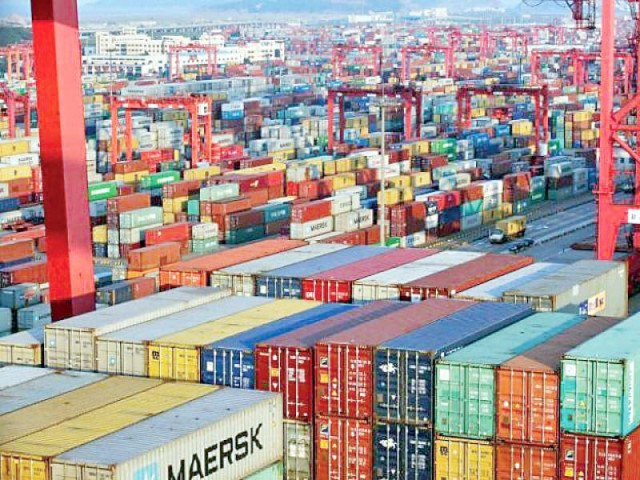

The key imported items included in the notification are mobile sets, automobiles, furnace oil, ceiling fans, rubber for tyres, betel nuts, air conditioners, refrigerators and ceramics. PHOTO: REUTERS

Serious measures such as imposition of additional regulatory duties on hundreds of non-essential goods will only result in a reduction of $1-2 billion in imports, Topline securities estimated.

The estimated reduction in imports, however, is equivalent to mere 2-4% of total imports of $53 billion in last fiscal year 2016-17 (FY17).

This will not be enough to contain the ballooning current account deficit (CAD), which is fast eating up Pakistan’s foreign exchange reserves and may badly impact the country’s ability to service its foreign debts going forward.

Pakistan’s first coal import terminal begins operations

The Federal Board of Revenue (FBR) has notified updated regulatory duties on non-essential import items. A total of 731 non-essential import items have been included in the notification. “As per our analysis, 331 new items have been notified while 307 items are subject to higher regulatory duty in the range of 5-30%,” Topline Securities said in comments to its clients.

“As per initial estimates, the above measures may help curtail annual imports by $1-2 billion besides generating additional taxes,” the brokerage house said.

It said the latest measures would not meet the purpose and the government would have to take other measures as well to control the deficit.

These measures may include rupee depreciation - which seems unlikely in view of the government’s repeated refusals, hike in interest rates, amnesty schemes, revisiting the Free Trade Agreement with China and increase in taxes, the brokerage house added.

Earlier, the government had announced incentives for exporters to reverse the country’s declining export trend and enhanced the cash margin requirement for imports of several goods in January, but the measures have so far failed to make a significant impact.

The key imported items included in the notification are mobile sets, automobiles, furnace oil, ceiling fans, rubber for tyres, betel nuts, air conditioners, refrigerators and ceramics.

Impact on cars, home appliances

In the auto category, additional regulatory duty on used automobiles of low-engine size has not been notified as per initial impression.

The enhanced regulatory duties would however be collected on new motor cars (of engine capacity 1,000cc-1,300cc), used motor cars (higher than 1,800cc) and all types of mini-vans, SUVs and Jeeps.

“Our estimate suggests that around 4,000 imported new automobiles worth $100-200 million and close to 60,000 used cars worth $300-500 million come into Pakistan every year,” Topline Securities said.

Away from Gulf, Pakistan set to import oil, gas from Central Asia

“The above measures will not have a major impact on local car assemblers as low engine size used cars are not in the notification. High-end car producers like Honda Car (HCAR) and Indus Motor will marginally benefit given higher import duties on new completely built units (CBUs),” it said.

“Higher regulatory import duty on appliances including refrigerators and air conditioners will not have a significant impact on local appliance manufacturers as imports account for less than 5% of local sales,” the brokerage house further said, adding that there is no change on major steel sector items.

Published in The Express Tribune, October 18th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ