Stock market ends week at the lowest level for 2017

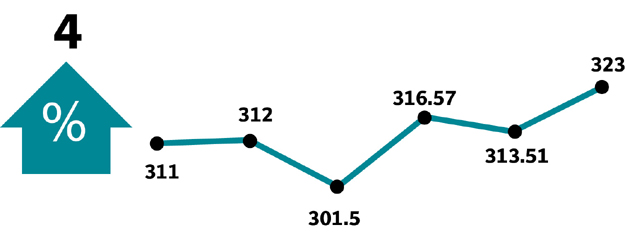

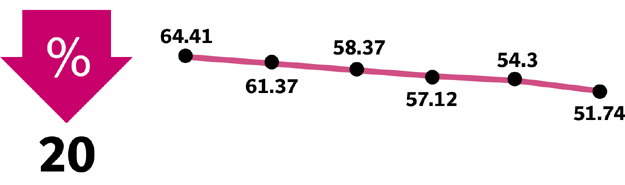

Benchmark index drops 1,466 points or 3.5% to 39,846.78 points

PHOTO: AFP

Political tensions and dismal performance on the economic front kept the market under pressure. Despite foreign interest, a series of political and judicial face-offs kept the investors anxious and dragged the index below 40,000-point level.

PM likely to announce bailout package for stock market

Matters were further aggravated when the army chief commented on the deteriorating macroeconomic indicators. The State Bank of Pakistan’s acceptance of external and fiscal account pressures on the economy, in its annual report, also caused panic among investors who remained on the sidelines.

Monday kicked off on a negative note as political noise made investors jittery. This was followed by another turbulent session, where the index dropped 800 points in intra-day trading, however, value-picking at attractive levels helped the index to gain some momentum.

Sadly, there was no respite as volatile activity led the index to plummet further on Wednesday. Share prices slumped to a one-year low in intra-day trading on Thursday, while Friday was no better as the index finished at the lowest level of 2017.

The World Bank also released its report this week in which it painted a very dismal picture of the country’s external balance.

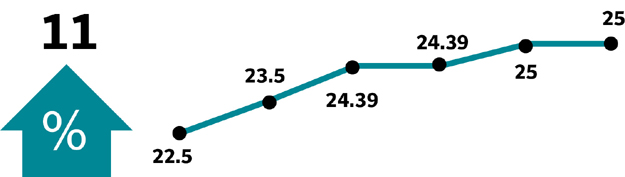

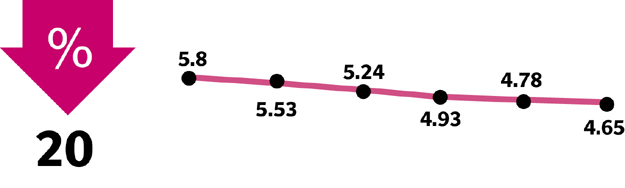

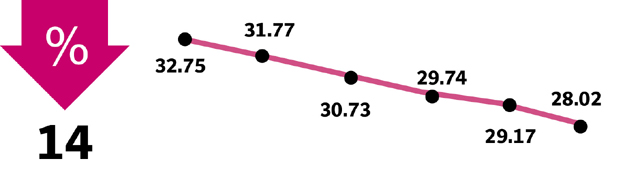

That said, average volumes during the week were 146 million shares, up by 4.1% week-on-week, whereas the average traded value pulled back by 16.5% to $59.25 million, indicating that major activity was generated by sideboard items. K-Electric dominated the volumes following a decision on its multi-year tariff.

In particular, sectors that triggered the downward cycle were cement (312 points), fertilisers (208 points), OMCs (164 points), banks (154 points) and power generation and distribution (121 points). Cement stocks remained under pressure owing to pricing concerns.

Support to the index was provided by oil and gas exploration companies (up 71 points) given international oil prices (Arab Light) were up by 2% on average since last week’s closing.

Stock-wise, the top five laggards were Lucky Cement, HBL, Engro, Dawood Hercules and SNGPL, that wiped 390 points off the market.

In terms of foreign inflows, “the domestic equity bourse attracted the biggest net inflows in a single week since May 2013, led by official government statements denouncing the need for rupee devaluation,” according to AHL Research.

Weekly review: KSE-100 succumbs to political apprehensions, 1,097 points wiped off

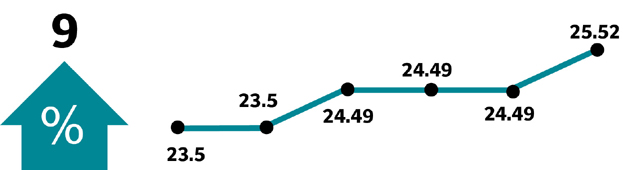

During the week, foreigners accumulated stocks worth $38.88 million. On the domestic front, selling was concentrated in cement ($5.65 million) and commercial banks ($5.40 million) with mutual funds being the main culprits behind offloading ($30.17 million) followed by individuals ($7.79 million).

Among major highlights of the week were; Nepra granted 70 paisa tariff increase to K-Electric after review, fiscal deficit for Jul-Sep 2017 dropped to a 10-year low, trade deficit surged to $9.09 billion in Jul-Sep 2017, SBP revealed its annual report, remittances witnessed a slight annual rise to $4.79 billion in Jul-Sep 2017 and auto sales increased 17% in September.

Winners of the week

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Standard Chartered Bank

Standard Chartered Bank Pakistan Limited is an international bank that offers consumer and wholesale banking.

National Foods

National Foods Limited is a diversified food manufacturer. The group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts, and a number of kinds of health foods.

Losers of the week

Crescent Jute Products

Crescent Jute Products Ltd manufactures and markets jute and cotton textiles.

Ghani Glass

Ghani Glass is a company of the Ghani Group with interests in container glass and float glass, automobile manufacturing/marketing and mining for silica sand, coal and rock salt. The company has seven glass plants producing container glass, float glass and value added glass.

Sui Southern Gas

Sui Southern Gas Company Limited transmits and distributes natural gas, and constructs high pressure transmission and low pressure distribution systems. The company’s transmission system extends from Sui in Balochistan to Karachi in Sindh.

Published in The Express Tribune, October 15th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1710175205-0/image-(9)1710175205-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ