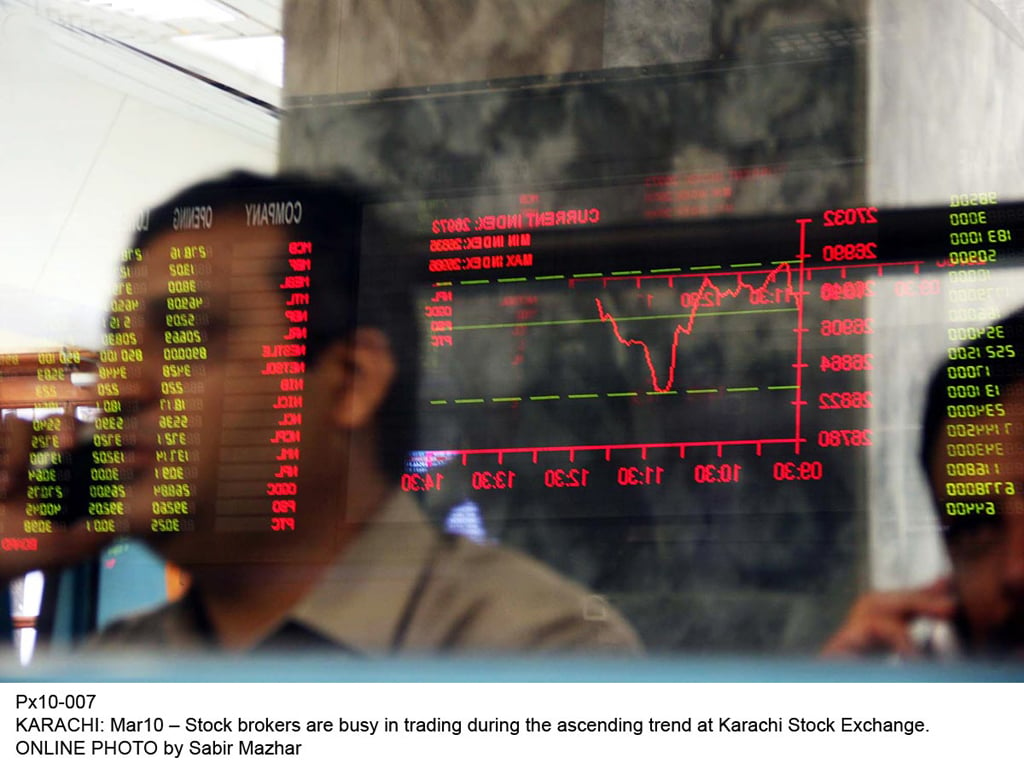

Undermined by endless political drama and concern over the mounting trade deficit as well as persistently falling foreign reserves, the KSE-100 index dropped from the word go. It plunged almost 750 points and hit an intra-day low of 39,478.05 points.

However, as trading began after the midday break, the index posted a decent recovery with investors coming forward to pick stocks at attractive valuations. Despite this change in trend, the index finished deeply in the red.

At close, the benchmark KSE 100-share Index registered a decline of 390.75 points or 0.97% to finish at 39,846.78 points.

Elixir Securities, in its report, stated Pakistan equities closed lower for the fifth consecutive session with the benchmark index settling below 39,900, down 1%.

"Stocks opened lower with cement shares carrying bearish momentum and trading lower amid concerns surrounding retail pricing," stated Elixir.

Market watch: Index hits one-year low in intra-day trading

Maple Leaf Cement (-4.7%) bore the brunt of selling followed by DG Khan Cement (-1.4%) and Lucky Cement (-3.8%). Other sectors also followed suit and were dragged down amid thin turnover, pulling the KSE-100 index down as much as 1.9%.

Oil stocks, however, helped to pare losses in the second session with Pakistan Oilfields (+1.9%) leading gains on local interest while select index names including National Bank (+3.3%) and Engro Fertilizers (+1.6%) also showed cherry-picking.

"(We) expect volatile trading to continue next week with benchmark index hovering in a range of 500 to 700 points. Upcoming quarterly earnings announcements are expected to bring some respite, however, politics will continue to dictate investors' sentiments," the report added.

JS Global analyst Maaz Mulla said bloodbath continued at the local bourse as aggressive selling was observed throughout the day, which broke the psychological barrier of 40,000 points.

"The index was dragged down by 391 points which closed at 39,847 likely on continued investor scepticism about the political scenario," Mulla said.

Selling pressure caused decline in the cement sector as well where heavyweights such as Lucky Cement (-3.4%), Maple Leaf Cement (-4.8%), Cherat Cement (-4.3%) and Pioneer Cement (-2%) closed in the red.

Market watch: Losing streak continues in volatile stock trading

In the banking sector, mixed sentiments were witnessed as National Bank of Pakistan (+3.9%) and Bank Alfalah (+1.5%) were in the green whereas United Bank Limited (-0.4%) and MCB Bank (-0.5%) shed value. The exploration and production sector, however, advanced as crude oil prices rose on decline in US crude production and inventory that pointed towards a tightening market.

"Moving forward, the political scenario is expected to continue to affect the stock market. We recommend investors to stay cautious and avoid short-term positions," he added.

Overall, trading volumes rose to 153 million shares compared with Thursday's tally of 137 million.

Shares of 382 companies were traded. At the end of the day, 88 stocks closed higher, 282 declined while 12 remained unchanged. The value of shares traded during the day was Rs7.1 billion.

K-Electric was the volume leader with 13.4 million shares, losing Rs0.14 to close at Rs6.16. It was followed by Maple Leaf Cement with 8.1 million shares, losing Rs3.24 to close at Rs66.31 and TRG Pakistan with 7.9 million shares, losing Rs0.84 to close at Rs32.50..

Foreign institutional investors were net buyers of Rs1.91 billion during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

1732013245-0/now-you-see-me-(1)1732013245-0-405x300.webp)

1730959638-0/trump-(19)1730959638-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ