Pakistan’s reliance on indirect taxes continues unabated

FBR collects Rs482.2b as indirect collection, overall revenue stands at Rs757.2b

PHOTO: AFP

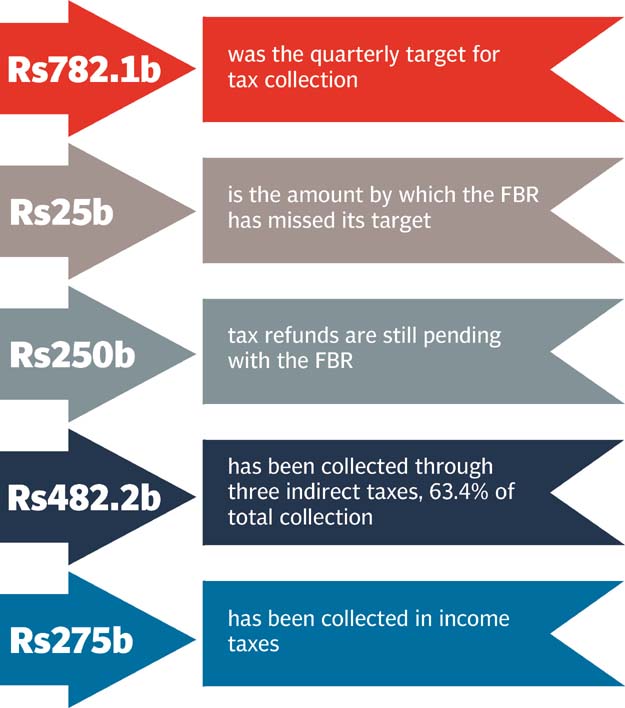

The break-up of provisional tax collection of Rs757.2 billion from July through September showed that the Federal Board of Revenue (FBR) missed its quarterly targets of income and sales tax collection by significant margins. But the customs duty collection exceeded the quarterly target due to high rates of duties and change in calculation methodology sanctioned in the previous years.

The FBR had set its quarterly target at Rs782.1 billion, which is 19.5% of its annual target of Rs4.013 trillion. By the end of the first quarter, provisional collection stood at Rs757.1 billion, according to FBR’s own data. The collection was higher than the corresponding period of the previous year by Rs130 billion, registering a healthy growth rate of 20.7%, which was still insufficient to hit the quarterly benchmark.

Deadline to file income tax returns extended by a month

However, on Monday Finance Minister Ishaq Dar showed satisfaction with the provisional revenue collection figures and expressed confidence in the continuation of the trend. A finance ministry hand-out stated that FBR briefed the finance minister that it clocked an unprecedented provisional revenue collection of over Rs765 billion for the first quarter of the fiscal year. The FBR did not give a breakup of the Rs765 billion to substantiate its claim. The FBR’s provisional collection figure available with The Express Tribune showed the collected amount to be Rs757.2 billion.

What is more important than the disparity in claims and calculations is the question mark this puts on the credibility of FBR’s statistics in the eyes of the data users.

When FBR spokesman Mohammad Iqbal was contacted for his version, he defended the Rs765-billion collection figure. Iqbal refused to share any data to back his department’s claim, which has further created doubts.

The tax machinery faces serious problems like weak administration and enforcement, which has limited its options to arm twist and over-burden existing taxpayers to cough up revenues.

According to some estimates, more than Rs250 billion in tax refunds are still pending, over 575,000 audit cases are awaiting disposal and cases involving sums of over Rs300 billion are stuck up at various stages in tax tribunals.

There are slightly over 125,000 registered and active sales tax payers and only 1.216 million income tax filers which speaks volumes about the efficiency of the FBR.

Breakup

Revenue shortfall: FBR misses tax collection target by over Rs250b

The segregation of the data among the four kinds of taxes shows that most of the revenue is generated by charging indirect taxes, which are regressive in nature. Out of Rs757.2 billion, the FBR collected Rs482.2 billion on account of three indirect taxes, which is 63.4% of the total collection.

The FBR has also imposed various kinds of withholding taxes, which it claims fall in the category of income tax despite independent economists stating otherwise. The Rs482.2 billion indirect collection is exclusive of withholding tax collection.

The FBR provisionally collected Rs275 billion in income taxes, which was 17.7% higher than the collection made in the same period of the last fiscal year. However, it fell short of the quarterly target by Rs20.4 billion or 6.9%.

The total sales tax collection during the first quarter stood at Rs314.5 billion - higher by Rs53 billion or 20.2%. But again the FBR missed its quarterly sales tax collection target by Rs16.1 billion or 4.9%. The FBR’s sales tax collection at the domestic stage stood at Rs121.7 billion - up by only Rs9.4 billion or 7.7%.

The FBR’s spokesman defended the sales tax collection at the domestic stage without sharing the details.

Contrary to this, the sales tax collection at the import stage amounted to Rs192.7 billion - higher by Rs57.4 billion or 29.8%. This was because the FBR charges sales tax on petroleum products by including all the taxes into the cost of the commodity. There were also minimum leakages at the import stage compared with huge problems at the domestic stage.

The Federal Excise Duty collection stood at Rs38.9 billion - higher by 25% and was equal to its quarterly target. The customs duty collection amounted to Rs128.8 billion during the first quarter - higher by 27.7%. It exceeded the quarterly target by Rs11.6 billion.

Published in The Express Tribune, October 4th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ