Market watch: Index slips in the red despite oil price surge

Nawaz Sharif’s return deflates investor interest, KSE-100 ends 77.42 points lower

Stock exchange. PHOTO: AFP

Despite an encouraging opening, which saw the index almost touch 43,000 points on the back of strong buying in the crude oil sector due to high global crude oil prices, stocks failed to carry the momentum with banking and cement sectors being the major laggards.

At close, the benchmark KSE 100-share Index recorded a fall of 77.42 points or 0.18% to stand at 42,666.23.

According to Elixir Securities, Pakistan equities closed marginally lower due to lacklustre trading with Benchmark KSE-100 Index trading in a narrow range of 350 points.

Market watch: Index fails to stay over 43,000, ends almost flat

“The day started on a positive note as oils lead gains tracking higher global crude prices,” the report said.

“Wider market, however, failed to follow the lead and struggled for direction throughout the day with political uncertainty remaining a major distraction as ex-PM Nawaz Sharif appeared before an accountability court on corruption charges.

“Activity was depressed with most investors remaining at bay or trading selectively, as evident from the under 150 million shares traded on KSE-All Index. Fertiliser also closed in the red due to profit-taking by investors despite a strong showing on Monday on the back of higher global urea prices.

“National Bank of Pakistan (-5%) hit its second consecutive lower price limit after the apex court verdict on pension liability case which could see penalties amounting to two years of profit being levied on the bank.

“We expect range-bound trading to continue in the near term owing to dearth of positive triggers and on-going politics dominating headlines,” the report added.

JS Global anlalyst Maaz Mulla said volatility prevailed in the market as index remained range-bound today and traded between -144 to +214 points.

Weekly review: Uncertainty erodes away gains, KSE-100 ends almost flat

“Volume traded was slightly better, where K-Electric (+9.19%) was the volume leader for the day with 34 million shares of the power stock changing hands,” he said.

“POL (+3.53%), ATRL (+0.83%), INDU (+0.96%) and MTL (+0.67%) were the major leaders for the day cumulatively contributing +48 points to the index. On the other hand, LUCK (-1.06%), HBL (-2.57%), ENGRO (-1.19%), and NBP (-5%) were the major laggards, taking the index down by 135 points.

“Crude oil prices hovered near their 26-month high supported by Turkey’s threat to cut crude exports from Iraq’s Kurdistan region, leading to E&P sector closing in the green zone, where POL (+3.53%) and PPL (+1.25%) were the major gainers in the aforementioned sector.

“Selling pressure was witnessed in the cement sector where heavyweights LUCK (-1.06%), DGKC (-0.86%), KOHC (-2.56%), and MLCF (-1.22%) closed in the red zone.

“Moving forward, we expect volatility to continue until clarity emerges in the on-going political scenario,” Mulla added.

Overall, trading volumes rose to 145 million shares compared with Monday’s tally of 126 million.

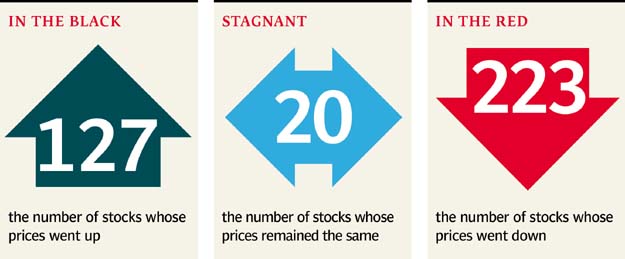

Shares of 370 companies were traded. At the end of the day, 127 stocks closed higher, 223 declined while 20 remained unchanged. The value of shares traded during the day was Rs7.2 billion.

K-Electric was the volume leader with 33.8 million shares, gaining Rs0.58 to close at Rs6.89. It was followed by Dolmen City with 8.2 million shares, gaining Rs0.09 to close at Rs11.00 and Maple Leaf with 6 million shares, losing Rs1.08 to close at Rs87.38.

Foreign institutional investors were net sellers of Rs699 million during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, September 27th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ