Market watch: Amid volatile activity, KSE-100 records small gains

Benchmark index rises 93.77 points to settle at 43,347.03

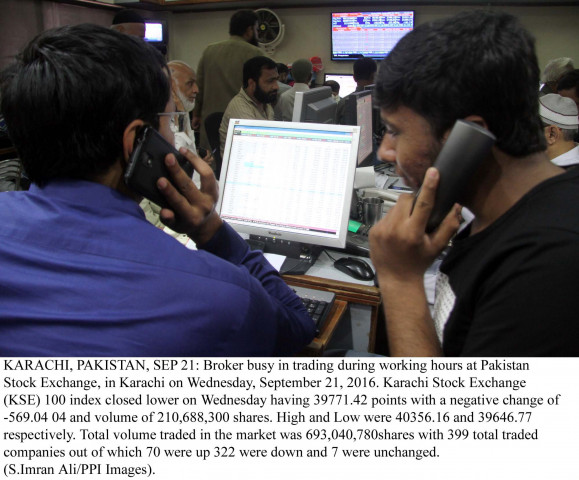

Benchmark KSE 100-share Index loses 569.04 points. PHOTO: PPI

The index was mostly led by support from selected oil, cement and textile stocks amid consolidation post-major corporate earnings announcements.

At close, the benchmark KSE 100-share Index recorded a rise of 93.77 points or 0.22% to stand at 43,347.03.

According to Elixir Securities, Pakistan equities stood a little higher in a volatile and range-bound trading session.

The market, after opening sideways, struggled to find direction that resulted in the benchmark index oscillating around previous day's close until mid-day.

"Later on, buying in select index names notably MCB Bank (+1.9%), United Bank (+1.5%), and Nishat Mills (+3.2%) put the index on a small upward trajectory, however, selling pressure in the last 30 minutes of trading erased half of the intra-day gains," stated Elixir.

On the results front, Fauji Cement (+1.2%) closed in the green after coming up with earnings a little higher than estimates.

Market watch: Foreign buying continues to propel KSE-100 forward

"(We) expect the market to consolidate and trade range bound in the near term with the KSE-100 index hovering in a range of 400 to 500 points with support and resistance defined around 43,000 and 43,700 respectively," the report added.

JS Global analyst Maaz Mulla said the market remained range bound, hitting an intra-day low of -107 and high of +183 points.

"Habib Bank (-1.85%) lost value to close in the red zone on news that Moody's has downgraded its BCA rating to Caa1 from B3 and the State Bank has started probe into the issues regarding the bank's recent penalty," Mulla said.

The cement sector enjoyed a buying spree as most stocks gained. Attock Cement (+2.36%), Cherat Cement (+1.59%), DG Khan Cement (+0.57%) and Maple Leaf Cement (+1.70%) were among major gainers in the sector.

Fauji Cement (+1.24%) announced its financial results for FY17, where the company reported earnings per share of Rs1.89 and declared final cash dividend of Rs0.90.

According to Mulla, the market is expected to recover in the near term over some clarity on the political front while a relatively softer current account deficit for August 2017 also showed signs of improvement in economic indicators.

Market watch: KSE-100 closes in the green amid volatile activity

"We recommend investors to adopt a selective buying strategy in stocks based on strong fundamentals," the analyst added.

Overall, trading volumes rose to 222 million shares compared with Tuesday's tally of 218 million.

Shares of 396 companies were traded. At the end of the day, 207 stocks closed higher, 170 declined while 19 remained unchanged. The value of shares traded during the day was Rs11.9 billion.

WorldCall Telecom was the volume leader with 26.4 million shares, losing Rs0.38 to close at Rs3.37. It was followed by TRG Pakistan with 24.4 million shares, gaining Rs0.21 to close at Rs40.97 and Dost Steels with 14.2 million shares, losing Rs0.55 to close at Rs12.67.

Foreign institutional investors were net buyers of Rs106 million during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ