KSE-100 registers highest weekly gain in months

Benchmark index rises 1,386 points to settle at 42,787.19

Sound fundamentals, stable news flow among other factors propelled the index forward, pushing the benchmark index past 42,000 - a level that had remained elusive for a while. However, the increase was mostly led by FTSE’s latest inclusion of five stocks from Pakistan in its Asia Pacific ex-Japan Index namely; MCB Bank (MCB), Sui Northern Gas Pipelines (SNGP), Bank Al-Falah (BAFL), Millat Tractors (MTL) and Thal Limited (THAL).

Stocks opened Monday on a negative note with the Index plunging 300 points and activity remaining dull. Tuesday brought a break from the usual trend, as despite thin volumes, stocks recovered lost ground to close in green. The rally continued on Wednesday, as the KSE-100 Index shot up 1,000 points on account of foreign buying and attractive valuations, which helped share prices. The following two sessions also built on the gains taking the index higher to settle at 42,787.19.

The market buzzed with activity, which coincided with the rebalancing of indices provided by FTSE and S&P Dow Jones, where in the latter’s case Pakistan status is being upgraded to Emerging Market from a Frontier Market effective September 18, 2017.

This resulted in resurgence in traded activity at the bourse as opportunist domestic and foreign investors built positions ahead of the inclusion while passive foreign funds bought into the stocks on Friday.

Average trading volumes during the week reached 157 million shares, up 15% week-on-week from 136 million shares, while value traded was up 8.3% to $82 million during the week. Volumes continued to remain concentrated in small cap stocks with TRG leading the way.

Pertinently, bullish sentiments were led by commercial banks contributing 744 points, as HBL regained some of its lost weight in the market post payment of a $225 million penalty to the US regulator in NY.

Meanwhile, fertilisers remained buoyant (+284pts) amid foreign interest in ENGRO (+180pts) alongside higher international urea prices. Following suit, oil and gas exploration companies added another 192 points to the index supported by a rally in global oil prices (WTI crossed the $50/bbl threshold for the first time in five weeks and remained up by 2% WoW as refineries in the US operate at dented capacities given the aftermath of Hurricane Harvey).

Stock-wise, Habib Bank (HBL) and National Bank of Pakistan (NBP) contributed a cumulative 518 points to the index. Engro Corporation (ENGRO) was the second major contributor to the index at 182 points.

The new FTSE additions didn’t move much as passive tracker funds opted to avail Friday’s post close sessions, executing all their big orders at closing rates to eliminate tracking error.

On the foreign front, net inflows of $27.7 million (an 11 week high) were recorded vis-à-vis net selling of $0.03 million in the prior week with interest reignited across the board (barring food producers). On the other hand, local individuals resorted to profit-taking (-$15.9 million) led by insurance ($5.7 million), banks ($3 million), companies ($1.9 million) and individuals ($1.5 million), whereas brokers accumulated scrips worth $9.7 million.

Among major highlights of the week were; remittances increased by 13% during 2MFY18 to $3.49 billion, foreign exchange reserves improved to $20.58 billion, ECC set to approve textile package in upcoming huddle, government ruled out fresh IMF bailout, and Hascol Petroleum looking to raise Rs4 billion through rights issue for expansion along CPEC.

Winners of the week

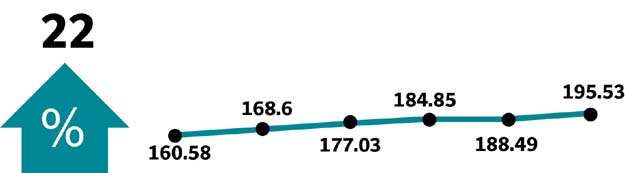

Habib Bank

Habib Bank Ltd operates commercial bank in Pakistan. The bank offers commercial, corporate, investment, retail and International Group Banking.

Jahangir Siddiqui Company

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Engro Corporation

Engro Corporation Ltd manufactures and markets fertilisers and plastics, generates electricity and processes food.

Losers of the week

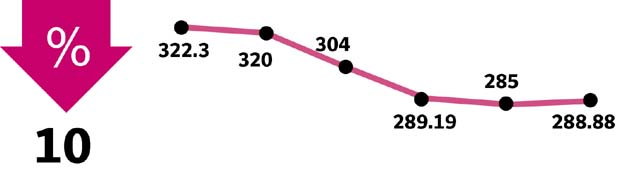

Shifa International Hospitals

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicines, paediatrics, surgical, obstetrics and gynaecology, dentistry, rehabilitation services and ophthalmology.

Indus Dyeing

Indus Dyeing and Manufacturing Company Ltd manufactures

and sells yarn.

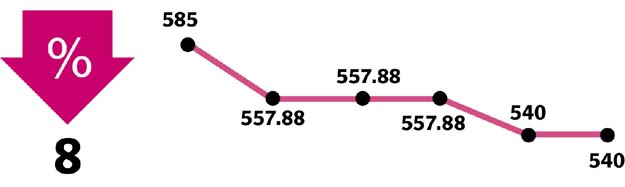

Cherat Cement

Cherat Cement Company Limited manufactures and sells

cement and clinker.

Published in The Express Tribune, September 17th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ