Weekly review : KSE-100 slips 2% amid lacklustre activity

Start of results season fails to trigger investor interest.

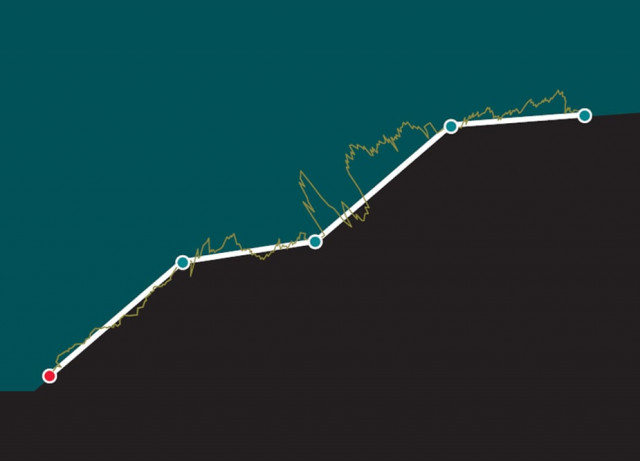

Lack of interest due to absence of triggers resulted in a dull activity at the stock market, as the KSE-100 index shed 2.08 per cent (248 points) during the week ended April 15.

Average volumes stood at a meagre 60.5 million shares per day, down 17 per cent over the previous week, reflecting investor apathy towards the market. The index recorded steady declines throughout the week, only to recover slightly on Friday to close at 11,684 points.

The market had been going through a dry patch in terms of activity as there had been no triggers in the past few weeks. As a result, it had been oscillating between 11,500 and 12,000-point barriers.

The start of the earnings season also failed to generate interest from investors despite Habib Bank Limited (HBL), one of the country’s largest banks, posting healthy earnings of Rs4.7 billion for the quarter ended March 31.

The stock price of HBL has increased almost 17 per cent in the current month, but the effect has failed to spill over to the rest of the banking sector, as activity remained restricted to HBL’s share.

Foreign flows also dried up, as there was a net outflow of $2.9 million during the week compared with a net inflow of $3.4 million in the previous week. Foreign interest has waned in recent months and the flow of funds has slowed down in the same manner as trade volumes.

Disruptions in gas supply from the Qadirpur gas field, from which the Oil and Gas Development Company (OGDCL) generates 40 per cent of its gas sales, also resulted in scepticism in the energy and power sector. As a result, OGDCL and Pakistan Petroleum recorded declines in their stocks.

The curtailment in gas supply generated interest in the fertiliser sector, as gas shortages led to Engro Corporation announcing a hike of Rs60 per bag in urea prices.

Demand for fertiliser sector products is largely price-inelastic and any increment in manufacturing costs is passed on to end-consumers. Fauji Fertiliser was the biggest beneficiary of the announcement, climbing 2.7 per cent during the week.

Investment in the Margin Trading System (MTS) stood at Rs340 million between Monday and Thursday, compared with Rs271 million in the previous week. The average financing rate stood at 17 per cent against 16.6 per cent last week.

While volumes declined by 17 per cent, average daily value declined further by 26 per cent and stood at Rs2.32 billion, reflecting that trading was mostly done in second and third-tier stocks. The index’s market capitalisation also declined by 1.9 per cent and stood at Rs3.11 trillion.

What to expect?

The current results season should not be expected to trigger a major rally, as dividends are rarely declared in this quarter. However, healthy earnings reports may result in stock-specific activity.

Furthermore, the political landscape and the direction of foreign flows will also play a key role in the coming weeks. For now, the market remains trigger-less and investors should adopt a conservative approach.

Monday, April 11

The stock market kicked off the week with a lacklustre session, in line with regional markets, amid low activity. Limited institutional and foreign interest was witnessed despite the start of the

quarterly corporate results season later in the week.

Tuesday, April 12

Bearish activity continued at the bourse as it continued to decline on low volumes, with investors preferring to stay sidelined in the absence of any immediate triggers. Almost all major blue-chip stocks remained in the red throughout the day, with sketchy support from locals.

Wednesday, April 13

Bearish activity continued at the bourse with thin volumes across the board, amid limited foreign and institutional interest. Investor concerns over power and gas shortages in the country, which have affected industrial output, played a significant role in the negative close.

Thursday, April 14

Bearish activity continued in scrips across the board on the back of limited institutional and foreign interest, before the corporate earnings season got into full swing. Investors remained concerned over power and gas shortages, which have hampered industrial output in recent days.

Friday, April 15

Bullish activity was witnessed in the final trading session of the week on the back of institutional and foreign interest over expectations of handsome corporate earnings. Higher prices of cement, fertilisers and oil acted as a catalyst in the market’s advance.

Published in The Express Tribune, April 17th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ