HBL settlement pulls market back, index ends losing streak

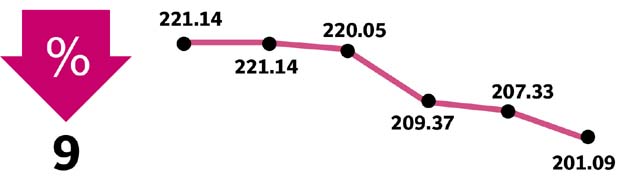

KSE-100 gains 0.5% week-on-week, volumes pick up

PHOTO: AFP

However, this figure does not aptly reflect the volatile week witnessed by the stock market. In fact, there was a likelihood of the KSE-100 Index ending another week in the red, had news of HBL’s out-of-court settlement with the New York State Department of Financial Services not pacified investors. Impressive statistics posted by the oil marketing companies also helped push the index higher.

An index-heavy stock, HBL massively contributed to the index’s decline due to suspected violation of US laws and regulations by its New York branch, causing it to slip to an 11-month low of 40,686 points. News of NAB finalising references against former prime minister Nawaz Sharif and disappointing fiscal data showing a record high budget deficit of Rs1.864 trillion in FY17 also kept the investors jittery.

The week kicked off on Tuesday, after the long Eid holidays, as share prices shot up amid increased activity due to institutional buying. However, Wednesday saw the KSE-100 retreat to the red zone wiping out all gains of the preceding session. This downward trajectory continued on Thursday as the benchmark index finished below 41,000 for the first time in 2017.

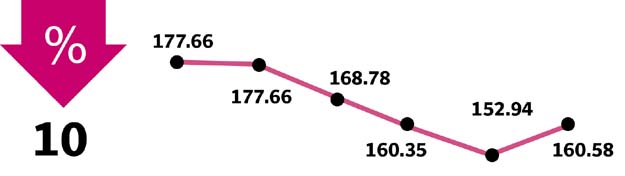

Overnight news of HBL’s settlement acted as a catalyst for Friday’s session, pushing the index up 677 points in just the first half hour of trading. After closing at its lower circuit for seven straight sessions, HBL recovered to closed Friday at its upper cap. Terminals were flooded with pre-market buy orders for HBL after Pakistan’s largest bank managed to settle the ‘outrageous’ $630 million penalty for only $225 million. Only 5,300 shares were traded in the ready market as the script was locked shut at its upper limit of Rs160.58/share.

Participation ticked up from last week’s rain lashed activity, as average turnover rose 25% to 136 million while value rose 33% to $76 million.

Key outperformers during the week were E&Ps (+3.6% WoW) as Ogra notified increase in wellhead gas prices, automobiles (+1.3% WoW) as expectations of PKR devaluation fade away and pharmaceuticals (+2.6% WoW) on news of government looking to increase medicine prices and DRAP approving vaccine for dengue virus.

On the other hand, key laggards were cements (-0.3% WoW) on concerns over pricing arrangement and textiles (-1.2% WoW). On a positive note though, foreign selling somewhat abated as foreign investors offloaded stocks worth of $0.3 million during the week compared to net sell of $14.3 million seen in the prior week.

Of particular relevance was the net buy of $6.34 million noticed on Tuesday, coinciding with the FTSE rebalancing whereby in its semi-annual review, five Pakistani companies made the cut for the ex-Japan global market index (namely MCB, THALL, SNGP, BAFL and MTL).

On the local front, mutual funds remained major sellers of $11.02 million while it was absorbed for the most part by individuals who accumulated $10.77 million. Among major highlights of the week were; SBP’s reserves increased by 2.35% WoW, amounting to $14.6 billion, K-Electric to take bids for one million ton per year import of LNG, and inflation jumps to 3.4%.

Winners of the week

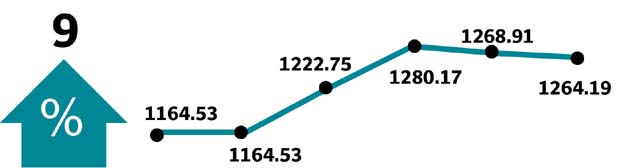

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world

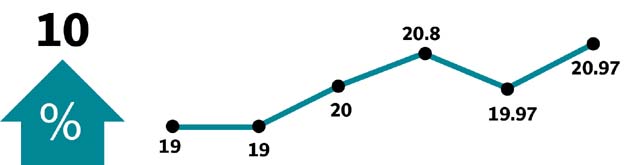

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services

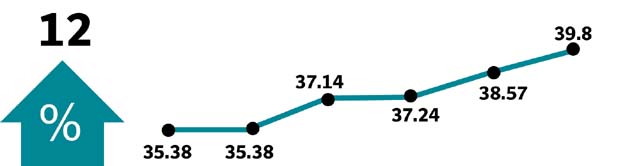

Millat Tractors

Millat Tractors Limited assembles and manufactures tractors, implements and equipment

Losers of the week

Habib Bank

Habib Bank Ltd operates a commercial bank in Pakistan. The bank offers commercial, corporate, investment, retail and International Group Banking

Cherat Packaging

Cherat Packaging Limited manufactures and markets paper bags for the construction industry. The company manufactures various types of paper bags using clupak sack kraft paper imported from Austria, Sweden and the Czech Republic

Hascol Petroleum

Hascol Petroleum is a fully integrated oil marketing company engaged in the marketing and distribution of petroleum products through its petrol pumps and to industrial customers

Published in The Express Tribune, September 10th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ